Meta Platforms Set for Earnings Surge Amid AI Investments

Meta Platforms Inc. META is the largest social media platform globally. This tech giant has expanded its offerings from a single Facebook app to a collection that includes Instagram for photo sharing and WhatsApp for messaging, thanks to strategic acquisitions. In addition to Messenger, these apps now comprise Meta’s array of products.

On October 30, after the market closes, the company is anticipated to release its third-quarter 2024 earnings results. Currently, its stock has a Zacks Rank of #2 (Buy) and boasts a positive Earnings ESP of 2.83%. For a comprehensive overview, check the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research indicates that stocks rated Zacks Rank #3 (Hold) or better (Rank #1 or 2) combined with a positive Earnings ESP have a 70% chance of outperforming earnings expectations. Such stocks often see price increases post-announcement. Find the best stocks to consider with our Earnings ESP Filter.

Meta is pouring substantial resources into generative artificial intelligence (AI), though some analysts question the timing of monetizing these hefty investments.

A potential earnings and revenue beat could strongly indicate Meta’s path toward monetizing its AI spending. Coupled with its favorable Zacks Rank, this may significantly influence its stock price in the near term.

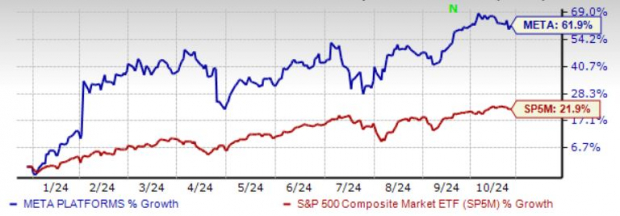

The chart below illustrates META’s price performance year to date.

Image Source: Zacks Investment Research

Third Quarter Considerations

Meta Platforms is experiencing consistent user growth across all regions, especially in Asia Pacific. The company utilizes AI to enhance its services, which currently reach over 3.3 billion users daily. In the United States, user growth remains strong, with WhatsApp surpassing 100 million monthly users and Threads nearing 200 million.

Strong growth in advertising revenues is also a key driver; in Q2 2024, these revenues increased by 21.7% year over year to $38.33 billion, making up 97.9% of total revenue. The impact of increased advertiser spending, thanks to Meta’s expanding AI capabilities, is expected to boost these figures further.

Meta’s use of AI and machine learning enhances various platforms, including Instagram, WhatsApp, Facebook, and Threads. This notable investment in AI aims to enhance its position in the digital advertising market.

Key metrics such as daily active users, ad impressions, and average ad prices are projected to show year-over-year growth in Q3, underscoring Meta’s dominance in the digital ad sector.

However, the Reality Labs division, which focuses on virtual and augmented reality, has been a burden on profits. The effectiveness of these investments in achieving profitability remains uncertain.

Positive Earnings Estimates for META

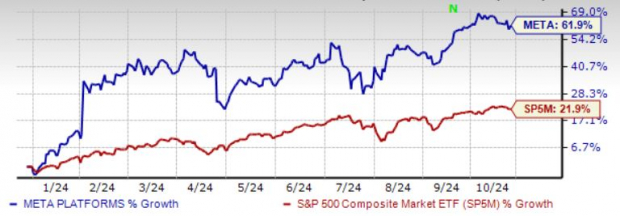

For the third quarter of 2024, the Zacks Consensus Estimate predicts $40.16 billion in revenue, a 17.6% increase from the previous year. Earnings per share (EPS) is forecasted to be $5.17, indicating a rise of 17.8% year over year. The company has consistently reported positive earnings surprises over the last four quarters, with an average beat of 12.6%.

Further, META has seen upward revisions to earnings estimates for 2024 and 2025 in the past week. Currently, the Zacks Consensus suggests year-over-year increases of 20% in revenue and 44.2% in EPS for 2024.

For 2025, the estimates anticipate a 14% growth in revenue and a 13.3% increase in EPS. META also boasts a long-term EPS growth rate of 19.1%, outpacing the S&P 500’s rate of 13.1%.

Image Source: Zacks Investment Research

Additional Catalysts for META Stock

Meta Platforms will soon receive its first shipments of NVIDIA Corp. NVDA’s new flagship AI chip, Blackwell. This next-generation chip, specifically the B200 Blackwell, aims to drive Meta’s AI capabilities forward.

The AI enhancements are improving ad delivery efficiency and boosting returns on ad spending for advertisers. Key sectors like e-commerce, gaming, entertainment, and media are benefiting from Meta’s strong performance.

Management plans to allocate $37-$40 billion for AI initiatives in 2024, with capital spending projected to exceed $50 billion in 2025.

On July 24, META introduced its Llama 3 AI model, designed to maximize revenue potential for API providers. A dollar invested using this model can generate $7 in revenue over four years. This free model is set to compete with established players like OpenAI.

On October 24, Meta entered a multi-year agreement with Thomson Reuters Corp. TRI to provide its AI chatbot access to current event news content, marking a notable partnership between a tech leader and a news publishing entity.

Promising Future for META Shares

So far this year, Meta’s stock price has surged nearly 62%, significantly outperforming the Zacks Internet Software Industry, which has gained 23.1%. Despite this impressive growth, META shares remain attractively valued compared to industry peers, with a forward price-to-earnings (P/E) ratio of 26.5, below the industry average of 32.9. The company’s return on equity stands at a robust 34.2%.

Brokerage firms predict an average short-term price target reflecting a 9.1% increase from the recent closing price of $573.25. These targets range from $425 to $811, indicating potential upside of 41.5% and downside risk of 25.9%.

Image Source: Zacks Investment Research

Access to Zacks’ Insights for Just $1

It’s true!

Years ago, we surprised our members by offering 30-day access to all our investment picks for just $1, without any further obligations.

Thousands capitalized on this chance, while many hesitated, thinking there was a catch. Our aim was straightforward: to familiarize you with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which achieved 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Interested in the latest recommendations from Zacks Investment Research? Download today’s report on 5 Stocks Set to Double for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Thomson Reuters Corp (TRI): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect Nasdaq, Inc.