Note: The following is an excerpt from this week’s Earnings Trends report. To access the full report with detailed historical data and estimates for current and future periods, please click here>>>

Key Earnings Highlights from Q3

- So far, 258 S&P 500 companies have reported Q3 earnings through Wednesday, October 30th. They have seen earnings rise +8.9% accompanied by a +5.0% increase in revenues. Of these companies, 74.4% surpassed earnings per share (EPS) estimates, while 59.3% exceeded revenue expectations.

- When considering all of Q3, both the actual results and estimates from still-reporting companies suggest total S&P 500 earnings will show an increase of +4.4% year-over-year, alongside a +5.2% rise in total revenues.

- The Technology sector is marking its fifth consecutive quarter of double-digit earnings growth at +14.6%. Excluding Technology’s influence, earnings for the remaining S&P 500 companies would only rise by +0.4% this quarter.

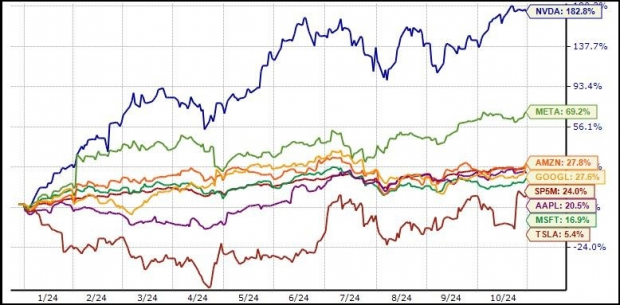

- The ‘Magnificent 7’ companies’ Q3 earnings are expected to increase by +20.1% from last year, with revenues up +14.0%, following substantial growth of +35.2% in earnings and +14.7% in revenues in Q2. If we exclude these seven, the overall index would only see a +0.7% rise in earnings, compared to +4.4% otherwise.

Strong Performances from the Magnificent 7

The reporting season for the Magnificent 7 began with Tesla TSLA’s results last week. While Tesla slightly fell short of revenue expectations, it significantly outperformed earnings estimates. Specifically, Tesla’s Q3 earnings rose +16.9% year-over-year, with revenues increasing by +7.8%.

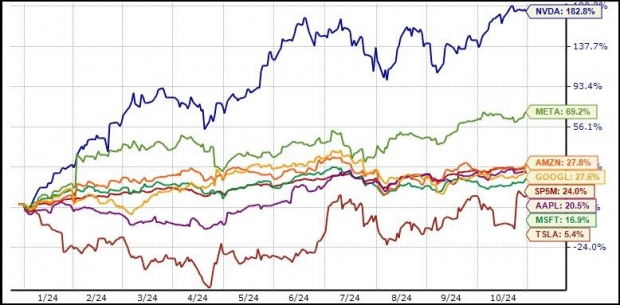

This year, Tesla’s stock has lagged among the Magnificent 7, now up +5.4% following a notable +20% surge after the earnings release. Investors were particularly interested in improvements in operating margins, which have increased compared to prior periods. Though the exact reasons for this margin growth are unclear, speculations suggest that a greater portion of Q3 deliveries came from Tesla’s higher-margin Shanghai factory. Overall, this margin uptick indicates some stabilization amid competitive pressures in the EV market.

In contrast, Alphabet GOOGL’s Q3 results reignited enthusiasm in the market. Following some investor skepticism about rising spending on its AI infrastructure after its prior quarterly report on July 23rd, Alphabet successfully addressed these concerns in its latest release. The Q3 results showed not just increased revenue, but also hinted at improvements in operational efficiency driven by AI technologies.

Alphabet’s cloud revenues surged by +35% in Q3, compared to growth rates of +29% in Q2 and +28% in Q1. Management attributed these gains to enhanced AI capabilities that attracted new clients and secured larger contracts. Notably, around a quarter of their code-writing activities are now driven by AI, representing a concrete example of AI’s impact on productivity.

