Vanguard U.S. Value Factor ETF: Analysts Project 15.59% Upside Potential

In a detailed review at ETF Channel, our team examined the holdings of various ETFs and compared their trading prices to the average prices projected by analysts over the next 12 months. For the Vanguard U.S. Value Factor ETF (Symbol: VFVA), the analysis reveals an implied target price of $140.74 per unit based on these holdings.

Current Price and Analyst Expectations

Currently trading close to $121.76, VFVA shows a potential upside of 15.59% based on the expected targets for its underlying assets. Three notable stocks within VFVA that indicate significant upside are HanesBrands Inc (Symbol: HBI), First American Financial Corp (Symbol: FAF), and Green Brick Partners Inc (Symbol: GRBK). HBI, priced at $6.25 per share, has an average target price of $7.80, suggesting a 24.80% increase. FAF shows a 19.07% potential rise from the recent price of $62.99, with a target of $75.00. Meanwhile, analysts predict GRBK could climb 15.99% from its current price of $60.35 to a target of $70.00.

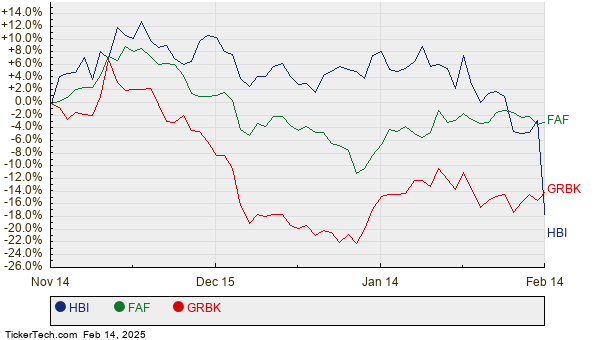

Visual Performance Comparison

Below is a chart illustrating the stock performance of HBI, FAF, and GRBK over the past twelve months:

Analyst Target Price Summary

The table below summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard U.S. Value Factor ETF | VFVA | $121.76 | $140.74 | 15.59% |

| HanesBrands Inc | HBI | $6.25 | $7.80 | 24.80% |

| First American Financial Corp | FAF | $62.99 | $75.00 | 19.07% |

| Green Brick Partners Inc | GRBK | $60.35 | $70.00 | 15.99% |

The Analyst Perspective

The questions arise: Are analysts overly optimistic with these targets, or do they possess valid reasoning based on industry trends? A high price target can signal optimism, but it could also indicate potential adjustments if their estimates do not align with current market conditions. Investors are encouraged to conduct thorough research to understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Dividend History

• LEDS Insider Buying

• LILAK Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.