“`html

Investors Eye Utility Stocks Amid Economic Slowdown Opportunities

The economy is clearly slowing, at least for the near term, providing contrarians with a limited buy opportunity on two “dividend twofer” utility stocks we’ll explore today.

One of these stocks boasts a solid 7% yield, while the other offers 4.9% and has an overlooked potential for upside. Both companies fall under the utility sector, which typically thrives as the economy slows and interest rates decline.

Economic Indicators and Their Impact on Utilities

Recent economic data highlights the slowdown, epitomized by last week’s GDP report, confirming that the US economy did shrink early this year.

GDP Growth and Economic Context

In the first quarter, GDP growth decelerated by 0.3%. However, the underlying data is more optimistic than headlines may imply.

The decline largely stems from a spike in imports as retailers stocked up ahead of anticipated tariffs—these imports negatively affect GDP calculations. This trend is expected to subside. Moreover, government spending has diminished due to DOGE budget cuts, while consumer spending has largely remained stable.

We can accept a drop in GDP attributed to short-term factors like temporary import surges and cuts in government expenditure.

Recent labor market data supports the idea of a slowdown, with initial jobless claims hitting 241,000 for the week ending April 26, surpassing the anticipated 225,000.

Interest Rates: A Beneficial Strategy for Investors

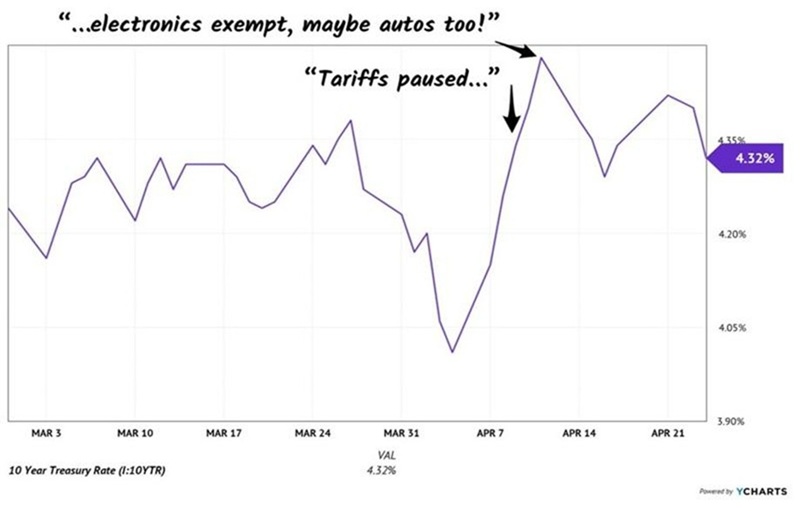

The ongoing tariff situation evolves by the hour, with changes in the “Liberation Day” tariffs and exemptions for electronics and car parts manufacturing. Anticipate continued dovish maneuvers on trade. However, tariffs will likely remain elevated compared to their levels before January 20, forming a crucial part of Treasury Secretary Scott Bessent’s plan to lower interest rates:

- Implementing tariffs to slow economic growth (and inflation).

- Deregulation to counterbalance the drag from tariffs.

- Increasing domestic drilling to reduce energy prices.

As highlighted previously, Bessent emphasizes the importance of the 10-year Treasury yield, which serves as a benchmark for business and consumer loans.

When the yield on the 10-year treasury spiked in early April, President Trump momentarily paused most Liberation Day tariffs, responding to Bessent’s concerns.

In essence, we’ve uncovered a beneficial strategy for stocks, particularly in the bond market, thanks to the push for lower interest rates. This shift provides a unique opportunity for high-yielding utility stocks.

Taking into account the latest economic figures, particularly the personal consumption expenditures (PCE) index—favored by the Fed as an inflation measure—the index dipped to 2.3% from 2.7% year-over-year.

Correspondingly, 10-year Treasury rates decreased, reflecting a bond market that anticipates an economic slowdown.

Though a slowdown isn’t ideal, it presents a chance to acquire these two high-yielding utilities before their next market rise.

