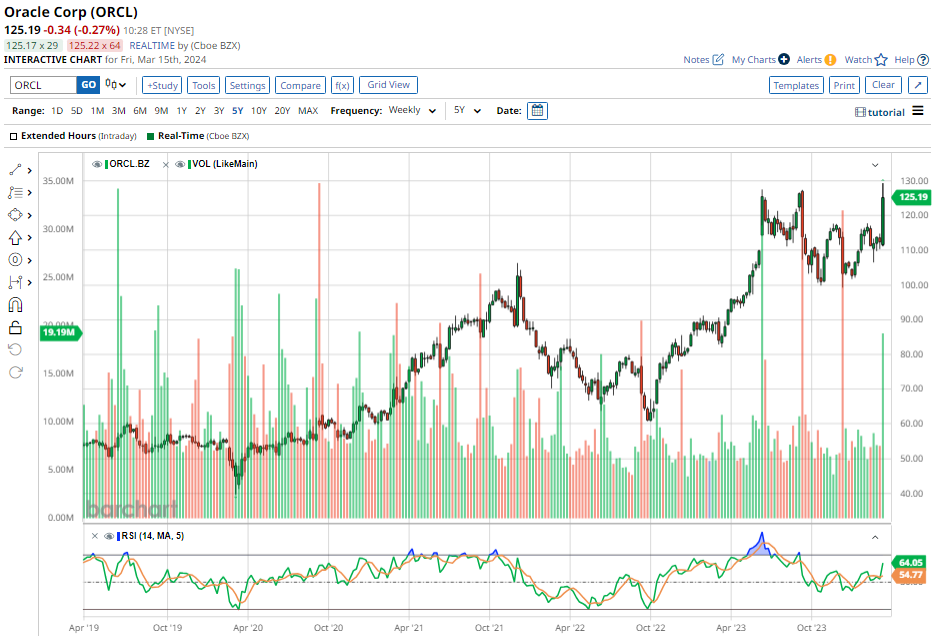

Cloud computing behemoth Oracle (ORCL) witnessed a staggering 12% jump in its stock price in a single trading session post its quarterly results, propelling its year-to-date gains to a robust 18.9%. Alongside surpassing earnings estimates, market excitement peaked as Oracle hinted at a potential collaboration with AI chip giant Nvidia (NVDA), with CEO Safra Katz teasing forthcoming joint announcements with Nvidia. The market cap of Oracle stands strong at $345 billion and has soared over 100% in the past five years, overshadowing the general market performance during this period.

As the Oracle stock continues its upward trajectory, let’s delve into the merits of investing in Oracle at its current valuation.

Uncovering the Oracle Story

Established over four decades ago, Oracle (ORCL) stands as one of the pioneering tech firms in the U.S., gaining prominence with its enterprise-centric database management software. Evolving its product spectrum over time, Oracle has expanded into burgeoning markets beyond its initial domain.

In 2016, Oracle introduced Oracle Cloud Infrastructure (OCI), facilitating enterprises in migrating their operations to the cloud. Presently, Oracle is venturing into providing data center infrastructure to drive AI workloads, poised to be a pivotal revenue catalyst in the forthcoming decade.

The Power Play of AI for Oracle

In late 2023, Oracle accentuated its rapid expansion of existing data centers to satiate the mushrooming demand among AI clientele. Leveraging its GPU cluster technology, Oracle enables clients to fortify AI models at a competitive cost, fueling substantial demand.

Owing to 40 fresh bookings exceeding $1 billion awaiting execution post-fiscal Q3 2024 closure, Oracle secures near-term revenue visibility, hinting at a promising outlook.

Oracle reported revenue of $13.3 billion in fiscal Q3, marking a 7% annual increase. Meanwhile, sales from its OCI segment surged by a staggering 49% to $1.8 billion. Although this segment constitutes a modest 13.5% of total sales, its exponential growth trajectory positions it as a key revenue driver moving forward. Oracle anticipates a more than 50% surge in this business vertical in fiscal 2024 and beyond. Echoing robust demand, Oracle’s AI bookings hit $80 billion in Q3, reflecting a 29% yearly escalation.

Forecasting Oracle’s Profit Landscape

Benefiting from a strategic focus on cost containment and operational efficacy, Oracle witnessed a 27% elevation in adjusted earnings to $0.85 per share, amounting to $2.4 billion, up from $1.9 billion in the corresponding period last year. The ascent in profit margins and cash flows is anticipated to underpin dividend growth, with Oracle currently proffering shareholders an annualized dividend of $1.60 per share, suggesting a yield of 1.25%. These dividends have surged at an annual pace of 17% over the past 12 years.

Analyst Prognosis for Oracle Stock

Of the 26 analysts scrutinizing Oracle stock, 14 advocate a “strong buy” stance, while 12 recommend “hold.” The average target price for ORCL shares is pegged at $129.75, affirming a potential upside of 3.7%. Notably, Oracle’s stock carries a low target price of $100 and a high target price of $160, indicating a premium of approximately 28% from current levels.

In terms of earnings projections, analysts foresee adjusted earnings to scale from $5.12 per share in fiscal 2023 to $5.59 per share in fiscal 2024, with a continued uptrend to $6.23 per share in fiscal 2025. Trading at 20 times forward earnings, Oracle stock is deemed reasonably priced considering an anticipated 11% annual earnings growth over the next five years.

The information and views expressed here are for informational purposes only and do not reflect the stance of Nasdaq, Inc.

As of the publication date, Aditya Raghunath does not hold any positions, directly or indirectly, in the securities mentioned. Please refer to the Barchart Disclosure Policy for further information.