“`html

The Cohen & Steers Infrastructure Fund (UTF) currently offers a 7.9% monthly dividend and is viewed as a strategic investment in the AI sector, focusing on utilities and infrastructure. As of now, approximately 35% of UTF’s holdings are in utilities, 18% in gas distributors, and 15% in corporate bonds. Data centers, which power AI applications like ChatGPT, are rapidly increasing their electricity consumption, contributing to the fund’s growth potential.

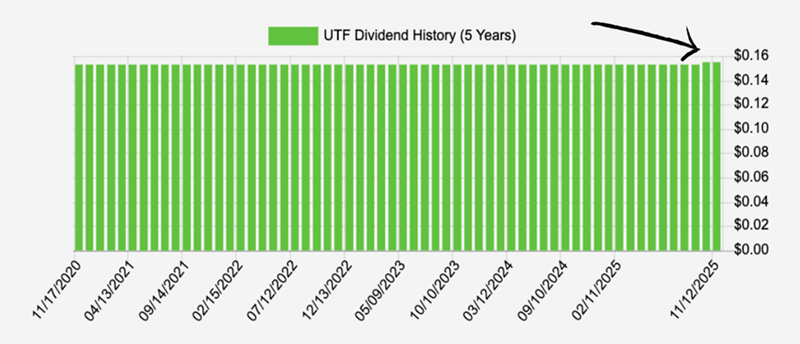

Since its purchase in November 2020, UTF has returned 40%, and in its previous tour (2016-2019), it nearly doubled in total return. The fund is currently trading at a significant discount due to fears of dilution from a recent share offering, creating a buying opportunity as the market price is expected to rise above its net asset value (NAV) shortly.

“`