Utility Investment Recommendation No. 1: Reaves Utility Income Fund (UTG)

The Reaves Utility Income Fund (UTG) is a recurring recommendation in our discussions. Since its inclusion in our portfolio in June 2023, it has achieved a notable return of 41% for members of my income service.

UTG primarily invests in leading US utility companies, including Entergy Corp. (ETR), Xcel Energy (XEL), and CenterPoint Energy (CNP), as well as “utility-like” firms like Enterprise Products Partners (EPD).

Historically, UTG’s valuation shifts when the 10-year yield fluctuates. It typically transitions from a discount to a premium during times of declining yields.

UTG Valuation and Growth Potential

Given the anticipated slowdown, UTG’s current neutral valuation is likely to increase to a premium. This expectation suggests both gains from an uptick in valuation and a consistent 7% dividend, which rolls in monthly and provides a reliable income stream.

Source: Income Calendar

UTG offers a robust income stream, a likelihood of improved premium valuation, and lower volatility, with a beta of 0.84—indicating it’s 16% less volatile than the S&P 500—making it an attractive buy under current conditions.

Utility Investment Recommendation No. 2: Dominion Energy (D)

For those interested in a single-stock investment, consider Dominion Energy (D), based in Virginia. The company provides electricity to 3.6 million homes and businesses across Virginia, North Carolina, and South Carolina and supplies natural gas to around 500,000 users in South Carolina. Currently, its stock yields 4.9%.

Utilities have remained resilient this year, and Dominion has fared similarly—though it has not kept pace with the sector average, evident from its comparison to the benchmark utility index fund, XLU:

D’s Performance Relative to Sector

“`

Dominion Energy’s Dividend Recovery Signals Investment Opportunity

Long-time investors may recall that Dominion Energy (D) remains in the “dividend doghouse” following a cut by management in 2020. This decision stemmed from excessively high debt levels, a fact that illustrates how lasting the memories of dividend investors can be.

However, the reality is that, unless a company’s management is severely lacking, the safest dividends are often those that have recently been slashed. Dominion has more than paid its dues by maintaining its dividend and even implementing a small hike since the cut.

Despite this, the company’s share price has lagged behind its payout. Historically, share prices tend to align with dividend growth, marking this lag as the second indicator of a potential investment opportunity.

Lagging Share Price Highlights a Potential Bargain

Furthermore, Dominion is trading at a forward P/E ratio of 16.6, below its five-year average of 19.3. Recent strong earnings results have nudged this figure upward, making it more critical to consider a buy opportunity.

Below-Average (Yet Rising) P/E Ratio as a Third Indicator

It’s time for investors to begin moving on from past issues. In Virginia, Dominion’s home state, exciting developments are underway. The state is experiencing a data center boom that supports the ongoing growth of artificial intelligence.

Electric vehicle adoption is also on the rise, and consumers increasingly seek out heating pumps. This trend appears sustainable regardless of federal policies. Dominion projects a doubling of its power demand by 2039.

The company is somewhat insulated from tariffs too. While Dominion expects approximately $123 million in steel and aluminum tariffs on its Coastal Virginia Offshore Wind project, this accounts for only a small fraction of the project’s overall $10.8 billion budget. Their Q1 revenues alone totaled $4.1 billion, demonstrating significant financial strength. There’s also potential for tariffs to be reduced or eliminated in the future.

Seizing the “Trump Put” in Bond Markets for Investment Gains

Interestingly, the “Trump Put,” particularly in the bond market, hasn’t received the attention it deserves. This situation is offering a chance for substantial gains in utilities and bond proxies while limiting interest rate risks.

The 10-year yield is already starting to decline, making this an opportune moment for action. Dominion and the Utilities Select Sector SPDR Fund (UTG) represent solid entry points, but one fund stands out, offering a remarkable 11% yield.

This fund is managed by a renowned bond strategist and presents an attractive opportunity that may not remain long available as awareness of the “Trump Put” increases among investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.