Analysts See Positive Outlook for Vanguard ESG U.S. Stock ETF

Market Insights and Target Price Expectations

At ETF Channel, we analyzed the underlying assets of the Vanguard ESG U.S. Stock ETF (Symbol: ESGV). By comparing the current trading price of each holding with the average analyst 12-month forward target price, we found that ESGV has an implied analyst target price of $118.92 per unit.

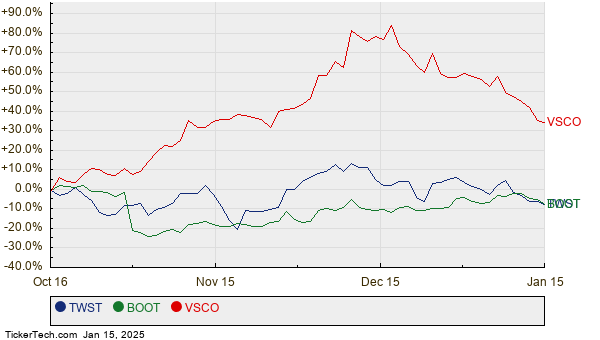

Currently, ESGV is trading at approximately $103.92 per unit. This suggests analysts anticipate a potential upside of 14.43% based on average expected targets for the ETF’s holdings. Among ESGV’s top holdings, three present particularly noteworthy upside potential: Twist Bioscience Corp (Symbol: TWST), Boot Barn Holdings Inc (Symbol: BOOT), and Victoria’s Secret & Co (Symbol: VSCO). Despite TWST’s recent trading price of $42.75 per share, analysts have set an average target price of $51.90, indicating a 21.40% upside. Similarly, BOOT’s recent price stands at $150.08, while its target price of $178.42 reflects an 18.88% potential increase. Lastly, VSCO, trading at $35.48, has a target price of $42.08—a projected 18.61% increase. Below is a chart showing the twelve-month stock performance of TWST, BOOT, and VSCO:

Current Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard ESG U.S. Stock ETF | ESGV | $103.92 | $118.92 | 14.43% |

| Twist Bioscience Corp | TWST | $42.75 | $51.90 | 21.40% |

| Boot Barn Holdings Inc | BOOT | $150.08 | $178.42 | 18.88% |

| Victoria’s Secret & Co | VSCO | $35.48 | $42.08 | 18.61% |

The validity of these analyst targets remains a point of discussion. Are they realistic or overly optimistic? Analysts may present these price targets based on future company prospects; however, they could also reflect outdated expectations influenced by recent industry developments. Investors should conduct thorough research to evaluate the potential risks and rewards involved.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• BIOD Split History

• GTXI shares outstanding history

• KNTE Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.