Investing 101: The Power of S&P 500 Index Funds for Your Retirement

A simple S&P 500 index fund can be a key tool to build a substantial nest egg for retirement.

Many options exist when it comes to S&P 500 index funds, including:

These funds are advantageous for long-term investors, primarily due to their low fees. The SPDR ETF carries the highest expense ratio at just 0.095%, which totals $9.50 for every $10,000 invested. In comparison, the other two ETFs have a remarkably low expense ratio of only 0.03%, costing you just $3 per $10,000 each year.

Image source: Getty Images.

Understanding the S&P 500

The S&P 500 is a collection of 500 of the largest companies in the United States, ranging from Apple to Zoetis (a top animal health firm). These companies together represent about 80% of the total U.S. stock market value.

When you invest in an S&P 500 index fund, you’re effectively investing in these 500 companies, which gives you a stake in much of the American economy. If you’re optimistic about the future of the U.S. economy, investing makes financial sense, as your investment is likely to grow along with the economy.

Is It Possible to Become a Millionaire with an S&P 500 Index Fund?

Absolutely! Historically, the S&P 500 has averaged annual returns of around 10% (not factoring in inflation) over long periods. Your specific returns may differ based on your investment timeline. Let’s explore how money grows at an annual rate of 8%:

|

Investing Period |

$7,500 Invested Annually |

$15,000 Invested Annually |

|---|---|---|

|

5 years |

$47,519 |

$95,039 |

|

10 years |

$117,341 |

$234,682 |

|

15 years |

$219,932 |

$439,864 |

|

20 years |

$370,672 |

$741,344 |

|

25 years |

$592,158 |

$1,184,316 |

|

30 years |

$917,594 |

$1,835,188 |

|

35 years |

$1,395,766 |

$2,791,532 |

|

40 years |

$2,098,358 |

$4,196,716 |

Source: Calculations by author.

As shown, it’s possible to become a millionaire by investing solely in an S&P 500 index fund within 25 years or even sooner if you can invest more than $15,000 annually. It’s important to remember that your earliest investments have the greatest potential to grow over time.

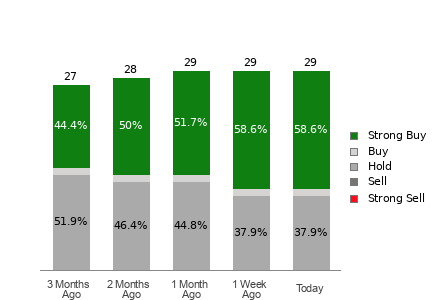

Exploring a Solid S&P 500 ETF

The S&P 500 index funds listed above are all trustworthy. Let’s focus on one, the Vanguard S&P 500 ETF. Like others, it operates as an exchange-traded fund (ETF), which means it trades like a stock.

Here’s a look at its past performance:

|

Time Period |

Average Annual Return |

|---|---|

|

Past 3 years |

8.51% |

|

Past 5 years |

14.96% |

|

Past 10 years |

13.02% |

|

Past 15 years |

14.04%* |

Source: Morningstar.com, as of Nov. 5, 2024.

*Since the Vanguard ETF hasn’t existed for 15 years (it started on Sept. 7, 2010), this figure refers to the SPDR S&P 500 ETF.

Any S&P 500 index fund with a low expense ratio should have a similar performance record.

Top Holdings in the Vanguard S&P 500 ETF

Here are the top 10 holdings of the Vanguard S&P 500 ETF, as of late September. These holdings are consistent across nearly all S&P 500 index funds:

|

Company |

Percentage of ETF |

|---|---|

|

Apple |

7.25% |

|

Microsoft |

6.55% |

|

Nvidia |

6.11% |

|

Amazon |

3.56% |

|

Meta Platforms |

2.56% |

|

Alphabet Class A |

1.99% |

|

Berkshire Hathaway Class B |

1.73% |

|

Alphabet Class C |

1.64% |

|

Broadcom |

1.64% |

|

Tesla |

1.49% |

Source: Vanguard.com. As of Sept. 30, 2024.

Note that all of the “Magnificent Seven” — including Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Facebook owner Meta Platforms, and Tesla — are well-represented with significant holdings. This makes investing in an S&P 500 index fund a straightforward way to include these major companies in your portfolio.

Considerations for More Aggressive Growth

- Vanguard Information Technology ETF

- Vanguard Growth ETF

- SPDR Portfolio S&P 500 Growth ETF

- VanEck Semiconductor ETF

No matter your approach, ensure you have a sound retirement plan and adhere to it, possibly with the assistance of a reliable S&P 500 index fund.

Seize a Second Chance for Potential Gains

Have you ever felt you missed out on high-performing stocks? You might want to pay attention.

Occasionally, our expert analysts provide a “Double Down” stock recommendation, highlighting companies poised for significant growth. If you’re worried those opportunities have passed, now could be the perfect time to invest. Consider the results:

- Amazon: Investing $1,000 when we first recommended it in 2010 would now be worth $23,446!*

- Apple: A $1,000 investment from our 2008 recommendation would be worth $42,982!*

- Netflix: A $1,000 investment from our 2004 recommendation would be worth $428,758!*

We are currently issuing “Double Down” alerts for three remarkable companies, and this could be a rare opportunity.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on the board. Randi Zuckerberg, who worked in market development at Facebook and is the sister of Meta Platforms CEO Mark Zuckerberg, serves on the board. Selena Maranjian has investments in Alphabet, Amazon, Apple, Berkshire Hathaway, Broadcom, Meta Platforms, Microsoft, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, and Zoetis. The Motley Fool additionally recommends Broadcom and has specific options strategies involving Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.