JD.com Sets Stage for Strong Performance in 2025 Investing

JD.com, China’s top supply chain-based e-commerce platform, stands out as a leading investment choice heading into 2025. Its stock has seen a remarkable increase of 52.8% over the past year, far surpassing the returns of the Zacks Retail-Wholesale sector (13.8%) and the S&P 500 index (10.7%). In comparison to its rivals, such as Amazon.com (AMZN), Expedia (EXPE), and MercadoLibre (MELI), which recorded returns of 12.8%, 26.6%, and 40.6%, respectively, JD.com’s growth is particularly compelling.

The significant price appreciation has certainly drawn investor interest; however, the underlying fundamentals and growth potential are equally important for considering JD.com for your investment portfolio.

1-Year Performance

Image Source: Zacks Investment Research

Impressive Financial Results Indicate Long-Term Growth

JD.com’s financial performance for the fourth quarter and full-year 2024 illustrates a company that is thriving. In the fourth quarter, JD.com reported net revenues of RMB347.0 billion ($47.5 billion), marking a 13.4% increase year-over-year, a rate that exceeds the general market growth. Moreover, non-GAAP net income attributable to ordinary shareholders surged by 34%, reaching RMB11.3 billion ($1.5 billion) in the fourth quarter, while the company’s full-year non-GAAP net margin reached 4.1%.

Steady margin expansion over an uninterrupted 11 quarters highlights the company’s effective operational management and aligns with management’s goal of achieving high single-digit margins in the future. This financial prudence is complemented by strategic investments aimed at enhancing user experiences, developing the platform ecosystem, and expanding into general merchandise categories.

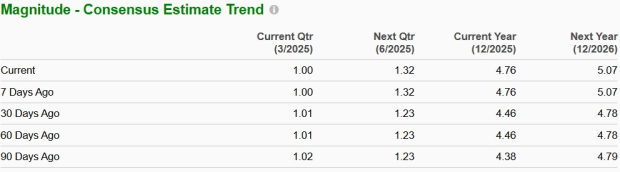

The Zacks Consensus Estimate anticipates 2025 revenues to hit $173.05 billion, reflecting a year-over-year growth of 7.65%, with earnings projected to increase by 11.74%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

Evaluating JD.com from a valuation stance, the company offers a forward 12-month P/E ratio of 8.58X, notably lower than the industry average of 22.25X. This disparity suggests investor apprehensions regarding China’s economic growth and regulatory issues, even as recent government stimulus measures have been positively influencing consumer confidence.

JD’s Discounted P/E Ratio

Image Source: Zacks Investment Research

Expanding Beyond Core Business for Enhanced Growth

JD.com is actively broadening its reach beyond traditional retail into high-growth segments that leverage its strengths in logistics and supply chain management.

Recently, JD Logistics opened its third warehouse in Poland, enhancing its European presence with an additional 10,000 square meters of capacity. This strategic move bolsters cross-border supply chain capabilities and equips JD to take advantage of the increasing global e-commerce market. The company aims to double its overseas warehouse capacity by 2025 to support its international growth strategy.

In addition, JD Health has made significant contributions to specialized markets, supporting over 23,000 patients with rare diseases through its dedicated charity initiatives. Notably, it has established China’s largest retail platform for Food for Special Medical Purposes, alongside advanced resources like the Doctor-Searching Map for rare diseases.

Moreover, JD’s partnership with the UEFA Champions League as the official e-commerce innovation partner enhances its global brand presence and opens new revenue streams through merchandise sales and innovative fan experiences.

Technological Innovation Positions JD for Future Growth

JD.com’s strong focus on technology and innovation is a vital factor supporting long-term investment. The company is strategically implementing AI and automation to improve various operations, from customer interaction to supply chain management.

AI applications have been integrated across multiple functions, including marketing and customer support, along with advanced algorithms optimizing search and recommendations, increasing operational efficiency. JD is also investing in emerging fields like embodied intelligence, establishing specialized departments for home applications.

In the automotive sector, JD Auto’s collaboration with Continental Tires has introduced China’s first rapid tire delivery and installation service, providing customer convenience in a slow-moving industry. Additionally, JD has launched an official flagship store for Xiaomi Auto, solidifying its presence in the expanding electric vehicle market.

Investment Outlook: Strong Positioning for the Future

JD.com’s remarkable financial results, diverse growth strategies, and commitment to technology present a strong investment case. The company has enhanced its attractiveness with a 32% annual dividend increase to $1.0 per ADS, alongside its substantial $5 billion share repurchase program.

With confidence in meeting long-term margin objectives and several growth drivers on the horizon, JD.com is well-positioned for continued outperformance in 2025. The considerable valuation discount when compared to industry counterparts offers a margin of safety while allowing for potential upside as the company executes its multifaceted growth strategy.

For investors aiming to capitalize on China’s burgeoning digital economy backed by disciplined financial management and innovation, JD.com stands out as an attractive opportunity, extending beyond its notable Stock performance over the past year. JD.com currently holds a Zacks Rank #1 (Strong Buy). You can find the full list of today’s Zacks #1 Rank stocks here.

Zacks Identifies Top Semiconductor Stock

While only a tiny fraction of NVIDIA, which has climbed over +800% since our recommendation, our latest chip Stock holds greater growth potential.

With robust earnings growth and a widening customer base, it is poised to meet surging demand for Artificial Intelligence, Machine Learning, and Internet of Things applications. Global semiconductor manufacturing is projected to soar from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Interested in the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click to access this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Expedia Group, Inc. (EXPE): Free Stock Analysis report

MercadoLibre, Inc. (MELI): Free Stock Analysis report

JD.com, Inc. (JD): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.