Equity Opportunities ETF Shows Strong Analyst Target Upside Potential

In our ongoing analysis of ETFs at ETF Channel, we compared the trading price of each holding with the average 12-month forward target price set by analysts. This evaluation led us to calculate the weighted average implied analyst target price for the First Trust US Equity Opportunities ETF (Symbol: FPX), which stands at $139.56 per unit.

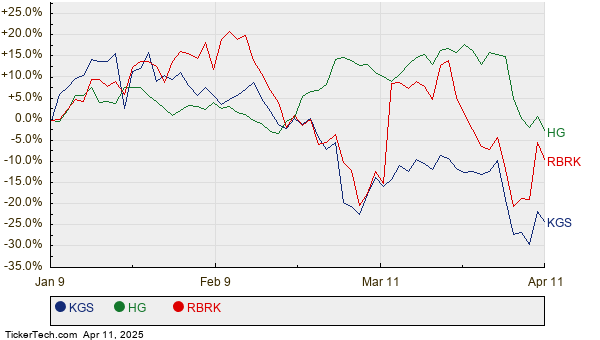

Currently, FPX is trading near $106.90 per unit, implying a potential upside of 30.55% based on analyst targets for its underlying assets. Notably, three holdings in FPX present significant upside compared to their respective target prices: Kodiak Gas Services Inc (Symbol: KGS), Hamilton Insurance Group Ltd (Symbol: HG), and Rubrik Inc (Symbol: RBRK). KGS is trading at $32.22 per share, with an average target of $45.42, indicating a 40.96% upside. Similarly, analysts project a target of $23.83 for HG, 34.80% above its recent price of $17.68. Meanwhile, RBRK’s current price of $58.35 suggests an increase of 32.15%, with a target of $77.11 per share. Below is a twelve-month price history chart comparing the stock performance of KGS, HG, and RBRK:

Here’s a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust US Equity Opportunities ETF | FPX | $106.90 | $139.56 | 30.55% |

| Kodiak Gas Services Inc | KGS | $32.22 | $45.42 | 40.96% |

| Hamilton Insurance Group Ltd | HG | $17.68 | $23.83 | 34.80% |

| Rubrik Inc | RBRK | $58.35 | $77.11 | 32.15% |

As we analyze these price targets, investors should consider whether analysts are justified in their optimistic projections or if they might be overly ambitious regarding these stocks’ potential trading prices in 12 months. High price targets relative to current trading prices may reflect confidence in future performance but could also signal a risk of downgrades if they do not align with evolving company or industry trends. Further investor research is essential to navigate these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

ETFs Holding CRI

JPX Split History

BIS Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.