The Shift in Stock Performance: Small-Caps Surge as Big Tech Falters

Editor’s Note: This is Eric Fry, here. I want to share insights about my colleague Luke Lango’s innovative system, Auspex.

Over the past year, Luke and his team have worked hard on developing Auspex, and the results are noteworthy. A thorough backtest shows it has outperformed the market by more than 10 times across various time frames, including 5, 10, 15, and 20 years.

Today, Luke will explain how you can utilize Auspex to identify potential breakout stocks. On January 2, he will unveil a new list of stocks marked as “Buys” by Auspex. This release is approaching, so make sure to click here for access to Luke’s Auspex tool.

Now, I’ll turn it over to Luke.

Small-Cap Stocks Outperform Big Tech

The Magnificent 7—Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA), and Tesla Inc. (TSLA)—have dominated the market over the past few years. Remarkably, from early 2023 to summer 2024, the Magnificent 7 skyrocketed approximately 150%, while the Russell 2000, which tracks 2,000 small-cap stocks, only increased by 17%.

In numerical terms, this means that small-cap stocks lagged behind the Magnificent 7 stocks by a staggering nine-to-one margin during that time frame.

However, a significant change has occurred since summer 2024. Small-cap stocks are now outpacing their Big Tech counterparts.

The Magnificent 7 stocks peaked on July 10, 2024, and have since decreased by about 1%. Meanwhile, the Russell 2000 has risen more than 15% during the same period.

This marks the first instance since the bull market began in late 2022 where small-cap stocks are consistently outpacing the established giants of Big Tech.

This shift is noteworthy.

Throughout 2023 and most of 2024, the U.S. economy benefitted from substantial AI spending, primarily from large tech companies. These giants invested billions in building AI data centers, chips, and chatbots. While this spending fueled their own growth, it offered little benefit to small-cap stocks, which explains their earlier underperformance.

Looking ahead, many analysts predict the U.S. economy might expand beyond AI in 2025. Factors like pro-growth policies, potential rate cuts, and reduced inflation suggest that growth opportunities could favor companies outside the AI sphere.

Whether you call it a small-cap resurgence or a revival in the broader economy, one thing is clear: small-cap stocks are rising.

The market is evolving into one that benefits a wider array of companies.

Reconsidering Buy-and-Hold Strategies

Nevertheless, traditional buy-and-hold investing is becoming less effective.

This evolution makes it increasingly challenging to select the right stocks for the long term.

To thrive in the current market, investors must adapt their trading strategies.

This is where Auspex shines.

Introducing Auspex: Your Stock Screening Solution

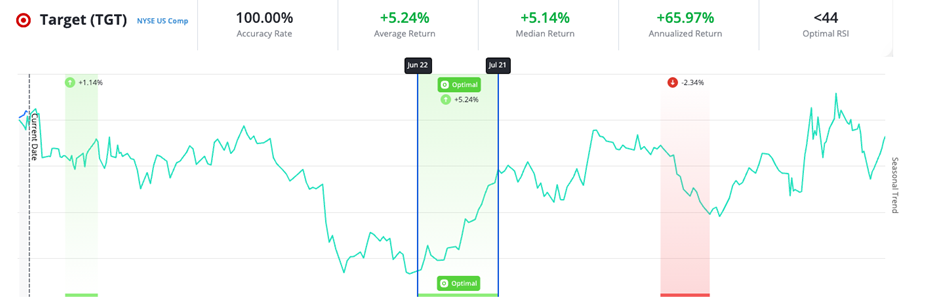

Auspex is a robust stock screening tool designed to pinpoint “the best stocks at the best time” by integrating fundamental, technical, and sentiment factors.

From a fundamental perspective, Auspex shares similarities with our colleague Louis Navellier’s Stock Grader. It emphasizes stellar sales growth, profit expansion, and improving profit margins.

On the technical side, Auspex draws on principles from our Breakout Trader system, analyzing momentum through moving averages and favorable price action.

In terms of sentiment, Auspex monitors trading volume and money flows, ensuring it tracks increasing investor interest.

In essence, Auspex combines the most effective elements from various trading systems into a single, powerful tool.

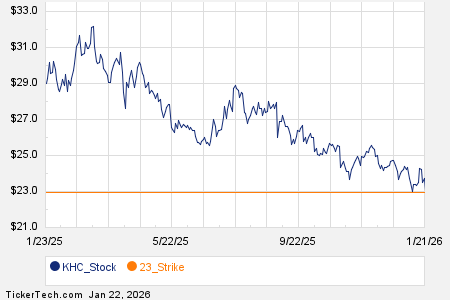

The core advantage of Auspex? It allows investors to buy and sell the most promising stocks each month.

Forget about long-term holding…

Disregard the guesswork…

No more worrying about lagging behind the market.

Monthly, Auspex reviews over 10,000 stocks and applies stringent criteria to identify the strongest candidates based on fundamentals, technicals, and sentiment. This analysis typically surfaces 5-20 stocks for the monthly lineup. Investors simply sell stocks from the previous month and acquire those selected for the new month.

Over the last five months (July to November), Auspex has consistently yielded positive returns for subscribers. Backtesting has demonstrated its exceptional performance, outperforming the market by about 10 times or more across multiple durations.

As an example, our March backtest revealed that Auspex identified Forestar Group Inc. (FOR) as a top candidate. During March, the FOR stock increased nearly 20%, contrasted with a mere 3% rise in the S&P 500.

Additionally, the backtest for February…

“`html

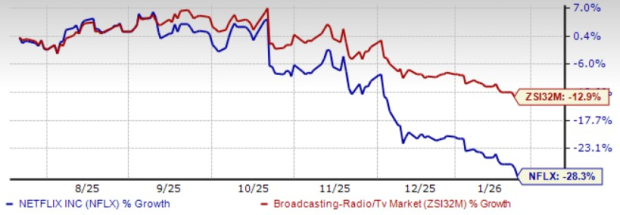

Auspex Highlights Top Stock Opportunities: A Deep Dive into Recent Winners

In February, Auspex identified ICON Public Limited Co. (ICLR) and Couchbase Inc. (BASE) as two stocks to watch. During that month, ICLR stock increased by over 20%, while BASE stock saw a nearly 15% rise. Comparatively, the S&P only climbed 3.5% in the same period.

Fast forward to December 2023, Auspex’s analysis pinpointed Oppfi Inc. (OPFI) and Talkspace Inc. (TALK) as top contenders for investment. OPFI stock surged around 45%, whereas TALK stock gained approximately 25%. In contrast, the S&P index modestly rose by just 4% that month.

As the market transitions to a “market of the many,” Auspex serves as a valuable tool for investors eager to take advantage of these shifts. By integrating fundamental, technical, and sentiment analysis, Auspex has shown its knack for spotting stocks poised for significant growth.

Conclusion

With the stock market evolving beyond traditional buy-and-hold methods and the prominence of large technology companies, Auspex stands prepared to lead investors to the next wave of market successes. In this era, adaptability and precision are more crucial than ever, making Auspex a modern solution for intelligent stock selection.

What’s more, using Auspex takes only five to ten minutes each month. Investors can simply follow alerts, purchase suggested stocks, and review their investments the following month—all hassle-free.

A new list of stocks identified by our Auspex tool as “Buys” will be released on January 2. To set yourself up for success in 2024, click here to learn how to access our Auspex tool. Discover the next potential market winner before it takes off.

Best regards,

Luke Lango,

Editor, Hypergrowth Investing

“`