Analysts Predict Positive Upswing for Vanguard S&P Mid-Cap 400 ETF

In our latest analysis at ETF Channel, we examined the performance of various ETFs, focusing on the Vanguard S&P Mid-Cap 400 ETF (Symbol: IVOO). After comparing the current trading prices of its underlying assets with the average 12-month target prices set by analysts, we calculated that the ETF’s implied price target stands at $124.54 per unit.

Market Insights: Strong Potential for IVOO

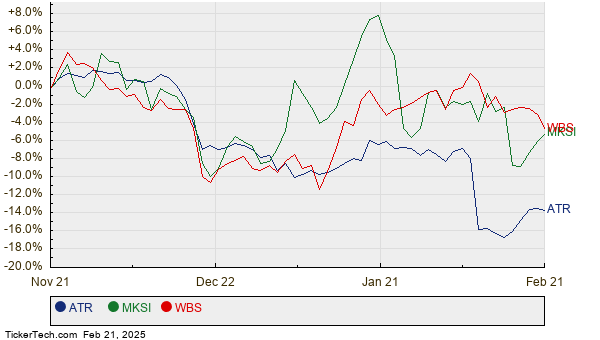

IVOO is currently trading at approximately $107.59 per unit, suggesting a potential upside of 15.75% based on the average analyst targets for its underlying holdings. Notably, three of IVOO’s component stocks show significant potential for growth: AptarGroup Inc. (Symbol: ATR), MKS Instruments Inc. (Symbol: MKSI), and Webster Financial Corp (Symbol: WBS).

ATR, trading at $146.68, has an average target price suggesting it could rise 24.76% to $183.00. Similarly, MKSI is currently priced at $107.85, with a target indicating a 24.53% increase to $134.31. Meanwhile, analysts expect WBS, priced at $57.67, to climb 22.62% to $70.71.

Below is a chart illustrating the stock performance of ATR, MKSI, and WBS over the last year:

Current Analyst Targets Summary

Here’s a summary table of the target prices we discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 ETF | IVOO | $107.59 | $124.54 | 15.75% |

| AptarGroup Inc. | ATR | $146.68 | $183.00 | 24.76% |

| MKS Instruments Inc | MKSI | $107.85 | $134.31 | 24.53% |

| Webster Financial Corp | WBS | $57.67 | $70.71 | 22.62% |

Understanding Analyst Targets

The question remains: Are analysts too optimistic about these stocks’ future prices, or do they have valid reasoning for their projections? A high target in relation to a stock’s trading price might suggest confidence in its growth. However, it could also lead to target adjustments if market conditions change. Investors should conduct thorough research to evaluate these tallies and their implications.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Oversold Metals Stocks

• WEED Options Chain

• ETFs Holding AL

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.