Analyzing Upside Potential in SPDR S&P 600 Small Cap Growth ETF

Investors typically look for promising opportunities in exchange-traded funds (ETFs). One such option is the SPDR S&P 600 Small Cap Growth ETF (Symbol: SLYG). Recent analysis has revealed that this ETF has an estimated target price that suggests the potential for growth based on its holdings.

According to our findings, the implied target price for SLYG, informed by its underlying assets, sits at $103.02 per unit. Currently, the ETF trades at about $91.64 per unit, indicating a potential upside of 12.42%. This forecast is rooted in the assessments of analysts monitoring the underlying companies within the ETF.

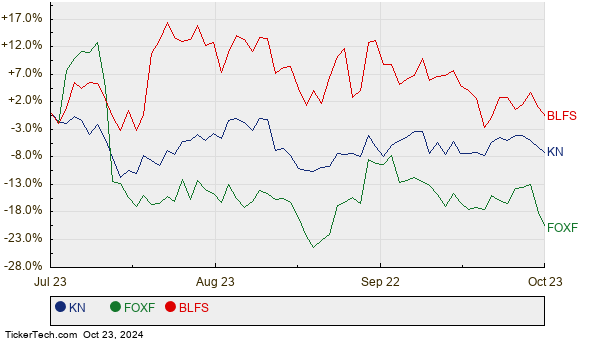

Three notable companies within SLYG that display significant potential include Knowles Corp (Symbol: KN), Fox Factory Holding Corp (Symbol: FOXF), and Biolife Solutions Inc (Symbol: BLFS). Knowles Corp, trading at $17.29, has an analyst target of $22.50, suggesting a bullish potential of 30.13%. Similarly, Fox Factory’s recent trading price of $37.39 has a target price of $47.86, reflecting an expected upside of 27.99%. Finally, for Biolife Solutions, the stock trades at $22.61, while the analysts’ average target stands at $28.40, indicating a potential gain of 25.61%. Below is a chart depicting the stock performance for these companies over the past year:

Here’s a summary of the current target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Growth ETF | SLYG | $91.64 | $103.02 | 12.42% |

| Knowles Corp | KN | $17.29 | $22.50 | 30.13% |

| Fox Factory Holding Corp | FOXF | $37.39 | $47.86 | 27.99% |

| Biolife Solutions Inc | BLFS | $22.61 | $28.40 | 25.61% |

These targets raise important questions for investors. Are analysts being realistic, or overly optimistic about these stocks’ future performance? A higher target price compared to a stock’s current trading price can signal optimism, but it may also lead to downward adjustments if the targets fail to reflect the latest market realities. Investors should consider these aspects carefully.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Also see:

• Preferred Stocks By Industry

• RNP shares outstanding history

• Funds Holding RYLG

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.