Analysts Predict Promising Upside for John Hancock Multifactor Mid Cap ETF

In our latest analysis at ETF Channel, we’ve examined the performance of various ETFs and their underlying stocks. For the John Hancock Multifactor Mid Cap ETF (Symbol: JHMM), the current implied analyst target price comes in at an impressive $69.64 per unit.

Current Trading Overview

Recently, JHMM has been trading at around $61.29 per unit. This suggests a potential upside of 13.62% based on average analyst expectations for its underlying holdings. Among these holdings, three companies stand out with significant growth potential: Viatris Inc (Symbol: VTRS), Match Group Inc (Symbol: MTCH), and Science Applications International Corp (Symbol: SAIC). VTRS, priced recently at $11.39 per share, has an average target of $13.17, indicating a 15.59% upside. MTCH is currently trading at $32.07, with analysts predicting a target of $36.88, which implies a potential increase of 14.98%. Similarly, SAIC is trading at $116.07, with an anticipated target price of $132.33, reflecting a 14.01% upside.

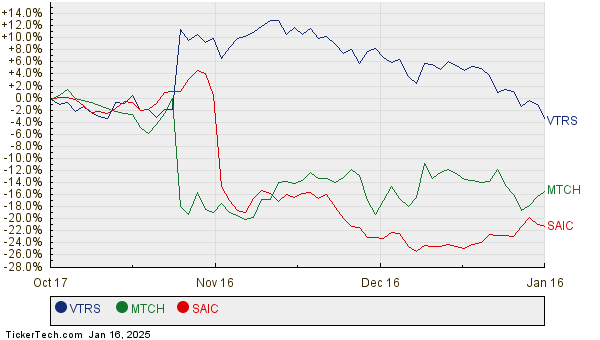

Performance Comparison

Below is a chart illustrating the performance of VTRS, MTCH, and SAIC over the past year:

Target Price Summary

Here’s a summary table of the current analyst target prices for the ETF and its main holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Mid Cap ETF | JHMM | $61.29 | $69.64 | 13.62% |

| Viatris Inc | VTRS | $11.39 | $13.17 | 15.59% |

| Match Group Inc | MTCH | $32.07 | $36.88 | 14.98% |

| Science Applications International Corp | SAIC | $116.07 | $132.33 | 14.01% |

Time for Investor Reflection

Questions remain regarding the validity of these analyst targets. Are the predictions realistic, or might they be too optimistic given recent market changes? High targets compared to current stock prices may indicate confidence but could also lead to adjustments if they do not reflect the current market realities. Investors are encouraged to conduct their own research to better understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• NTIC market cap history

• EHC YTD Return

• EVRI Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.