Analysts Forecast Growth for Capital Group Growth ETF

In our ongoing analysis of ETFs at ETF Channel, we looked closely at each fund’s underlying holdings. We compared their current trading prices with the average analyst target prices for the next 12 months, providing a weighted average implied target price for each ETF. For the Capital Group Growth ETF (Symbol: CGGR), we determined an implied target price of $41.48 per unit based on these holdings.

Current Performance and Analyst Outlook

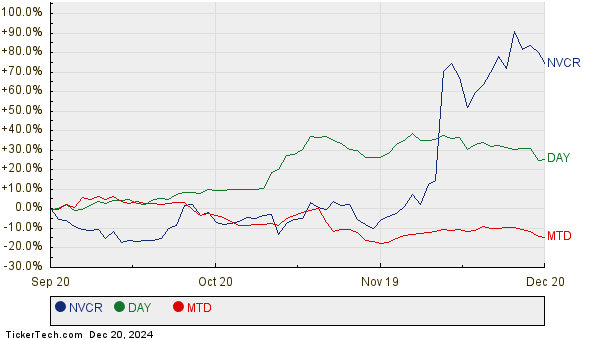

Currently priced around $37.42 per unit, CGGR is projected to have an upside potential of 10.84% according to analysts’ targets for its underlying assets. Noteworthy stocks within CGGR include NovoCure Ltd (Symbol: NVCR), Dayforce Inc (Symbol: DAY), and Mettler-Toledo International, Inc. (Symbol: MTD), all of which show considerable potential. NVCR is currently trading at $30.40/share, yet it has an average analyst target of $34.43/share, suggesting a 13.25% increase. Similarly, DAY’s price of $74.00 has a target of $83.23/share, indicating a 12.48% upside. Meanwhile, analysts expect MTD, which trades at $1206.02, to reach $1342.50/share, reflecting an 11.32% rise. Below is a 12-month price history chart showcasing the performance of NVCR, DAY, and MTD:

Analyst Targets Summary

Here’s a summary table detailing the analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Capital Group Growth ETF | CGGR | $37.42 | $41.48 | 10.84% |

| NovoCure Ltd | NVCR | $30.40 | $34.43 | 13.25% |

| Dayforce Inc | DAY | $74.00 | $83.23 | 12.48% |

| Mettler-Toledo International, Inc. | MTD | $1206.02 | $1342.50 | 11.32% |

Investors Consider Analyst Predictions

Questions remain about whether analysts’ targets are grounded in reality or overly ambitious. Are these predictions based on legitimate market trends, or do they lag behind significant developments within the companies and their sectors? While high price targets can suggest hope for future growth, they can also herald potential downgrades if established expectations have become outdated. These considerations warrant further exploration by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• BDC Investor

• HUVL Insider Buying

• XHR Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.