Analysts Predict Upside for iShares ESG Aware MSCI USA Small-Cap ETF

In our latest analysis of ETFs, we evaluated the underlying holdings of the iShares ESG Aware MSCI USA Small-Cap ETF (Symbol: ESML). By comparing the current trading price of each holding with the average analyst 12-month target price, we calculated the weighted average implied analyst target for the ETF at $48.19 per unit.

Currently, ESML is trading at approximately $38.30 per unit. This suggests that analysts foresee a 25.83% upside based on the average target prices of the ETF’s underlying holdings. Notably, three of these holdings show significant potential for price appreciation: Wave Life Sciences Ltd (Symbol: WVE), McGrath RentCorp (Symbol: MGRC), and Energizer Holdings Inc (Symbol: ENR).

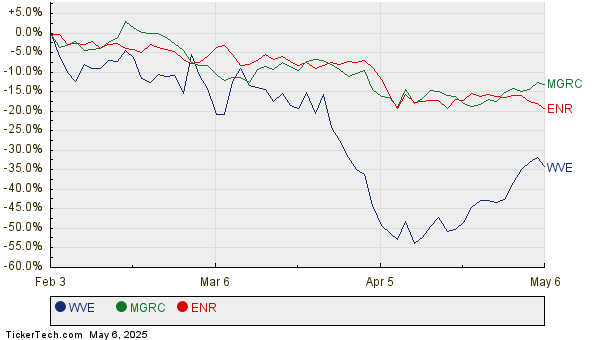

Wave Life Sciences Ltd is currently trading at $7.73 per share, yet analysts project a target price of $21.08, representing a potential upside of 172.74%. Meanwhile, McGrath RentCorp, trading at $108.50, has an average target of $142.50, indicating 31.34% upside. Energizer Holdings Inc is priced at $25.88, with an expected target of $33.75, amounting to 30.41% upside. Below is a twelve-month price history chart comparing the stock performance of WVE, MGRC, and ENR:

Here is a summary table presenting the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Aware MSCI USA Small-Cap ETF | ESML | $38.30 | $48.19 | 25.83% |

| Wave Life Sciences Ltd | WVE | $7.73 | $21.08 | 172.74% |

| McGrath RentCorp | MGRC | $108.50 | $142.50 | 31.34% |

| Energizer Holdings Inc | ENR | $25.88 | $33.75 | 30.41% |

Are these analyst targets justified, or do they display overly optimistic forecasts for these stocks’ future performance? Investors should consider whether there is a substantial foundation for these targets, especially in light of recent developments in the companies and their respective industries. A high price target relative to a stock’s current trading price may signal optimism, but could also indicate potential target price downgrades if the targets become outdated. These considerations warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• ETF Fund Flows

• USAU Stock Predictions

• SDC YTD Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.