Rollins, Inc. Shows Resilience with Impressive Stock Performance

Rollins, Inc. (ROL) has demonstrated notable performance over the past year, with its stock rising 14% while the industry experienced a 36% decline.

Positive Factors: Strong Demand and Consistent Dividends

A commitment to returning value to shareholders positions Rollins as a solid choice for long-term investors. The company has paid out dividends totaling $298 million, $264.3 million, $211.6 million, and $208.7 million for 2024, 2023, 2022, and 2021, respectively.

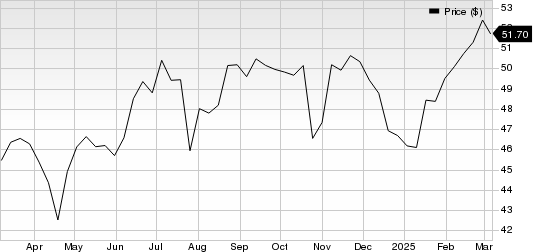

Rollins, Inc. Stock Price

Rollins, Inc. stock price | Rollins, Inc. Quote

Demand for Rollins’ pest and termite control services remains strong across all business sectors. In the third quarter of 2023, revenues rose 10.3% year over year, with segment growth reported at 9% for residential, 10% for commercial, and 13.6% for termite services.

Acquisitions continue to play a crucial role in Rollins’ expansion strategy, enhancing brand visibility and regional reach while increasing revenue. In total, the company has executed 99 acquisitions, including 44 in 2024.

Rollins utilizes a proprietary Branch Operating Support System that streams service tracking and payment processing for its technicians. This system also offers virtual route management tools, which enhance route efficiency and contribute to cost reductions, allowing for improved customer service and retention.

Zacks Rank and Alternative Stock Options

Currently, Rollins holds a Zacks Rank of #3 (Hold).

In the broader Zacks Business Services sector, higher-ranked stocks include AppLovin Corporation (APP) and ABM (ABM).

AppLovin Corporation boasts a Zacks Rank of 1 (Strong Buy) and has a long-term earnings growth expectation of 20%. It recorded an average earnings surprise of 23.5% over the last four quarters.

ABM, holding a Zacks Rank of 2 (Buy), anticipates long-term earnings growth at 5.2%. The company has delivered an average earnings surprise of 11.6% over the last four quarters.

Exclusive: Zacks’ Top 10 Stocks for 2025

Act now to access our handpicked selection of ten top stock picks for 2025. Curated by Zacks Director of Research, Sheraz Mian, this portfolio has consistently outperformed expectations. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio rose +2,112.6%, significantly surpassing the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies covered by the Zacks Rank to identify the top ten stocks to buy and hold for this year.

ABM Industries Incorporated (ABM): Free Stock Analysis Report

Rollins, Inc. (ROL): Free Stock Analysis Report

AppLovin Corporation (APP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.