Analysts Predict Upside for Invesco S&P MidCap Low Volatility ETF

In our analysis of ETF holdings, we compared the current trading prices of individual stocks within the ETFs we cover at ETF Channel. Specifically, for the Invesco S&P MidCap Low Volatility ETF (Symbol: XMLV), we calculated the weighted average implied analyst target price based on its underlying assets. The determined target price for this ETF is $67.85 per unit.

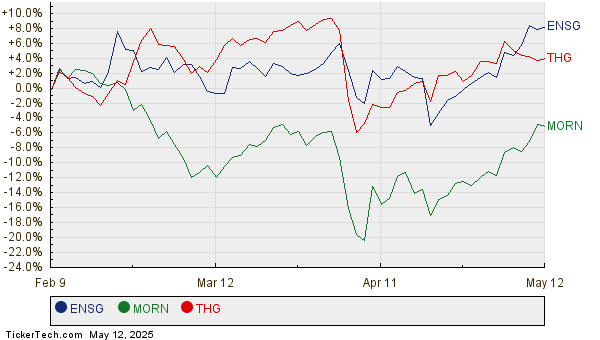

As XMLV trades at approximately $61.15 per unit, analysts suggest a potential upside of 10.96%. Among XMLV’s underlying stocks, three show significant upside relative to their analyst target prices: Ensign Group Inc (Symbol: ENSG), Morningstar Inc (Symbol: MORN), and Hanover Insurance Group Inc (Symbol: THG). Currently, ENSG’s share price stands at $136.68, with an average target price indicating a 20.87% rise to $165.20. Similarly, MORN, with a recent price of $304.30, could see a 20.49% increase to a target of $366.67. Analysts project that THG, trading recently at $166.67, may reach a target price of $185.71, reflecting an 11.43% upside. Below is a twelve-month price history chart comparing the stock performance of ENSG, MORN, and THG:

For a clearer view, here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Low Volatility ETF | XMLV | $61.15 | $67.85 | 10.96% |

| Ensign Group Inc | ENSG | $136.68 | $165.20 | 20.87% |

| Morningstar Inc | MORN | $304.30 | $366.67 | 20.49% |

| Hanover Insurance Group Inc | THG | $166.67 | $185.71 | 11.43% |

Investors should consider whether these targets are justified or if there is underlying optimism about the companies’ futures. High target prices relative to current trading levels can indicate potential, yet they may also lead to downgrades if they stem from outdated analyses. Further research is warranted to evaluate these assessments and market conditions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• The Online Investor

• LX Dividend History

• ROSG Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.