Recent months have seen the Magnificent 7 relinquish their market-leading position due to investor concerns regarding valuation and increasing capital expenditures related to AI, as reflected in Alphabet’s reports.

Nevertheless, if upcoming results from the remaining Magnificent 7 echo the successes of Tesla and Alphabet, they may regain their leading status in the market.

This anticipated shift is evident in a year-to-date performance chart. Other than Nvidia and Meta, the remaining five Magnificent 7 stocks have struggled against the market.

Image Source: Zacks Investment Research

The upcoming Q3 earnings from these companies will provide another opportunity to demonstrate their growth potential, which is especially crucial for Alphabet, Microsoft, and Amazon, as AI developments are pertinent to all of them.

Despite current market issues surrounding the Magnificent 7 stocks, it’s undeniable that these tech giants are consistently achieving strong profitability growth. Collectively, they are forecasted to report $116.1 billion in earnings for Q3, alongside $488.7 billion in revenues, reflecting a +20.1% year-over-year increase in earnings on +14.0% higher revenues.

Image Source: Zacks Investment Research

The Magnificent 7 are projected to account for 21.7% of all S&P 500 earnings in Q3. Without their major contributions, many of the remaining S&P 500 companies would show a decline in earnings.

The Overall Earnings Landscape

Overall, when evaluating Q3, combining reported results and forecasted estimates, S&P 500 earnings are poised to grow by +4.4% year-over-year on +5.2% higher revenues.

Notably, Q3 earnings growth could have reached +6.8% if it weren’t for challenges in the Energy sector, which is facing a sharp decline of -26.6%. Additionally, isolating the Tech sector would show a modest +0.4% increase in overall earnings.

Looking forward, the pace of earnings growth is expected to improve in subsequent quarters. Below is a forecast chart that captures the expected earnings progression over the next few months.

Image Source: Zacks Investment Research

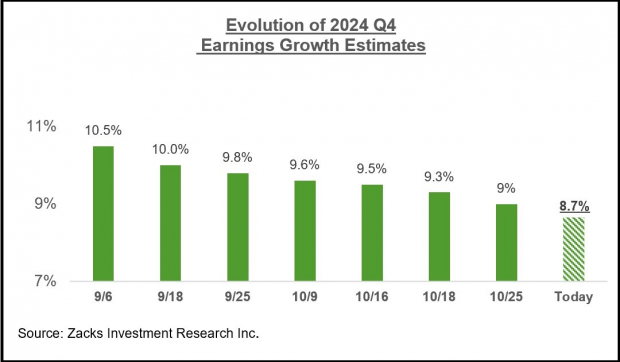

For Q4 2024, total S&P 500 earnings are projected to rise by +8.7% supported by +5.2% higher revenues. Without the impact of the Energy sector, this growth jumps to +10.5%.

Although earnings estimates for Q4 have begun to decline, the revisions so far have been less severe than what was observed at the start of Q3, as shown in the chart below.

Image Source: Zacks Investment Research

The following chart offers an annual overview of the earnings picture.

Image Source: Zacks Investment Research

This year’s earnings growth of +7.3% on merely +1.9% revenue growth highlights ongoing weaknesses in the Finance sector. Excluding Finance, earnings growth climbs to +6.3%, with revenue improving to +4.2%. This indicates that about half of this year’s earnings growth is linked to revenue gains, with the remainder due to improved margins.

Zacks Highlights Top Semiconductor Stock

One notable semiconductor stock, which is only 1/9,000th the size of NVIDIA—whose stock has soared over +800% since our recommendation—has immense potential for growth. While NVIDIA remains strong, this new leading chip stock is well-positioned to address the increasing demand for AI, Machine Learning, and IoT applications. Global semiconductor manufacturing is set to rise dramatically from $452 billion in 2021 to an estimated $803 billion by 2028.

Explore this stock for free >>

Interested in Zacks Investment Research’s latest recommendations? Download our report on 5 Stocks Set to Double today for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read more articles on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.