Tesla’s Stock Surge: Factors Behind the Recent Rally

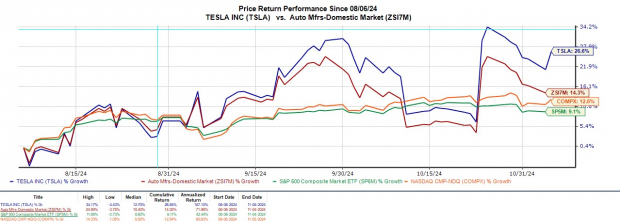

Tesla TSLA shares have soared nearly +20% since its Q3 report in late October and the rally could continue.

With a Zacks Rank #1 (Strong Buy), Tesla’s stock is gaining momentum due to rising earnings estimates.

Analysts Boost Earnings Outlook

Analysts are upgrading their earnings predictions for Tesla, and positive investor sentiment follows the successful launch of Tesla’s Cybertruck.

Elon Musk’s optimistic forecast for fiscal 2025 adds to the stock’s momentum, as he expects vehicle growth between 20% and 30% next year.

Moreover, Tesla’s regulatory credits have enhanced profit margins, supporting impressive growth in its energy storage sector.

Image Source: Zacks Investment Research

Cybertruck Hits Milestones

Investors were pleased to learn that Tesla’s Cybertruck production rose sequentially, achieving a positive gross margin for the first time during Q3. Notably, the Cybertruck became the third best-selling EV in the U.S., trailing only the Model Y and Model 3.

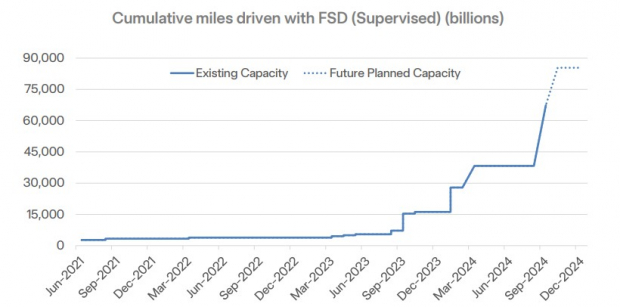

In terms of technology, Tesla expanded its AI compute training by 75% last quarter, focusing on enhancing the safety and functionality of its autonomous, or Full Self-Driving (FSD) features.

The company reported over 2 billion miles driven cumulatively on supervised FSD in Q3. This system generated $326 million in revenue, largely due to the inclusion of this feature in the Cybertruck.

Image Source: Tesla Investor Relations

Earnings Per Share on the Rise

Tesla’s stock rally is also fueled by increased profitability, with Q3 net income rising 17% to $2.17 billion from $1.85 billion compared to the previous year.

This resulted in adjusted earnings of $0.72 per share, up from $0.66 in Q3 2023. A significant contribution came from $739 million in automotive regulatory credits, part of the Inflation Reduction Act, which supports zero-emission vehicle (ZEV) manufacturers.

Interestingly, earnings estimates for Tesla’s fiscal 2024 have increased by 8% in the past month, moving from projections of $2.25 a share to $2.45. Additionally, FY25 EPS estimates grew by 4% over the last month, now estimated at $3.18 per share.

Image Source: Zacks Investment Research

Regulatory Credits and Energy Revenue Growth

Alongside its regulatory successes, Tesla is well-positioned to profit by selling its credits to traditional automakers that need to comply with emissions regulations.

Tesla Energy’s growth is also noteworthy, with energy revenue boosting 52% in Q3, reaching $2.4 billion compared to $1.55 billion a year earlier.

Record Cash Flow Achievement

Tesla demonstrated strong management with record Q3 free cash flow of $2.7 billion, and operating cash flow peaked at $6.3 billion.

Image Source: Zacks Investment Research

Conclusion

Tesla’s operational improvements are clearly reinvigorating investor interest. The combination of increasing earnings forecasts and Elon Musk’s optimistic outlook for FY25 suggests the stock may continue to rise.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.