Contrarian Investing: Discovering AI Opportunities Beyond NVIDIA

Can investors still identify as contrarians while embracing mainstream trends like AI? Absolutely.

In this article, we will explore a less obvious investment that offers substantial potential compared to popular AI stocks. Rather than picking up well-known names like NVIDIA (NVDA), we’ll focus on a fund yielding 8% that could have even more upside.

Rethinking Profitable Contrarian Strategies

Our strategy centers on “oblique investing,” a concept often overlooked in investment discussions. While the term might sound unexciting, it conveys a significant approach: investing in powerful forces that will shape the market and economy over the foreseeable future.

Investing directly in mainstream trends often leads to overpaying, as the market typically prices in expectations. Instead, we will explore stocks and funds positioned to capitalize on these trends, but which are not immediately obvious choices.

A Case Study on Oblique Investments

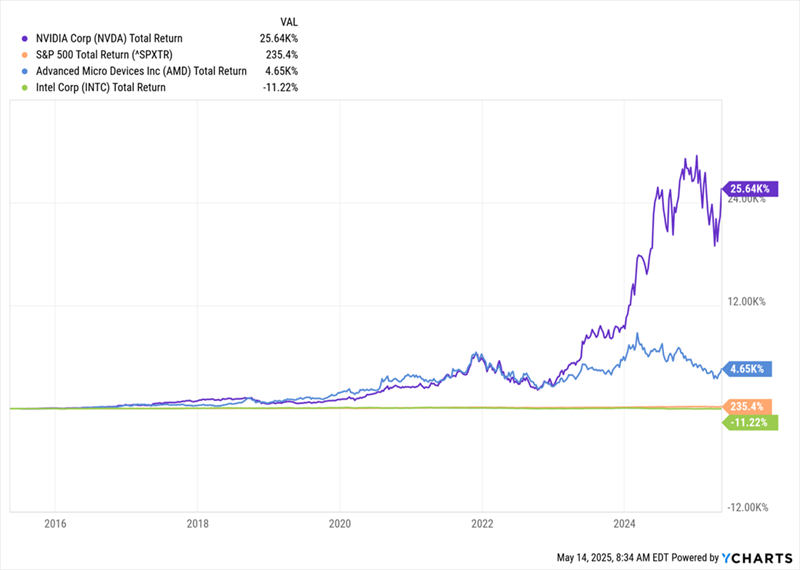

To illustrate this, consider the rise of technology in the mid-2010s. Investors who recognized this trend and bought stocks from the “big three” semiconductor companies—NVIDIA, Advanced Micro Devices (AMD), and Intel (INTC)—outperformed the S&P 500 on average.

Benefits of Trend-Based Investments

As shown in the graphic, significant gains from AMD (in blue) and NVIDIA (in purple) overshadowed Intel’s losses (in green).

However, at that time, investing in NVIDIA seemed risky compared to Intel, the manufacturer of most computer CPUs, which even Apple (AAPL) relied upon. This example underscores that the “obvious” investment didn’t yield the anticipated returns while the less expected, or “oblique,” option did.

Current AI Trends and Their Implications

Fast forward to today; AI is reshaping technology and many societal aspects. NVIDIA again stands out as a key player, its chips powering the AI revolution—similar to how Intel led technology in the past decade.

NVIDIA’s stock shifted dramatically; over the past decade, it rose from 0.063% to 5.8% of the S&P 500, a staggering increase. As of now, post-tariff selloffs, investor interest is returning to the growth narrative anchored in technology like AI.

Yet, NVIDIA’s remarkable rise—over 25,000% during the last 10 years—limits its future growth potential. Another unprecedented return seems improbable.

Introducing a Unique AI Investment Opportunity

Given this context, it’s clear we must pursue AI growth without entering a saturated market. Enter the Virtus Artificial Intelligence & Technology Opportunities Fund (AIO), a closed-end fund (CEF) previously included in my CEF Insider service. CEFs are often undervalued, positioning AIO as an excellent alternative to NVIDIA.

This 8%-yielding fund holds NVIDIA stocks, providing some exposure to its growth while also including other prominent AI firms like Meta Platforms (META).

What’s compelling about AIO is its investment in companies using AI in everyday operations, such as Eli Lilly & Co. (LLY), Progressive Corp. (PGR), and Deere & Co. (DE). These businesses are crucial for successful AI investment, as the true profits might emerge from tech users, rather than tech providers.

For example, Deere employs AI technology to enhance product efficiency, illustrating practical applications of AI not yet reflected in current stock prices. Progressive leverages AI to optimize marketing expenses, while Eli Lilly explores new drug discoveries through AI.

By holding these lesser-known AI beneficiaries, AIO remains well-positioned for long-term gains. The fund also boasts an 8% dividend yield, which has remained consistent since its inception. Special dividends have been awarded to investors as well.

Source: Income Calendar

Thus, AIO provides not only high dividends typically unattainable from mainstream tech stocks like NVIDIA but also robust investment opportunities in AI.

Additional High-Yield “Oblique” AI Investments

AIO represents just one of the many unique funds capitalizing on AI’s explosive growth without the exorbitant valuations found in stocks like NVIDIA. In fact, AIO is not the only compelling option for substantial dividends. I recommend exploring four additional “oblique” AI funds that average a 9.5% dividend yield, with one fund offering an impressive 12.1% return.

These funds are smartly positioned to capture the true winners in AI—the companies implementing technological advances to dominate their respective fields.

Investor interest in these opportunities may accelerate as market awareness grows. Don’t miss the chance to invest in these value-driven funds.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.