Analysts Predict Growth: Invesco S&P MidCap ETF Outlook

At ETF Channel, we analyzed the holdings of ETFs in our coverage universe, comparing their current trading prices with the average 12-month forward target prices set by analysts. For the Invesco S&P MidCap Low Volatility ETF (Symbol: XMLV), we determined an implied analyst target price of $67.80 per unit based on its underlying assets.

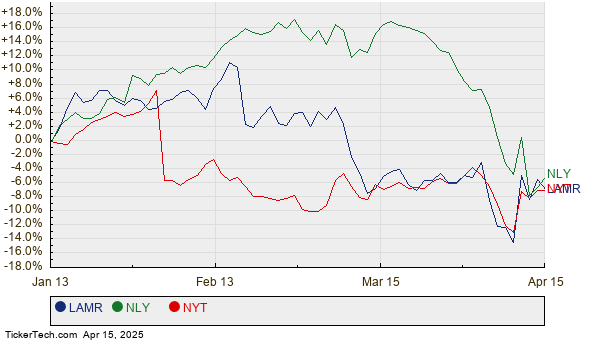

Currently, XMLV trades at approximately $59.11 per unit. This indicates that analysts foresee a potential upside of 14.71% based on the average target prices of the ETF’s holdings. Among XMLV’s underlying assets, three stocks stand out with significant upside potential: Lamar Advertising Co (Symbol: LAMR), Annaly Capital Management Inc (Symbol: NLY), and New York Times Co. (Symbol: NYT). LAMR, priced at $111.17 per share, has an average target price of $132.60, a 19.28% increase. Similarly, NLY, currently at $17.83, has an upside potential of 18.55%, with a target price of $21.14. Analysts expect NYT to reach an average target price of $57.14, which translates to a 17.84% rise from its current price of $48.49. See the twelve-month price history chart below comparing LAMR, NLY, and NYT:

Below is a summary table detailing the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Low Volatility ETF | XMLV | $59.11 | $67.80 | 14.71% |

| Lamar Advertising Co | LAMR | $111.17 | $132.60 | 19.28% |

| Annaly Capital Management Inc | NLY | $17.83 | $21.14 | 18.55% |

| New York Times Co. | NYT | $48.49 | $57.14 | 17.84% |

Are the analysts’ targets justified or too optimistic for these stocks’ future performance? Investors should consider whether the targets are based on sound justification or if they reflect outdated assessments in light of recent developments in the companies and their industries. A high target price compared to a stock’s trading price can signal optimism but may lead to potential downgrades if those targets become untenable. These are critical questions warranting further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Gas Utilities Dividend Stocks

Top Ten Hedge Funds Holding ISTR

JGH Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.