AI Boom: A Modern Reflection of the Dot-Com Era

In late 1994, tech firm Netscape introduced its web browser, unknowingly igniting one of the most significant investment booms in history.

The Dot-Com Boom from 1994 to 1999 transformed early investors into millionaires and billionaires. For example, Stripes founder Ken Fox achieved ‘paper billionaire’ status by investing in B2B e-commerce companies during this lucrative time.

Interestingly, exceptional returns were available not only to the initial investors but also to those who engaged later in the market.

The greatest profits emerged during the second half of the Dot-Com Boom.

Comparing Today’s AI Boom to the Dot-Com Era

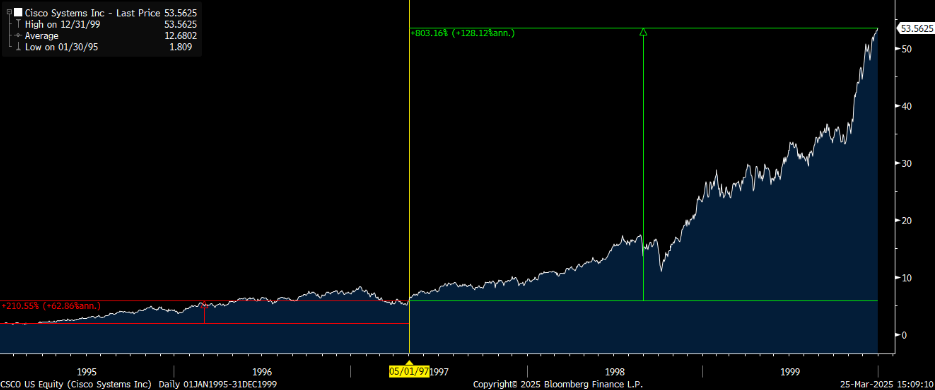

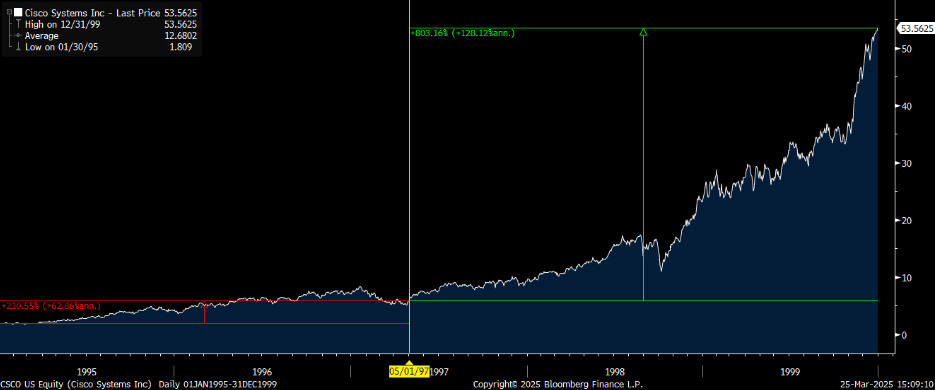

Take a look at Cisco (Stock-ticker”>CSCO), a leading example of this trend.

As the internet infrastructure expanded, demand for Cisco’s networking equipment surged, turning its stock into a major success story.

Between early 1995 and mid-1997, CSCO’s stock value increased by about 200%.

Remarkably, the bulk of Cisco’s gains occurred in the boom’s latter phase.

From mid-1997 to late 1999, CSCO experienced a staggering 800% increase.

This means Cisco tripled in value in the early years of the Dot-Com Boom, and then rose nearly ninefold in its final years.

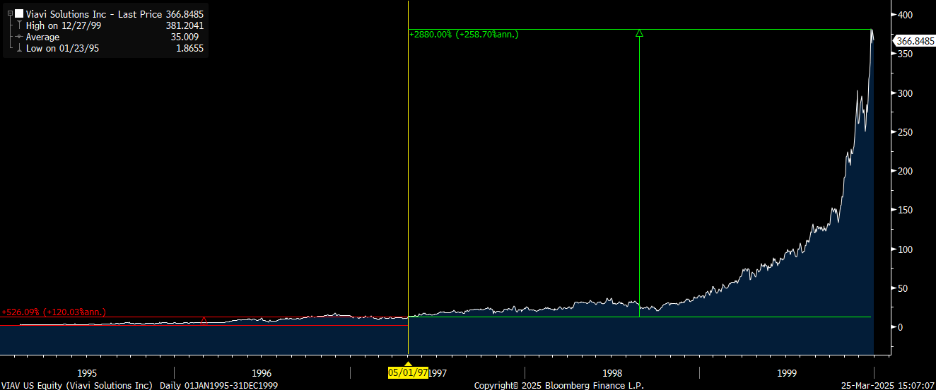

Viavi Solutions (Stock-ticker”>VIAV) shows a similar trajectory. During the first half of the Dot-Com Boom, from early 1995 to mid-1997, that stock rallied approximately 500%.

However, from mid-1997 to late 1999, it saw explosive growth, increasing by nearly 3,000%.

