“`html

Unlocking Market Cycles: How to Improve Your Stock Trading Strategy

We’ve cracked the code to identify the market’s repeating cycles. And now we’re putting that power in your hands.

Editor’s Note: If you’ve heard terms like the January Effect, “sell in May and go away,” or the Santa Claus Rally, you’re aware of seasonal trends in the stock market. Just as there are certain times to harvest crops in a garden, the same principle applies to stocks.

Our corporate partner, TradeSmith, has created a tool that helps you determine the best times to buy and sell stocks. On January 8 at 10 a.m. Eastern, TradeSmith CEO Keith Kaplan will demonstrate this tool. By signing up for the webinar, you’ll gain free access to it. So, click here to claim your spot.

For now, let’s let Keith explain more about the significance of these seasonal patterns.

*************************

Investors often keep an ear out for the Santa Claus Rally, the January Effect, and the advice to “sell in May and go away.” Market history shows that September tends to bring declines, while the period from November through April offers the best opportunities for profits in the S&P 500.

These are clear examples of “seasonality” within the stock market. Certain periods display predictable patterns of growth or decline, much like the cycles of planting and harvesting seen in gardening.

Importantly, seasonality applies to individual stocks as well. Each stock has its own seasonal trends, existing as predictable patterns, year after year.

It’s natural to be skeptical. This level of consistency might seem too good to be true. If such patterns exist, why aren’t they common knowledge?

Simply put, identifying seasonality trends in individual stocks requires extensive data analysis. However, witnessing these seasonal patterns in action can be surprising.

The Impact of Market Seasonality

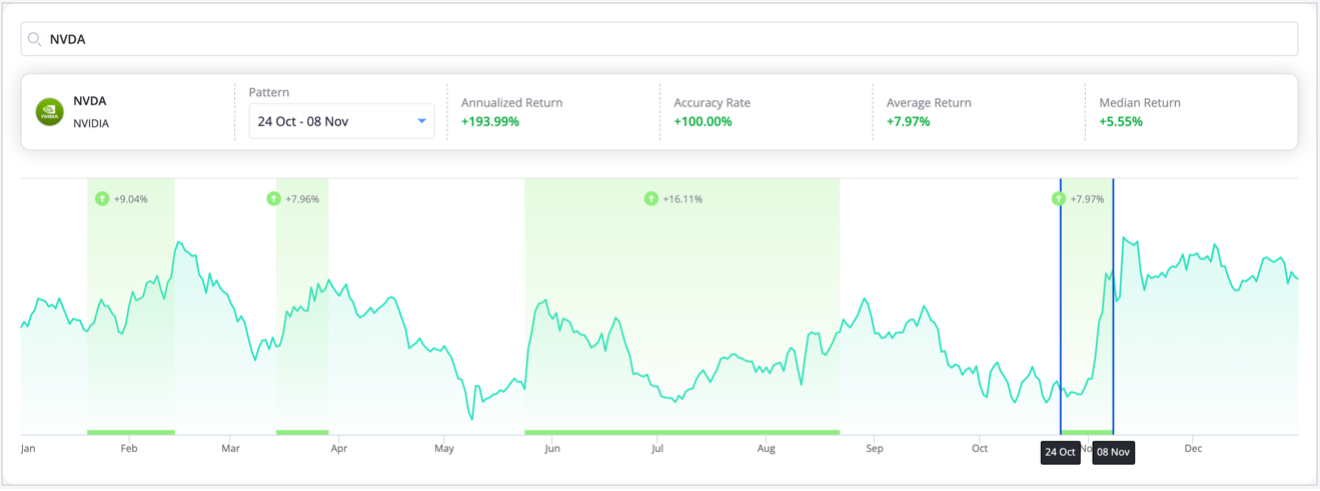

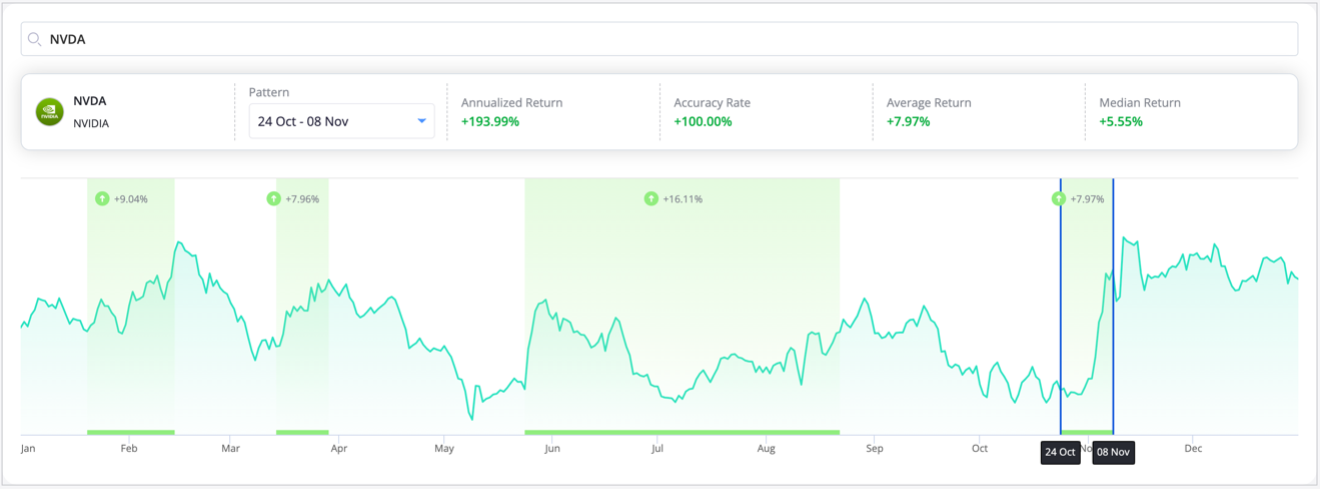

Last fall, a programmer at TradeSmith emailed me with a simple request: to monitor Nvidia’s stock starting on October 24.

