Tech Stocks Surge Despite Mixed U.S. Market Performance

On Thursday, U.S. stocks showed mixed results with technology stocks reclaiming their status as the strongest sector. At the beginning of the week, shares in semiconductor companies fell sharply due to unexpected earnings from Dutch semiconductor leader ASML Holding (ASML). ASML’s earnings report was mistakenly published on the company’s website, causing significant concern. This led to a more than 5% drop in the Semiconductor ETF (SMH). The company’s struggles had a ripple effect across the semiconductor sector.

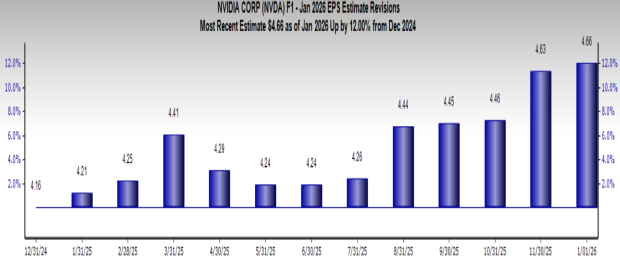

However, despite ASML’s significance in the AI market, many investors should consider Nvidia, renowned as the AI sector’s leader. In a positive turn of events, Taiwan Semiconductor (TSM) exceeded earnings expectations and increased its future guidance. Given that AI is currently a major growth driver, this trend can be seen as favorable for the market over the medium to long term, though short-term fluctuations may still occur.

Short-Term Volatility May Be on the Horizon

Several indicators suggest that short-term market volatility could be ahead, including:

Excessive Bullish Sentiment

The CNN Fear/Greed indicator currently shows that investors are exhibiting “extreme greed.” When investor sentiment swings too far in one direction, the market often needs to pause and reassess gains.

Image Source: CNN

QQQ Nears Historical Highs

The Nasdaq 100 Index ETF (QQQ) is getting close to its all-time highs. Typically, an index doesn’t surpass previous highs without some level of hesitation or adjustment.

Image Source: TradingView

Impact of Upcoming Elections

With the political landscape polarized and candidates offering vastly different proposals, investors may feel cautious leading up to the November elections. Historical trends show that the S&P 500 Index (SPY) often pulls back during uncertain periods before elections, as seen in 2016 and 2020. However, markets have typically rebounded strongly after the votes are counted.

Conclusion

Stocks continue to thrive in a bull market, with the AI sector showing remarkable resilience. Still, investors may consider being cautious as October approaches, anticipating potential short-term volatility.

Try Zacks’ Insights for Just $1

This isn’t a gimmick.

Years ago, we surprised our members by offering a 30-day trial for our picks at just $1. There’s no obligation to invest more.

Many have embraced this offer, while others were skeptical. The goal is to familiarize you with our services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which have seen remarkable success in 2023 with 228 positions closed at double- or triple-digit gains.

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

VanEck Semiconductor ETF (SMH): ETF Research Reports

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.