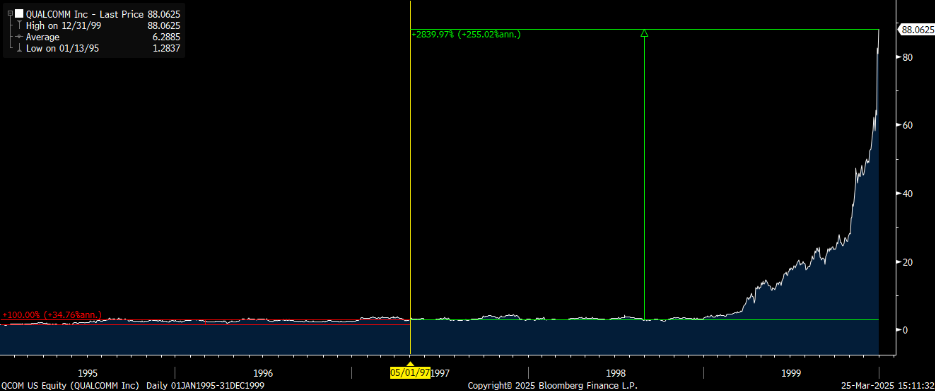

Qualcomm (Stock-ticker”>QCOM) experienced a comparable rise.

This stock doubled in value from early 1995 to mid-1997 and then surged over 2,800% from 1997 until late 1999.

# AI Investment Boom: Potential for Major Market Shifts Ahead

Just as we saw remarkable gains from prominent tech stocks during the Dot-Com Boom, today’s AI sector is poised for similar breakthroughs. Notable companies from the 90s, like Semtech (SMTC), Applied Materials (AMAT), Oracle (ORCL), Paychex (PAYX), and Sanmina (SANM), experienced substantial returns later in their growth, not at the onset.

The key to their success wasn’t the launch of groundbreaking technologies like Netscape’s browser, but rather the innovations that followed that innovation.

Anticipating Future Opportunities in AI

Historically, emerging technologies have required time to become mainstream. It wasn’t until browsers gained traction that we saw revolutionary applications such as Amazon emerge, changing how we interact with technology and commerce.

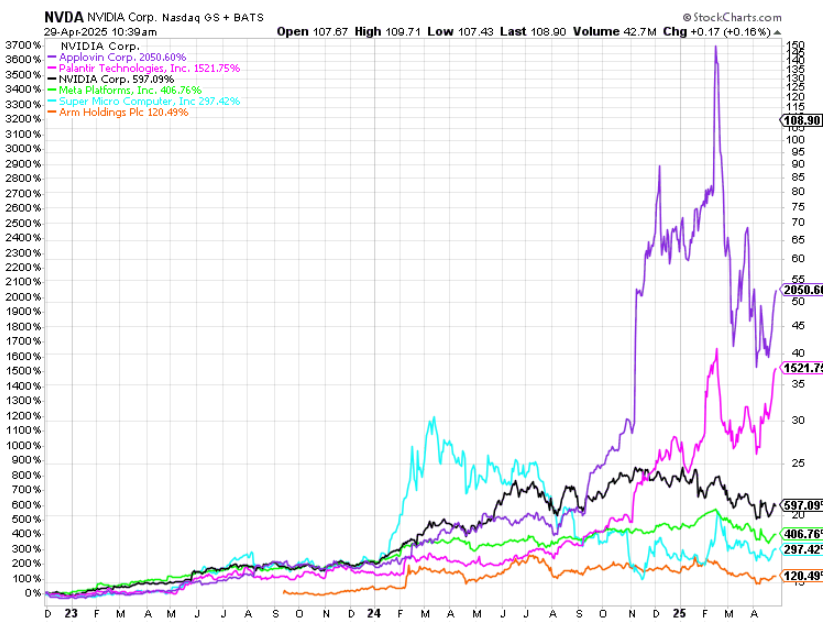

Today, we are on a similar trajectory with AI. The AI Boom ignited in late 2022 with the introduction of ChatGPT, which has transformed the landscape and boosted AI stock prices significantly.

However, it is important to recognize that we are not at the end of this lucrative phase. We are merely at the midpoint. Looking at historical trends, the next 24 months could yield even greater returns than the previous two years, similar to how 1998 and 1999 proved more lucrative than 1995 and 1996.

This time, external factors come into play. U.S. President Donald J. Trump has recently imposed a range of tariffs, escalating tensions in the global trade landscape and causing market fluctuations.

Market volatility has surged, characterized by historic swings—some of the most extreme one-, two-, and three-day changes witnessed have occurred over the past few months. The volatility index (VIX), often referred to as Wall Street’s fear gauge, recently peaked at 52.33, reminiscent of the COVID Crash and the 2008 financial crisis.

Indeed, we are experiencing one of the most volatile stretches in market history. Yet, many experts believe that the largest shock may still be forthcoming.

Looking Ahead: A Potential Rally Trigger on May 7

Echoing sentiments from the Dot-Com Boom, past market turmoil has often set the stage for significant rallies. In 1998, when global currencies were unstable and the crisis surrounding Long-Term Capital Management unfolded, many feared the end of the tech boom. History revealed otherwise.

Against this backdrop, I anticipate that on May 7, strategic movements by President Trump may catalyze a $7 trillion surge in market activity. This could potentially draw sidelined investors back into the market as fresh opportunities come to light.

The converging elements of current market chaos, trade tensions, and the ongoing AI Boom make this scenario plausible. The atmosphere resembles that of 1997, filled with uncertainty yet hiding immense potential.

As events unfold on May 7, the political discourse in Washington could ignite a rally, particularly among a select group of stocks.

This Thursday at 7 p.m. EST, I will be sharing insights during a briefing about what I term The 2025 Summer Panic. This event will explore historical parallels, the future of the AI Boom, and the implications of developments occurring on May 7.

We will also look into prominent companies I’ve identified as key players likely to benefit from the forthcoming rally.

Don’t miss this opportunity—mark your calendar for Thursday night at 7 p.m. EST. The outcomes could have lasting implications in the financial landscape.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article.

For feedback or inquiries, reach out at [email protected].