“`html

Visa (V) currently has a dividend yield of 0.68%, but its true shareholder yield is approximately 3.5%, factoring in buybacks and dividends. Visa spent $4.53 billion on dividends and $19.2 billion on buybacks in the 12 months ending June 30, 2025, totaling $23.7 billion in shareholder returns. This discrepancy highlights the company’s effective capital management.

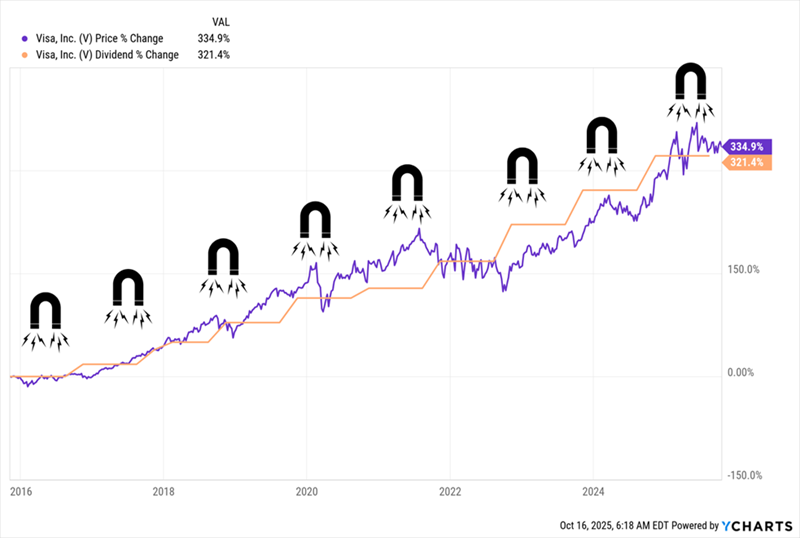

Over the past decade, Visa’s dividend has increased by 321%, aligning closely with a 335% rise in its share price. Furthermore, Visa has reduced its share count by 21% in the last five years, boosting per-share metrics.

With a market cap of $670.1 billion, investors who bought Visa a decade ago are currently yielding 3.1% on their initial investment, surpassing the current yield significantly. Visa’s strategic positioning in the digital payments market suggests potential for continued growth despite economic uncertainties.

“`