This programmer had conducted historical research suggesting that Nvidia’s stock typically rises about 7.8% over the following 15 days, a pattern observed with a perfect 100% success rate over the last 15 years.

I observed the stock. Surprisingly, there were no apparent catalysts for that day—no scheduled announcements, no Federal Reserve meetings, and no product reveals. Yet, on October 24, 2024, Nvidia’s stock surged, following the anticipated increase. In the next 15 days, the stock climbed 5.1%.

As a data scientist, I immediately began to dig deeper into the analysis.

When I met with the programmer, he detailed the historical data concerning Nvidia’s price movements. For 15 consecutive years, Nvidia’s stock had a predictable rise beginning October 24, maintaining a 100% hit rate across this period:

Fifteen years reaches back to 2009. At that time, Bitcoin was just emerging, and discussions about AI careers were largely speculative. Nvidia was primarily known for its graphics cards aimed at gamers and media professionals. Still, the stock experienced consistent growth each late October.

While a 5.1% gain might seem minimal, imagine repeating that increase every 15 days. Consistent historical patterns, like those observed with Nvidia, could theoretically yield a stunning 120% return annually—more than doubling your investment, especially when compared to the S&P 500’s average annual return of around 10.26%.

Moreover, these trades don’t need to be exceptionally large.

There are many undiscovered seasonal cycles hidden within the data of thousands of stocks. My team has devised a new approach to uncover these opportunities, utilizing a system that tracks and charts the most favorable seasonal patterns in the market, akin to a “Farmer’s Almanac” for stocks.

I will host a webinar in January that delves deeper into this strategy, and I’m making our seasonality tool available for you to explore these historical patterns yourself.

You can register for the webinar here—it’s completely free, and after signing up, don’t forget to test out the tool on your own.

This tool represents a revolutionary advancement in our software offerings. It can analyze more stocks than just Nvidia.

Identifying Seasonal Trends for Greater Profits

Our extensive research showed that stocks like Tesla and Broadcom tend to jump each May, while Advanced Micro Devices performs well in November. Conversely, buying Allient in October proved beneficial, but purchasing NeuroMetrix that same month could lead to losses.

Identifying these opportunities involved significant effort. Therefore, I assigned our entire research and development team—totaling 74 individuals—to streamline the identification of these cycles automatically.

The resulting algorithm performs 50,000 tests every day, analyzing all major stocks to find those with the highest seasonality trends and flagging the best opportunities down to the exact day.

As…

“`

Unlocking Seasonal Trading Strategies for Maximum Gains

An Analytical Approach to Stock Trading

Our extensive backtesting of this strategy revealed that trading stocks during specific times of the year is not just a unique idea but an incredibly effective one.

Across 18 years of analysis, these seasonal trades achieved a total growth of 857%. This performance surpasses the S&P 500’s returns during the same timeframe, which is less than half of our strategy’s growth. Notably, even in its weakest year, 2007, the strategy returned an impressive annualized rate of 37.9%.

This method has proven effective annually, guiding traders to the prime times to buy and sell each stock.

Take Amazon (AMZN) as a case in point. From May 24 to July 13 over the past 15 years, the stock has increased 100% of the time, averaging a return of 10.26% during this period:

If you had purchased shares at market close on May 24, 2024, priced at $180.75, and sold them at the end of the trading period on July 12, you would have seen a profit of 7.6%. Alternatively, selling near the peak on July 5 would yield a profit of 10.65%.

Examples of these seasonal trading patterns abound. Our firm has identified seasonal cycles not only in stocks and indexes but also in currencies and commodities. We are among the few capable of analyzing vast amounts of data thoroughly to pinpoint the most lucrative seasonal trades.

While establishing our own hedge fund leveraging this tool is an option, at TradeSmith, our focus lies in empowering individual investors and traders by providing access to this robust software.

Empowering Traders with Strategic Insights

By enabling investors to determine the best days of the year to buy or sell stocks, we are democratizing the use of seasonal trading principles. You can click here to try our Trade Cycles seasonality tool for free until Sunday, Jan. 8.

In the coming days, I will be sharing more information about this tool and our complete Trade Cycles service.

Reserve your spot for our event on Jan. 8 at 10 a.m. Eastern, where I will explain further details.

You will also have the chance to use TradeSmith’s Seasonality Tool free of charge for a limited time.

By leveraging these powerful seasonal cycles, you can plan your trades in advance, allowing for confident buying and selling strategies.

Best regards,

Keith Kaplan

CEO, TradeSmith