“`html

Core News Facts

Meta Platforms reported a 26% year-over-year revenue increase in Q3 2023, alongside a 20% rise in earnings per share. Despite these gains, Meta’s stock saw a decline, attributed to rising AI-related expenses and a compressed operating margin of 40% after a 3 percentage point drop.

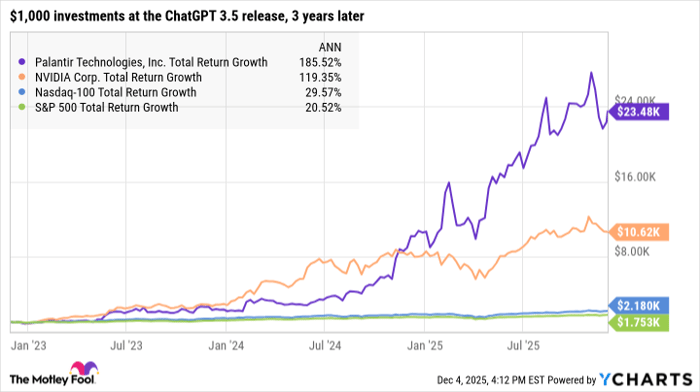

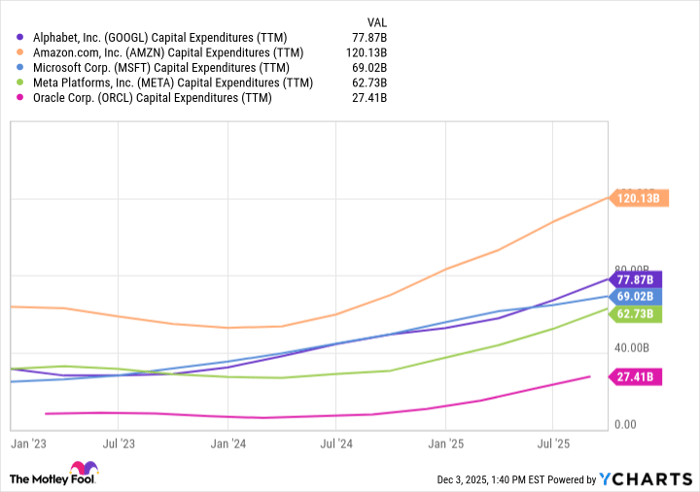

Nvidia and Palantir Technologies have been key beneficiaries of AI investment, with Nvidia providing infrastructure for advanced AI models and Palantir offering software solutions. In contrast, Meta is focusing heavily on AI investments, planning increased spending on AI data centers, which is expected to impact future income statements.

As of now, Meta’s stock is valued at less than 22 times analysts’ 2026 earnings estimates, a competitive price compared to peers. Analysts expect a steady top-line growth driven by improved advertising capabilities enhanced by generative AI, even as operating costs rise due to increased investment in AI technologies.

“`