Market Volatility Presents Buying Opportunity for PepsiCo Investors

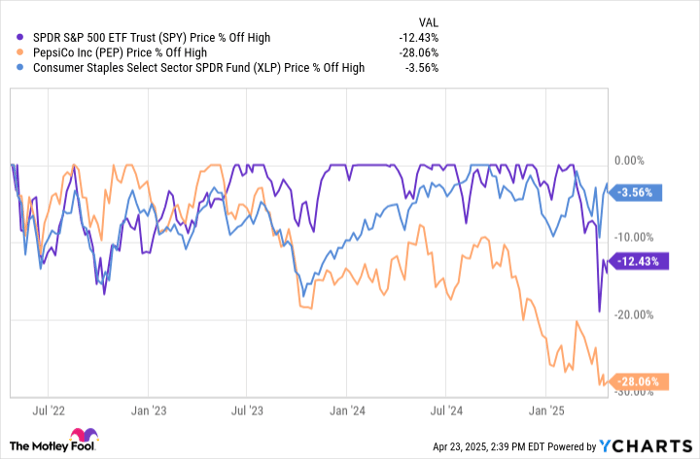

Market uncertainty is high right now due to various economic and geopolitical factors. Since the beginning of the year, the S&P 500 index (SNPINDEX: ^GSPC) has dropped approximately 8%, having previously fallen around 15%. In contrast, consumer staples stocks have increased by a couple of percentage points on average. However, one notable Dividend King in this sector—PepsiCo—has declined roughly 7% this year and is over 25% off its peak in 2023. This situation may signal a buying opportunity.

Understanding the Challenges Facing PepsiCo

Consumer staples companies, including PepsiCo (NASDAQ: PEP), typically offer lower-cost necessities that consumers buy regularly. These stocks are often considered defensive, as they tend to perform well in both good and bad economic times. This explains why investors frequently flock to consumer staples during periods of market uncertainty, evidenced by the sector’s relative strength.

Yet, PepsiCo’s performance deviates from the overall trend. It has faced several challenges, primarily related to investor perception. Post-pandemic inflation allowed PepsiCo to implement significant price increases, but revenue growth has since slowed as the company can no longer sustain this pricing power. Investors who overreacted during the peak are now becoming overly pessimistic.

Performance Analysis of PepsiCo

Moreover, PepsiCo is encountering a slowdown in its leading salty snack segment. There is a broader societal shift towards healthier eating habits, which affects not only PepsiCo but also its competition. The compounded impact of these factors has led to a weak outlook for the company.

Despite these challenges, PepsiCo remains optimistic. The company projects low single-digit organic sales growth and mid-single-digit core earnings-per-share growth for 2025. It has also announced a 5% dividend increase, marking the 53rd consecutive year of growth in dividends. These factors suggest that if this is a “bad year,” investors should rethink their exit strategies regarding PepsiCo stock.

Valuation Metrics Indicate Potential Upside

The recent selling pressure has elevated PepsiCo’s dividend yield to approximately 3.8%, approaching historic highs. In fact, the yield is now greater than during the Great Recession, pointing to a potentially undervalued stock. Traditional valuation metrics such as price-to-sales, price-to-earnings, and price-to-book ratios are all below their five-year averages, reinforcing the notion that PepsiCo may be a bargain at current levels.

Opportunities Amid Challenges

Even strong companies like PepsiCo can face difficult periods. However, this could be an opportune time for long-term dividend investors willing to think beyond short-term fluctuations. PepsiCo is actively reshaping its portfolio through acquisitions, laying the foundation for future recovery. Acting promptly could allow investors to capitalize on current pricing.

Should You Consider Investing in PepsiCo Now?

Before purchasing PepsiCo stock, consider the following:

Notably, the Motley Fool Stock Advisor team has highlighted other stocks that they believe may offer better returns in the coming years. PepsiCo was not included in their latest recommendations.

For example, if you had invested $1,000 in Netflix after it made the list on December 17, 2004, your investment would have grown to an astounding $594,046*!

Similarly, an investment in Nvidia following its recommendation on April 15, 2005, would have turned into $680,390*!

The Stock Advisor has achieved an impressive 872% average return, far exceeding the S&P 500’s 160%.

Explore the top 10 recommended stocks »

*Stock Advisor returns as of April 21, 2025

Reuben Gregg Brewer has positions in PepsiCo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.