Analysts Predict 9.87% Upside for ALPS Sector Dividend Dogs ETF

At ETF Channel, we’ve analyzed the underlying holdings of exchange-traded funds (ETFs) within our coverage universe. By comparing the trading price of each holding against the average analyst 12-month forward target price, we’ve calculated the weighted average implied target price for the ALPS Sector Dividend Dogs ETF (Symbol: SDOG), which stands at $62.25 per unit.

Currently, SDOG is trading at approximately $56.66 per unit. This suggests analysts anticipate a 9.87% upside based on the average target prices of SDOG’s underlying holdings. Notably, three holdings within SDOG exhibit significant potential for appreciation: Philip Morris International Inc (Symbol: PM), AbbVie Inc (Symbol: ABBV), and Exelon Corp (Symbol: EXC).

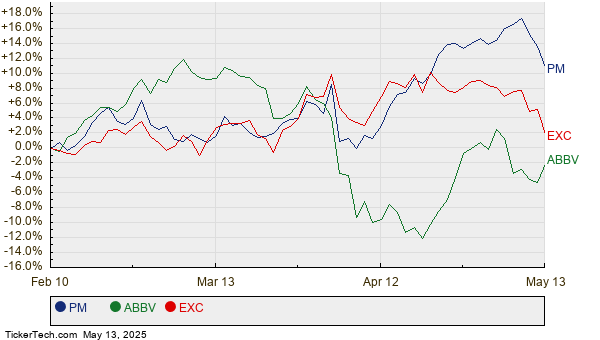

For instance, PM is trading at $164.83 per share, yet analysts project an average target of $182.45, indicating a 10.69% upside. Similarly, ABBV shares, priced at $190.07, also show a potential gain of 10.55%, with analysts setting an average target price of $210.12. Lastly, analysts foresee EXC reaching an average target of $48.13, representing a 10.37% increase from its recent price of $43.61. Below is the twelve-month price history chart comparing the performance of PM, ABBV, and EXC:

Collectively, PM, ABBV, and EXC comprise 6.06% of the ALPS Sector Dividend Dogs ETF’s holdings. The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ALPS Sector Dividend Dogs ETF | SDOG | $56.66 | $62.25 | 9.87% |

| Philip Morris International Inc | PM | $164.83 | $182.45 | 10.69% |

| AbbVie Inc | ABBV | $190.07 | $210.12 | 10.55% |

| Exelon Corp | EXC | $43.61 | $48.13 | 10.37% |

Questions arise regarding the justification of these analyst targets. Are they grounded in recent company performances and industry trends, or do they reflect an overly optimistic outlook? Price targets significantly higher than the current trading prices may suggest future optimism. However, they could also precede potential downgrades if analysts fail to keep pace with market changes. Investors should conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Insights on Additional Investment Opportunities:

• Top Ten Hedge Funds Holding CDXC

• Institutional Holders of STCK

• Ralph Lauren Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.