Analysts Project Upside for Invesco’s NASDAQ 100 ETF and Key Holdings

At ETF Channel, we’ve analyzed the underlying assets of the Invesco NASDAQ 100 ETF (Symbol: QQQM) by comparing their current trading prices with average analyst 12-month forward target prices. From this analysis, the weighted average implied analyst target price for QQQM stands at $245.85 per unit.

QQQM Shows Potential for Growth

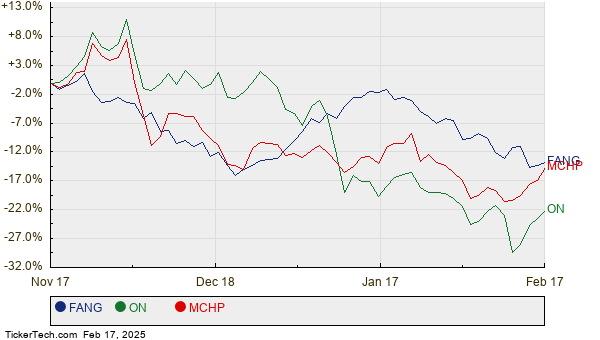

Currently, QQQM is trading around $221.56 per unit. Analysts predict a 10.97% upside for this ETF based on the expected performance of its underlying holdings. Specifically, three key companies are noted for their considerable upside potential: Diamondback Energy, Inc. (Symbol: FANG), ON Semiconductor Corp (Symbol: ON), and Microchip Technology Inc (Symbol: MCHP). For instance, FANG is trading at $156.99 per share, while analysts target $213.72 per share, indicating a 36.14% increase. Similarly, ON shares have a potential upside of 32.37%, moving from their current price of $51.83 to an anticipated $68.61. MCHP, currently priced at $55.76, has a target price of $66.64, reflecting a potential rise of 19.51%. Below is a chart illustrating the recent price performance of FANG, ON, and MCHP:

Analyst Target Price Summary

The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ 100 ETF | QQQM | $221.56 | $245.85 | 10.97% |

| Diamondback Energy, Inc. | FANG | $156.99 | $213.72 | 36.14% |

| ON Semiconductor Corp | ON | $51.83 | $68.61 | 32.37% |

| Microchip Technology Inc | MCHP | $55.76 | $66.64 | 19.51% |

Questions for Investors

Are these analysts’ target prices realistic, or are they overly optimistic about these stocks after 12 months? It’s essential to consider whether analysts have sound reasons for their forecasts or if they are lagging behind recent developments within the companies and their respective industries. High target prices can signal optimism but may also suggest possible future downgrades if the targets are outdated. Investors should conduct further research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additionally, see:

• Top Ten Hedge Funds Holding HELO

• QSR Dividend History

• QRFT Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.