Analysts Predict Strong Upside for Vanguard Small-Cap Growth ETF

ETF Channel analyzed the Vanguard Small-Cap Growth ETF (Symbol: VBK) and its underlying holdings. The weighted average implied analyst target price for VBK is $318.08 per unit.

Currently, VBK is trading at approximately $264.14 per unit, indicating a potential upside of 20.42% based on analysts’ targets. Three key holdings with significant upside include Global Business Travel Group Inc (GBTG), Champion Homes Inc (SKY), and Privia Health Group Inc (PRVA).

GBTG, trading at $6.21, has an average analyst target of $9.32, reflecting a 50.02% potential increase. SKY’s shares, at $65.62, could rise 48.07% to an average target of $97.17. PRVA’s recent price of $23.07 suggests a possible increase of 25.49% to its target of $28.95.

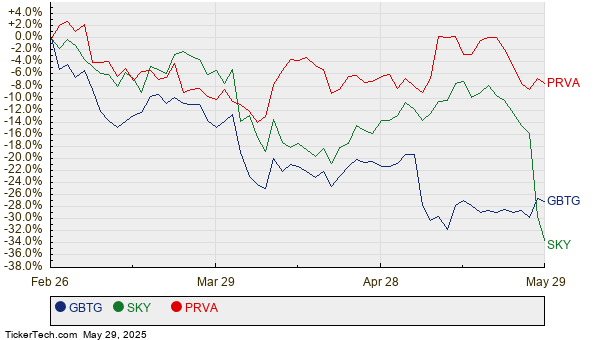

Below is a twelve-month price history chart comparing GBTG, SKY, and PRVA:

A summary table of the current analyst target prices is as follows:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Small-Cap Growth ETF | VBK | $264.14 | $318.08 | 20.42% |

| Global Business Travel Group Inc | GBTG | $6.21 | $9.32 | 50.02% |

| Champion Homes Inc | SKY | $65.62 | $97.17 | 48.07% |

| Privia Health Group Inc | PRVA | $23.07 | $28.95 | 25.49% |

Investors should consider whether analysts’ targets are realistic or overly optimistic, especially given recent developments within these industries. Significant price targets can reflect expected growth but may also lead to downgrades if market conditions shift.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

See also:

• TAXI Insider Buying

• ROCC shares outstanding history

• Funds Holding BVX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.