“`html

Strategizing for Success: Stock Picking Essential Amid Market Optimism in 2025

With the new year upon us, many may still be basking in the remnants of holiday joy.

However, as the first weeks of January progress, the initial enthusiasm tends to wane.

People are returning to work and school, and the carefree holiday spirit gives way to the reality of unfinished tasks. Moreover, late January typically brings the holiday credit card bills, coinciding with the usual abandonment of new year’s resolutions. The feeling of winter blues deepens as we face the long wait for spring.

This year’s post-holiday slump might feel more intense since consumers were already less optimistic before Christmas. According to recent findings from The Conference Board, their December data provides insight into consumer sentiment.

The Conference Board Consumer Confidence Index® fell by 8.1 points in December to 104.7 (where 100 is the historical average). The Present Situation Index, reflecting consumers’ views on current business and job markets, decreased by 1.2 points to 140.2. Notably, the Expectations Index, gauging short-term outlooks on income and business, plummeted by 12.6 points to 81.1, just above the recession warning level of 80.

“Compared to last month, consumers in December were significantly less positive about future business conditions and incomes,” noted Dana M. Peterson, Chief Economist at The Conference Board.

After enjoying stock market gains of over 20% for the past two years, consumer confidence has evidently dipped.

“In December, consumers were slightly less optimistic about the stock market: 52.9% anticipated stock prices to rise over the next year, down from a record high of 57.2% in November. Additionally, 25% expected a decline in stock prices, rising from 21.7%,” Peterson stated.

Ultimately, how people feel about the market is not as critical as the actual investments made. Achieving impressive returns hinges on smart stock selection and active management. Investing expert Louis Navellier, editor of Growth Investor, exemplifies how this strategy can build wealth.

Navellier’s analysis suggests that with the right stock choices, significant growth could be on the horizon for 2025.

Last spring, Louis successfully predicted two key political developments:

- Joe Biden being replaced on the Democratic ticket.

- Donald Trump winning the presidency.

Given Louis’s impressive history of accurately selecting winning stocks over the past four decades, his insights carry considerable weight.

As we approach 2025, Louis is making another noteworthy prediction that investors should consider carefully.

Trump’s Potential Impact on Economic Growth

The advent of Trump’s second administration could signal a resurgence of economic expansion and stock market gains.

As the capital gears up for the inauguration, Louis has advised his subscribers to focus on stocks poised to thrive. Here’s a reflection of his thoughts shared with Growth Investor readers.

Much of the uncertainty that led to drastic market fluctuations in 2024 has begun to settle, setting up the possibility for a prosperous New Year.

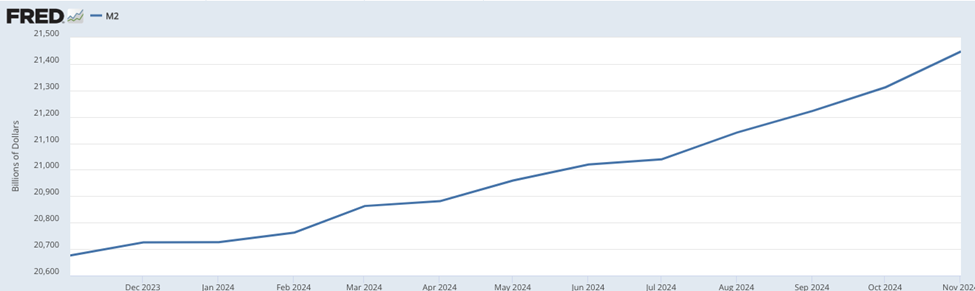

There is a rising optimism surrounding Trump’s return and his pro-business policies. Consequently, the speed at which money circulates, also known as the velocity of money, has increased. This can be observed through the money supply, specifically M2, which includes liquid assets like checking accounts and short-term deposits.

Stock market appreciation correlates closely with M2. As consumer spending rises, the velocity of money increases, leading to greater economic prosperity and, in turn, a stronger stock market.

The following chart from the St. Louis Fed illustrates the recent uptick in the M2 money supply that supports Louis’ analysis.

Which sectors is Louis targeting as Trump prepares for his second term? Energy leads the list.

He has shared his sentiments in correspondence with his Growth Investor subscribers:

Trump 2.0 is a significant boost for the natural gas sector.

Upon assuming office in January, Trump is expected to issue an executive order that lifts the ban on federal land drilling. The previous administration’s efforts to impede liquified natural gas (LNG) growth will be reversed.

The U.S. Environmental Protection Agency’s (EPA) previous carbon dioxide regulations for new natural gas power plants will also be removed, likely leading to a surge in new natural gas electricity generation.

“`

Strategic Stock Picking: Key Insights for Navigating 2025’s Market Landscape

As demand for artificial intelligence data centers rises, investors must be cautious and strategic in their stock selections.

I wish that I could tell you that we’re in a sector stock market; the truth of the matter is that we remain in a stock picking environment.

Tech Stock Performance: A Divergent Path

Looking at the technology sector reveals stark contrasts. NVIDIA Corporation (NVDA) has a solid A-rating and is viewed as a strong buy in the Stock Grader, bolstered by positive earnings forecasts and consistent institutional investments. In contrast, both Advanced Micro Devices Inc. (AMD) and Intel Corporation (INTC) receive lower ratings of D and F, respectively.

Similar patterns can be found across various sectors, emphasizing the need for diligent stock picking rather than general sector selection as we approach 2025.

Exclusive Insights for Growth Investors

Subscribers to Louis’ Growth Investor publication can tap into his Stock Grader system. This resource grants access to ratings on 5,000 stocks, aiding investors in identifying lucrative opportunities. Subscribers benefit from in-depth analysis conducted by Louis himself to refine their investment choices.

Navigating 2025: A Blend of Insight and Strategy

Despite favorable conditions ahead, strategic market navigation demands a blend of insight, discipline, and foresight. Investors who apply these principles may find substantial rewards in the upcoming year.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace