MercadoLibre (MELI): A Strong Contender in E-commerce and Fintech

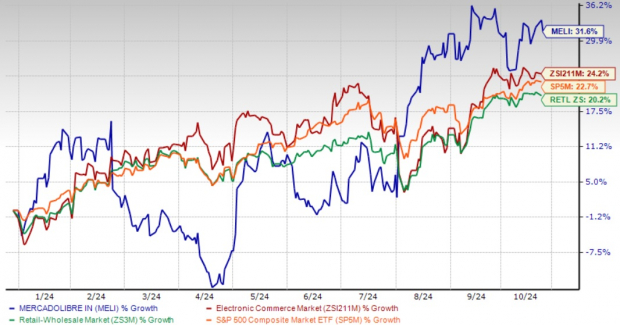

Strong Year-to-Date Surge

Image Source: Zacks Investment Research

Logistics Innovation Enhances Growth Prospects

MercadoLibre is making strides in transforming its logistics operations, enhancing its e-commerce capabilities in Latin America. The recent launch of robotics at its Cajamar distribution center marks a significant advancement. By the end of 2024, the company plans to utilize over 300 robots, which are designed to improve processing times by 20% and boost storage capacity by 15% per square meter. These robots can efficiently manage 20,000 items and 2,500 shelves each day, showcasing a major leap in operational effectiveness.

Additionally, MercadoLibre is optimizing delivery options with initiatives like MELI Delivery Day and SLOW shipment service. MELI Delivery Day consolidates deliveries to a single address for reduced last-mile costs, while SLOW enables flexible shipping for budget-conscious shoppers. Such innovations reflect MercadoLibre’s focus on both efficiency and customer preferences.

Geographic Expansion Fuels Revenue Growth

MercadoLibre’s strategic expansion into the United States marks a significant growth opportunity. Its new fulfillment center in Texas, set to launch in Q2 2024, has already shown positive results, allowing free two-day delivery to northern Mexico. This move not only boosts cross-border commerce but also broadens product access for Mexican consumers.

Moreover, the company’s stronghold in key markets such as Brazil, Mexico, and Argentina is robust, with its product offerings in fashion, consumer electronics, apparel, and sports categories continuing to grow. The MELI+ loyalty program has been particularly effective, leading to increased customer spending and engagement across various categories.

Mercado Pago: A Growing Fintech Force

MercadoLibre’s fintech segment, Mercado Pago, has emerged as a vital growth driver. In Q2 2024, it reached 52 million monthly active users—up 37.3% year-over-year. The Total Payment Volume (TPV) soared 86.2% from the previous year on a FX-neutral basis, totaling $46.33 billion, indicating robust adoption of the platform.

The company employs a data-centric approach to risk and cross-selling, enhancing its position in the LATAM financial services market. Strong performance metrics for managed assets and their credit card offerings further establish Mercado Pago’s growing relevance.

Overall, the company’s performance has been impressive, with commerce revenues climbing 53.4% and fintech revenues rising by 27.5% year-over-year in Q2 2024. Additionally, advertising revenues surged by 51%, showcasing MercadoLibre’s efforts to diversify income sources.

The Zacks Consensus Estimate for 2024 stands at $20.51 billion, projecting a year-over-year growth of 41.74%. Earnings estimates suggest a 92.96% rise to $37.55 per share, showing optimism as estimates have increased by 1.5% over the last 30 days.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Market Position and Financial Evaluation

While MercadoLibre thrives in the Latin American online retail space, it faces stiff competition from Amazon (AMZN) and Walmart (WMT), both of which aim to strengthen their positions in the region. Recent market pressures, including inflation and broader economic concerns, present challenges for MercadoLibre as it invests in free shipping and improved customer services to enhance competitiveness.

Currently, the stock trades at a high price-to-sales (P/S) ratio compared to its industry peers, indicating potential valuation concerns. MELI’s forward P/S ratio is 4.32, notably above the Zacks Internet – Commerce industry average of 1.69, reflecting risks surrounding the stock’s price movement in light of any negative developments.

Valuation Insights

Image Source: Zacks Investment Research

Final Thoughts

With its ongoing logistics improvements, expansion efforts, and successful fintech initiatives, MercadoLibre seems well-positioned for continued growth beyond current stock gains. For investors focused on long-term prospects, MELI’s strengths and strategic initiatives make it an appealing option in the evolving realms of digital commerce and fintech. Currently holding a Zacks Rank #2 (Buy) and a Growth Score of A, MELI presents a favorable investment opportunity according to the Zacks proprietary quantitative model. Explore the full list of today’s Zacks #1 Rank (Strong Buy) stocks.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our experts recently identified 5 stocks with the highest potential to gain +100% or more in the months ahead. Among these, our Director of Research Sheraz Mian emphasizes one that stands out.

This top choice is one of the most forward-thinking financial firms, already boasting over 50 million customers and a wide array of innovative solutions promising significant growth. While not every pick will succeed, this stock could exceed the performance of previous Zacks selections, such as Nano-X Imaging, which saw a +129.6% rise within just 9 months.

Free: See Our Top Stock And 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Download our free report on 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.