Analysts Predict Significant Upside for JPMorgan Mid Cap ETF

At ETF Channel, we’ve investigated the underlying holdings of various ETFs, specifically focusing on their trading prices compared to the average analyst’s 12-month forward target prices. For the JPMorgan BetaBuilders US Mid Cap Equity ETF (Symbol: BBMC), the implied analyst target price is calculated at $114.61 per unit based on its underlying assets.

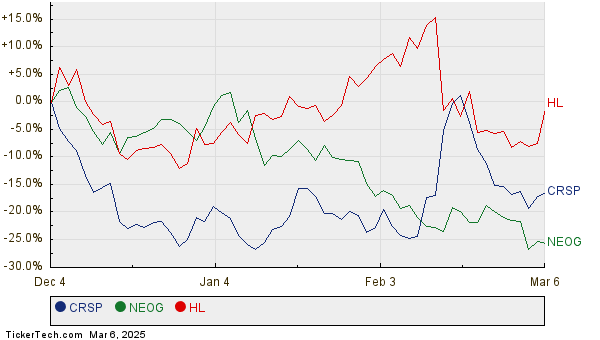

Currently, BBMC is trading at approximately $94.03 per unit, suggesting analysts foresee a potential upside of 21.88% by considering the average target prices from its holdings. Notably, among BBMC’s assets, three show significant upside potential: CRISPR Therapeutics AG (Symbol: CRSP), Neogen Corp (Symbol: NEOG), and Hecla Mining Co (Symbol: HL). CRSP recently traded at $43.84 per share, while its average analyst target price stands at $82.96, indicating an expected rise of 89.23%. Similarly, NEOG, priced at $9.54, has an average target of $14.00, reflecting a 46.75% upside potential. HL is projected to reach a target price of $7.56, which is 37.49% above its recent price of $5.50. Below, you can find a twelve-month price history chart that illustrates the stock performance of CRSP, NEOG, and HL:

Below is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan BetaBuilders US Mid Cap Equity ETF | BBMC | $94.03 | $114.61 | 21.88% |

| CRISPR Therapeutics AG | CRSP | $43.84 | $82.96 | 89.23% |

| Neogen Corp | NEOG | $9.54 | $14.00 | 46.75% |

| Hecla Mining Co | HL | $5.50 | $7.56 | 37.49% |

Questions arise concerning whether analysts are justified in these target prices or overly optimistic about future stock performance. It’s essential to evaluate whether these targets stem from recent developments in the companies and their industries, or if they are outdated. A higher target price compared to a stock’s current trading price may suggest optimism but could also lead to potential downgrades if targets do not align with market realities. Investors will need to conduct further research to navigate these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Funds Holding EERN

GVV Videos

SPHS Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.