Liberation Day 2.0 Summit Set to Start at 1 p.m. ET

The Liberation Day 2.0 Summit will commence today at 1 p.m. Eastern Time.

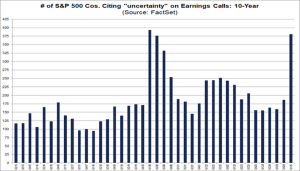

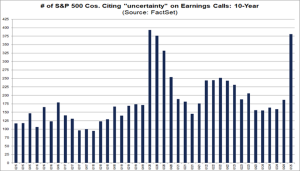

Editor’s Note:Over 350 S&P 500 companies have mentioned “uncertainty” in earnings calls, marking the highest usage in years.

Investor Louis Navellier emphasizes three major economic shifts occurring now.

He terms it Liberation Day 2.0, emphasizing Tax, Tech, and Energy Liberations driven by President Trump’s policies.

Navellier suggests these changes could unlock $10 trillion in new stimulus and create millions of jobs.

During the summit, he will unveil:

- A stock he believes could yield $5,000–$15,000 in gains.

- Three sectors expected to thrive under Trump’s administration.

- Ten stocks recommended for immediate sale.

- A strategy for capturing substantial profits.

The summit begins today at 1 p.m. ET — secure your free spot now.

This blueprint aims to transform current uncertainty into future opportunities.

Now, over to Louis…

In the first episode of Sesame Street back in November 1969, Kermit the Frog described the letter “W.” Cookie Monster’s interruptions led Kermit to swiftly change topics.

This memorable moment has led to an enduring “letter of the day” segment.

Today, however, the U.S. economy is defined by the letter “U” for uncertainty.

Currently, 84% of S&P 500 companies cited “uncertainty” in their recent earnings calls. Moody’s cited this term when downgrading U.S. debt.

This term’s overuse is evident in the Federal Reserve’s April 2025 “Beige Book,” where it appeared 80 times compared to just 11 times in April 2024.

While “uncertainty” has valid applications, it can also become an excuse for inaction:

- It enables media to target a vague enemy.

- It prompts financial analysts to express resignation about market conditions.

- It allows CEOs to deflect blame for poor performance.

However, key economic facts remain clear.

This edition of Market 360 will focus on three certainties tied to President Trump’s economic plan and how investors can benefit.

Certainty No. 1: Tax Liberation

Last week, Trump’s tax reform bill passed the House. It includes three significant changes:

- Permanent middle-class tax cuts: Individual rates will lower, decreasing the 15% bracket to 12% and the 25% bracket to 22%. Additionally, no taxes will apply to tips or overtime.

- Expanded family and child benefits: The child tax credit is permanently set at $2,000 per child, including new MAGA savings accounts for newborns.

- Health and wellness savings expansion: Health savings accounts (HSAs) can now cover expenses beyond doctor visits, like fitness memberships.

Moving forward, Trump plans to utilize tariff revenues to reduce income taxes for those earning $150,000 or less. This could mark the largest change to the tax code since the previous Tax Cuts and Jobs Act.

The tax alterations may significantly boost the middle class and overall economy. The Tax Cuts and Jobs Act previously led to higher wages, a 20% increase in business investment, and a 1% GDP boost, potentially resulting in trillions of dollars in growth over the next decade.

The fate of this bill now rests with the Senate for it to become law.

# AI’s Power Demand Set to Surge This Year

## AI Chips Drive Electric Consumption

Artificial intelligence’s demand for electricity is poised to escalate this year. In November, **NVIDIA Corporation** (*NVDA*) introduced its Blackwell chip, which is 3 to 4 times faster than its predecessor but consumes 1,200 watts—similar to a household toaster, up from 700 watts.

Despite this increase in power consumption, immediate demand for electricity won’t rise by 70%. Production of Blackwell chips is limited, causing major cloud firms like **Oracle Corporation** (*ORCL*) and **Microsoft Corporation** (*MSFT*) to experience supply delays. Microsoft CEO Satya Nadella mentioned during the first-quarter earnings call that profits would have been higher with adequate hardware.

By mid-2026, more Blackwell chips will be available, replacing older **Nvidia** Hopper chips and increasing power consumption, further straining the U.S. energy grid. AI developers are accelerating their efforts, as seen with OpenAI’s recent launch of GPT-4.1, a model that improves coding performance by around 20%. OpenAI also launched a new coding agent, Codex, capable of writing code, fixing bugs, and answering queries.

**Alphabet Inc.** (*GOOG*) showcased AI innovations, including a model named “Deep Think,” which has over twice the accuracy of OpenAI’s best models. This AI competition is driving up demand for Blackwell chips, putting power-generation firms in a strong position.

## Energy Liberation Initiatives

On his first day in office, President Trump signed three energy executive orders aimed at enhancing U.S. energy independence:

– **Executive Order 14154**, “Unleashing American Energy,” emphasizes increasing production on federal lands, prioritizing domestic mining, and reviewing regulations that restrict energy development.

– **Executive Order 14156**, declaring a national energy emergency, directs federal agencies to streamline energy development processes and enhance energy infrastructure.

– **Executive Order 14153** focuses on expanding resource development in Alaska, including advancing permits and infrastructure for LNG exports.

These initiatives could significantly impact the nation’s wealth. The U.S. is estimated to possess over $100 trillion in energy and natural resources, potentially eliminating the national debt multiple times.

## Trump’s Liberation Day 2.0

Tax, tech, and energy liberations form the basis of President Trump’s economic strategy, dubbed **Liberation Day 2.0**.

Recently, Trump enacted orders aimed at re-establishing the U.S. as a leader in nuclear energy. The goal is to expand nuclear capacity from 100 gigawatts to 400 gigawatts by 2050, with plans for ten new reactors by 2030. Following this news, nuclear stocks surged, as the demand for power from AI grows.

Among them, **Vistra Corp.** (*VST*), a major power generator with about 37,000 megawatts of capacity across various energy sectors, stands out. Their recent acquisition of Energy Harbor has positioned them as the second-largest U.S. nuclear power provider.

Investors interested in nuclear energy should consider VST. Further insights into **Liberation Day 2.0** opportunities will be shared in an upcoming summit. Details include sector predictions and stock recommendations to help maximize potential returns.