The emergence of prediction markets is revolutionizing how traders gauge market sentiment in real-time. Platforms like Kalshi and Polymarket allow participants to buy and sell contracts tied to future events—such as interest rate changes and geopolitical developments—rather than traditional stocks. These contracts settle at $1 if an event occurs or $0 if it does not, providing a continuously updated gauge of collective belief based on real financial stakes.

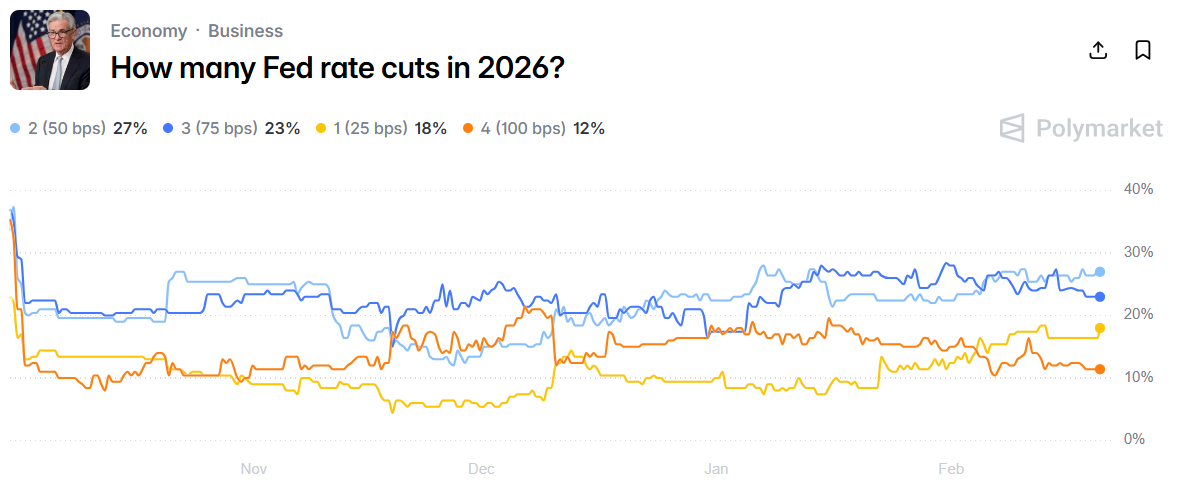

Currently, predictions for Federal Reserve rate cuts in 2026 show the highest likelihood of two cuts at 27%, followed closely by three cuts at 23%, displaying converging trends since January. In addition, there has been a notable rise in the probability of a U.S.-Iran nuclear deal by June 30, increasing from approximately 12% to 39% in just two months, indicating significant shifts in geopolitical risk assessments and their potential impact on markets.

Ultimately, prediction markets provide timely insights into market movements, enabling traders to capitalize on sentiment shifts before they are reflected in traditional market metrics, allowing for informed decision-making based on live data rather than delayed surveys or reports.