ETFs Show Promising Upside with Analyst Target Prices

At ETF Channel, we have analyzed the underlying holdings of various ETFs in our coverage universe. By comparing the trading prices of each holding against the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the WisdomTree U.S. Efficient Core Fund ETF (Symbol: NTSX). Our research indicates that the implied target price for NTSX is $55.30 per unit.

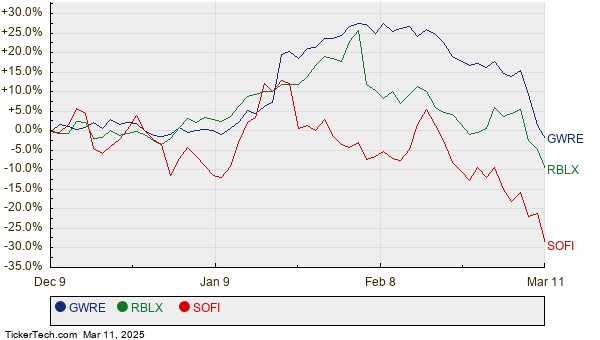

Currently, NTSX is trading at about $45.29 per unit. This suggests analysts foresee a 22.10% upside for this ETF based on the target prices of its underlying holdings. Notably, three underlying stocks exhibit significant upside potential according to analyst targets. These include Guidewire Software Inc (Symbol: GWRE), Roblox Corp (Symbol: RBLX), and SoFi Technologies Inc (Symbol: SOFI). Although GWRE is currently trading at $166.74 per share, the average analyst target stands at $215.83 per share, representing a potential upside of 29.44%. Similarly, RBLX’s recent price of $53.77 shows a 29.17% upside to its target price of $69.45 per share. Meanwhile, analysts expect SOFI to reach a target of $14.20 per share, which is 27.01% above its recent trading price of $11.18. Below is a twelve month price history chart comparing the stock performance of GWRE, RBLX, and SOFI:

Below is a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Efficient Core Fund ETF | NTSX | $45.29 | $55.30 | 22.10% |

| Guidewire Software Inc | GWRE | $166.74 | $215.83 | 29.44% |

| Roblox Corp | RBLX | $53.77 | $69.45 | 29.17% |

| SoFi Technologies Inc | SOFI | $11.18 | $14.20 | 27.01% |

Analysts now ponder whether these targets are justified or if they represent overly optimistic projections for stock performance in the coming year. Investors should assess if analysts’ expectations are based on sound reasoning or if they are lagging behind recent market developments. A high target price relative to a stock’s current trading price may signal optimism but could also lead to future downgrades if those targets do not reflect the current realities.

![]()

10 ETFs With Most Upside To Analyst Targets »

Also See:

• WRE Stock Predictions

• ETFs Holding CDK

• Top Ten Hedge Funds Holding TXAC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.