Analysts See Bright Future for Vanguard Value ETF and Key Holdings

In our latest analysis of ETFs at ETF Channel, we’ve examined how the current prices of holdings stack up against analyst forecasts. Our findings reveal that the Vanguard Value ETF (Symbol: VTV) has an implied target price of $197.44 per unit, suggesting potential for growth.

Current Performance Indicates Significant Upside

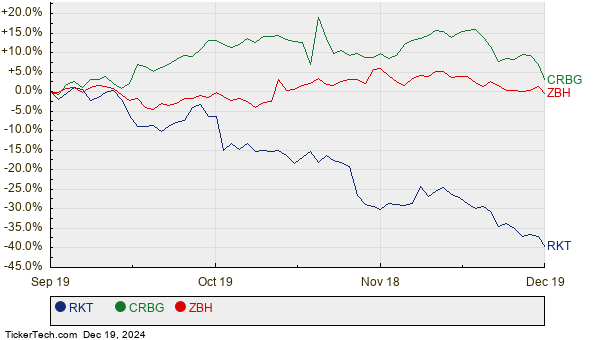

As VTV trades around $168.91 per unit, analysts predict a substantial upside of 16.89%. This optimistic outlook is bolstered by three key holdings: Rocket Companies Inc (Symbol: RKT), Corebridge Financial Inc (Symbol: CRBG), and Zimmer Biomet Holdings Inc (Symbol: ZBH). RKT is currently priced at $11.58 per share, with an average target of $14.75—marking a potential increase of 27.37%. Similarly, CRBG currently trades at $28.79, with analysts targeting $35.71, indicating an upside of 24.05%. ZBH, priced at $105.86, is expected to climb to $124.16, representing a 17.29% increase. Refer to the chart below for a twelve-month price history of these stocks:

Current Analyst Targets Compared

Here’s a quick summary of the analyst predictions for the stocks discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Value ETF | VTV | $168.91 | $197.44 | 16.89% |

| Rocket Companies Inc | RKT | $11.58 | $14.75 | 27.37% |

| Corebridge Financial Inc | CRBG | $28.79 | $35.71 | 24.05% |

| Zimmer Biomet Holdings Inc | ZBH | $105.86 | $124.16 | 17.29% |

Market Sentiment and Future Predictions

Are these analyst predictions too optimistic, or do they reflect a realistic view of the market? High target prices can indicate strong confidence in future performance. However, they can also be revised downward if expectations do not match reality. It’s crucial for investors to conduct thorough research to understand the context behind these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Highest Yield Monthly Preferreds

SLNH Insider Buying

Top Ten Hedge Funds Holding CRR

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.