AMD’s Steady Ascent: A Closer Look at the Semiconductor Rivalry

Amidst the excitement over Nvidia, Advanced Micro Devices (NASDAQ: AMD) is quietly challenging the graphics processing giant. With the introduction of its new Blackwell GPU architecture, Nvidia remains in the spotlight, but AMD is capturing attention for its potential growth in the AI chip market.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

AMD’s Hidden Growth Potential

The following table highlights revenue and gross profit growth for both AMD and Nvidia in the third quarter.

| Company | Revenue Growth (% Year Over Year) | Gross Profit Growth (% Year Over Year) |

|---|---|---|

| AMD | 18% | 24% |

| Nvidia | 94% | 95% |

Data source: AMD and Nvidia investor relations.

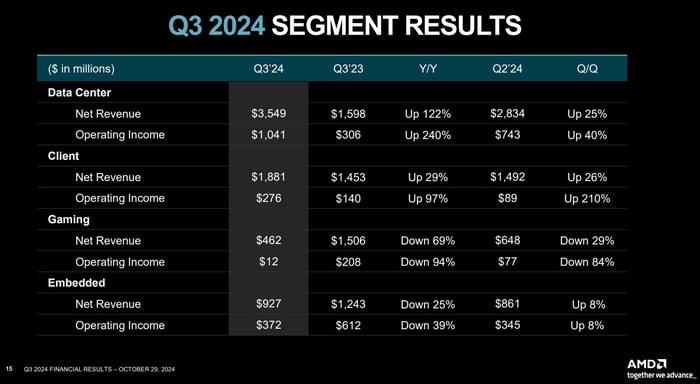

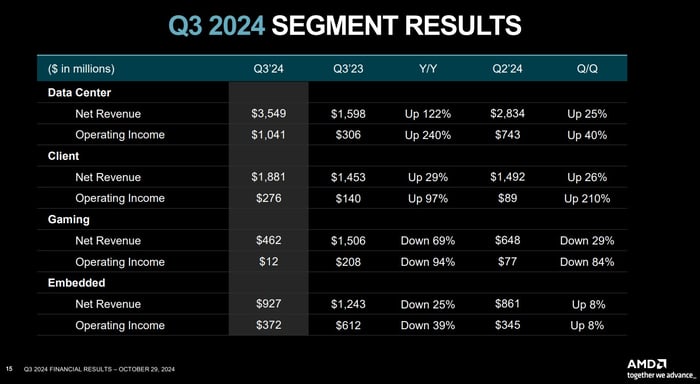

While Nvidia achieves higher revenue and profit growth rates, this doesn’t fully capture AMD’s momentum. AMD’s data center segment is thriving, even as its gaming and embedded divisions struggle, affecting the overall figures.

Image source: AMD.

Encouragingly, AMD’s data center revenue growth now rivals that of Nvidia, indicating that while Nvidia’s growth is slowing, AMD’s is just starting to take off.

Taking a Broader Perspective

Data from Jon Peddie Research reveals that Nvidia controls an impressive 90% of the AI GPU market, with AMD trailing at about 10%. However, this market dominance must be viewed in context. For much of the past two years, Nvidia faced little competition in this space, which helped it gain substantial market share.

In December 2023, AMD launched its MI300 series of AI accelerators, aiming to more directly compete with Nvidia. Within just one year, AMD has begun capturing enough market share to disrupt Nvidia’s growth pattern.

Looking ahead, AMD’s roadmap includes advancing GPU architectures set to roll out from this year through 2026, suggesting it could become a formidable competitor to Nvidia.

Image source: Getty Images.

Why AMD’s Stock is Worth Considering

Investing in AMD should not hinge solely on the expectation of outpacing Nvidia. Instead, there’s a strong case for viewing AMD as an early-stage growth company while Nvidia may see its growth trajectory slow in the coming decade.

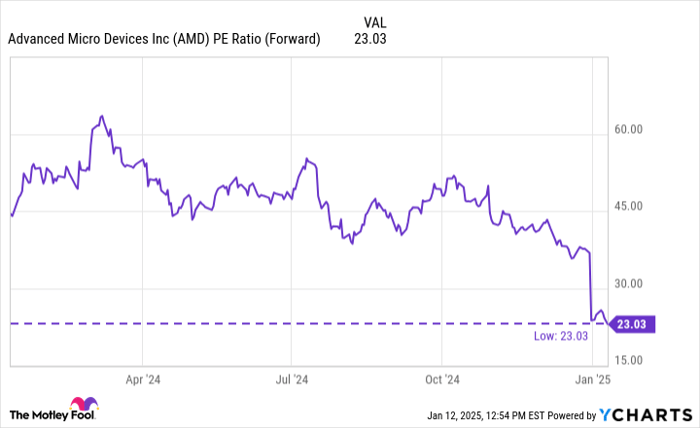

Currently, AMD trades at a forward price-to-earnings (P/E) ratio of 23, its lowest in a year, suggesting the market may not fully recognize its potential.

AMD PE Ratio (Forward) data by YCharts.

With its data center segment expanding rapidly, AMD could soon overshadow the slower growth of its gaming sector. As market adoption of AMD’s products increases, the overall sentiment around the company may shift, potentially reviving investor interest.

Now may be an opportune moment to capitalize on AMD’s stock price dip.

Where to Invest $1,000 Right Now

When our analyst team has a stock recommendation, it pays to consider. The Stock Advisor’s total average return stands at 865%, significantly outperforming the S&P 500, which returned 170%.*

The analysts recently revealed their picks for the 10 best stocks to acquire at the moment, and Advanced Micro Devices is among them — but there are also nine other promising stocks you might want to investigate.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.