Wall Street Faces Volatility Amid Economic Uncertainty and Tariff Policies

For over a century, Wall Street has been a major engine of wealth creation. While other asset classes such as real estate, bonds, and commodities have aided investors in growing their nominal wealth, none match the annualized returns of stocks over extended periods.

However, stocks are not immune to instability, even with their historical long-term growth potential.

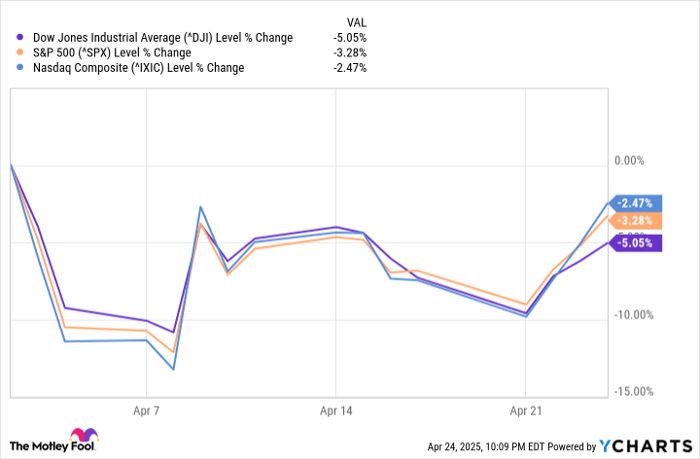

Over the past two months, key indices—the Dow Jones Industrial Average (DJINDICES: ^DJI), the leading S&P 500 (SNPINDEX: ^GSPC), and the growth-oriented Nasdaq Composite (NASDAQINDEX: ^IXIC)—have all reported declines exceeding ten percent. The Dow and S&P have entered correction territory, while the Nasdaq officially dropped into a bear market as of April 8.

April saw significant volatility for these indices. For instance, the S&P 500 experienced its fifth-worst two-day percentage decline (10.5%) in 75 years from the close on April 2 to April 4, followed by its largest single-day point gain in history on April 9.

Image source: Getty Images.

As stocks fluctuate, investors often look for tools or metrics that could provide insights into the future direction of major Wall Street indices. While no method guarantees accurate predictions, certain metrics have historically correlated well with movements in the Dow Jones, S&P 500, and Nasdaq Composite.

Notably, on April 24, a rare event occurred that has only happened 19 times since 1945. This event has consistently predicted the direction of stocks with a flawless track record.

Current Market Sentiment: Fear and Uncertainty

Before delving into this rare forecasting event, it’s essential to examine the factors that have contributed to the current climate of fear and volatility on Wall Street.

One significant driver has been President Donald Trump’s tariff strategy. On April 2, he announced a 10% global tariff and introduced higher “reciprocal tariffs” on nations with trade deficits against the U.S. While these tariffs are currently paused for all countries except China, the implications are vast. The aim is to increase revenue, protect American jobs, and enhance the competitiveness of U.S. goods. However, this policy carries risks.

Wall Street’s major stock indices have reacted strongly to Trump’s tariff announcements. ^DJI data by YCharts.

Concerns have arisen that inflation may rise again. Investors welcomed the decline in peak inflation rates from above 9% in 2022 to under 3% today. However, unclear tariff policies could lead to increased prices for consumers, complicating the domestic market’s competitiveness against foreign goods.

Lack of clarity in the administration’s messaging regarding tariffs has compounded investor anxiety. Changes in what goods are subject to tariffs and fluctuating rates create uncertainty.

Additionally, the stock market has faced pressure from rising long-term Treasury bond yields and a weakening economic outlook. Although higher yields may benefit conservative, income-focused investors, they signal rising borrowing costs—hence a potential drag on spending for both consumers and businesses.

The Atlanta Federal Reserve’s GDPNow forecast anticipates a 2.5% contraction in the U.S. economy for the first quarter, as updated on April 25. Such a decline mirrors the steep downturns faced during the Great Recession in 2009.

Image source: Getty Images.

The Zweig Breadth Thrust: A Unique Forecasting Indicator

While it’s difficult to predict when tariff-related uncertainties or economic conditions will stabilize, some events can offer valuable insights into potential market movements. One such event occurred recently, and it warrants investor attention.

On April 24, the technical indicator known as the Zweig Breadth Thrust (ZBT), developed by late market analyst Martin Zweig, was triggered for only the 19th time in the last 80 years. This momentum-driven indicator assesses the ratio of advancing stocks relative to total advancing and declining stocks, commonly referred to as “market breadth.”

The ZBT indicates a period of rapid advance in equities, suggesting a possible shift after downward trends in major indices. Typically, it signals when the 10-day moving average of advancing stocks on the New York Stock Exchange rises from below 40% to over 61.5% within ten trading days, accompanied by increased trading volume.

# Historical S&P 500 Signals Strong Performance Following Zweig Breadth Thrust

The recent performance of the benchmark S&P 500 has drawn attention following the triggers of the Zweig Breadth Thrust (ZBT).

Why does a Zweig Breadth Thrust matter?

Since WWII, it has occurred 18 times, and the S&P 500 has never been lower six or twelve months later.

Many mocked it when it triggered in recent years. pic.twitter.com/WBT1t0EWM5

— Ryan Detrick, CMT (@RyanDetrick) April 24, 2025

As noted by Carson Group’s Chief Market Strategist Ryan Detrick on X, the ZBT has positively signaled market conditions on 18 occasions since 1945, with April 24 marking the 19th instance. Historically, after ZBT triggers, the S&P 500 has increased 100% of the time at both the six-month and twelve-month marks (18-for-18).

Furthermore, returns following these signals have been impressive. The average 12-month return after a ZBT trigger was 24%, significantly outpacing the long-term average annualized return of the S&P 500, which sits at about 10%. The ZBT appears to indicate the beginning of a new bull market or a continuation of an existing one after significant corrections.

It is essential to recognize that while technical indicators like the ZBT are valuable, they cannot fully replace the fundamental drivers of market performance: corporate earnings growth and the overall business environment. A robust economy allows companies to innovate, hire, and grow, providing a solid foundation for indices like the Dow Jones, S&P 500, and Nasdaq Composite.

Should You Invest $1,000 in the S&P 500 Index Right Now?

Before making an investment in the S&P 500 Index, consider the following:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks for investment currently, and the S&P 500 Index did not make that list. The selected stocks have the potential to yield substantial returns in the coming years.

For example, when Netflix was featured on December 17, 2004, a $1,000 investment would be worth $594,046 today!* Similarly, a $1,000 investment in Nvidia recommended on April 15, 2005, would be valued at $680,390!*

It is important to note that Stock Advisor has achieved a total average return of 872%—significantly outperforming 160% return for the S&P 500. Joining Stock Advisor provides access to the latest top 10 list.

See the 10 stocks »

*Stock Advisor returns as of April 21, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.