Investing Strategies: Stocks to Consider During Market Corrections

The S&P 500 has experienced a decline of 10% or more nine times since 2010, excluding the current downturn. However, historical data shows that the index typically rebounds, averaging an 18% return in the year following these corrections. Notably, eight of the previous nine instances reported gains.

With above-average returns on the horizon and many stocks now trading at attractive valuations, it may be a prudent time to invest. Below are three compelling stocks trading at valuations that haven’t been seen in a decade, which I believe are worth acquiring now.

Looking to invest $1,000? Our analysts have identified the 10 best stocks to buy right now. Learn More »

1. Zoetis

Zoetis (NYSE: ZTS) leads the animal healthcare sector, providing over 300 medicines, vaccines, and precision health products for both companion animals and livestock worldwide.

Since its separation from Pfizer in 2013, Zoetis has achieved an annualized total return of 15%, showcasing its market-beating capabilities. Following a surge during the pandemic that drove pet adoptions and veterinary visits skyward, the company’s stock has since dropped 39% as conditions normalized.

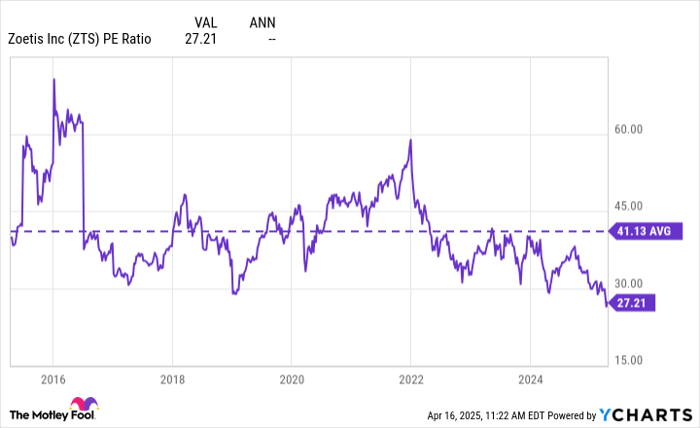

Currently, Zoetis trades at a price-to-earnings (P/E) ratio of 27, marking its lowest valuation in a decade.

ZTS PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Despite the market’s current pessimism regarding Zoetis’s stock, the company’s operational outlook remains robust. In 2024, Zoetis reported an 11% revenue increase and a 17% rise in adjusted earnings per share. Particularly noteworthy is its growth in treating osteoarthritis (OA) pain in pets, with Librela for dogs and Solensia for cats achieving sales growth of 80% and 20%, respectively.

With 40% of dogs experiencing OA at some point in their lives and longer lifespans for pets, these treatments could significantly enhance the quality of life for aging animals.

An additional benefit for investors is Zoetis’s current dividend yield of 1.2%, the highest on record, with management having increased dividend payments by 18% in the past decade.

With steady growth, emerging opportunities, and a robust dividend at a decade-low valuation, I am keen to continue investing in this key holding.

2. Yeti

Yeti (NYSE: YETI) is a well-known lifestyle brand recognized for its premium outdoor products and drinkware. The company has built a loyal following among outdoor enthusiasts, including surfers, fishermen, and barbecue pitmasters, through its high-quality offerings.

After Yeti’s stock quintupled in the three years following its 2019 IPO, expectations soared for the brand’s future. However, the stock has since fallen 75% from its peak, attributable to a significant recall and ongoing tariff issues with China.

While Yeti’s stock has reverted to its 2019 levels, the company has more than doubled sales, net income, and free cash flow (FCF) since then.

Looking ahead, Yeti is focused on two core growth strategies: expanding into new product categories and increasing its international presence. With a recent acquisition of cookware brand Butter Pat, collaborations with adjacent products, and sponsorships in major sports like soccer and Formula 1, Yeti’s brand reach continues to expand.

As of now, only 18% of Yeti’s revenue comes from international markets, a significant improvement from just 2% in 2018. However, a noteworthy 30% growth in international sales is expected in 2024.

Currently, Yeti is trading at its lowest ever P/E ratio of 13, presenting a potential buying opportunity as it shifts its drinkware production outside China.

YETI PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

By year’s end, Yeti aims to produce 80% of its drinkware outside the U.S., signaling that investors should not see it as damaged goods. Instead, Yeti remains a beloved brand backed by a substantial $300 million in net cash to maneuver through challenges.

3. Wingstop

Strongly positioned in the fast-growing sector of buffalo wings, Wingstop (NASDAQ: WING) operates 2,154 locations in the U.S. and 359 internationally. In 2024, the company reported its 21st consecutive year of same-store sales (SSS) growth, alongside increases in store count, overall sales, and net income by 16%, 36%, and 55%, respectively. Despite these positive metrics, Wingstop’s stock remains 49% lower than its 52-week highs.

At first sight, this decline seems illogical; however, it becomes clearer when considering that last year the stock traded at over 150 times earnings. It was priced for success but fell short in its recent performance. Currently, with a P/E ratio of 59, below its long-term average of 100, Wingstop presents a compelling investment opportunity.

Wingstop’s Ambitious Growth Strategy: Analyzing the Investment Potential

WING PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Strong Growth Prospects for Wingstop

Wingstop is on a path to significant growth, with management aiming to quadruple its store count over the long term. This ambitious goal is supported by a record pipeline of over 2,000 restaurant commitments currently in development, which nearly matches its existing store count. With a solid track record in same-store sales (SSS) growth, analysts expect the company to exceed its current valuation rapidly.

Concerns about Wingstop’s premium valuation may arise, especially given its historical average price-to-earnings (P/E) ratio of 100 across its public trading history. However, the company has delivered substantial returns over time, making it a noteworthy consideration for potential investors.

Investment Consideration: Zoetis and Wingstop

As you contemplate investing $1,000 in Zoetis, take this into account:

The Motley Fool Stock Advisor team has identified 10 top stocks that they recommend purchasing now, and Zoetis did not make the list. These selected stocks have the potential to generate substantial returns in the years ahead.

For context, Netflix was featured on the list on December 17, 2004. If you had invested $1,000 at that time, it would be worth approximately $524,747 today!* Similarly, Nvidia made the cut on April 15, 2005, and a $1,000 investment back then could now be worth around $622,041!*

It’s relevant to emphasize that the Stock Advisor program has delivered an average return of 792%, outperforming the S&P 500, which has returned just 153% over the same period. Don’t miss the opportunity to join and access their latest top 10 list.

*Stock Advisor returns as of April 14, 2025.

Josh Kohn-Lindquist holds positions in Wingstop and Zoetis. The Motley Fool is also invested in and recommends Pfizer and Zoetis, alongside Wingstop and Yeti. For more details, refer to their disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.