Market Uncertainty: Insights into Investing During Potential Bear Markets

Equities have struggled in 2025. President Donald Trump’s trade wars are causing significant uncertainty, and many investors are concerned about a possible recession—factors that could negatively impact the Stock market. Recently, the Nasdaq Composite and S&P 500 have both entered correction territory, characterized by a 10% decline from their peaks. The future remains unpredictable; however, a bear market is a tangible possibility.

Should a bear market materialize, it may offer substantial opportunities for knowledgeable investors. Let’s examine what historical trends indicate about buying stocks during bear market phases.

Where to invest $1,000 right now? Our analyst team has revealed their picks for the 10 best stocks to buy today. Learn More »

Embrace Opportunities Amid Fear

A bear market is defined as a drop of 20% or more from an index’s most recent peak. This means that with current corrections, the market is already facing significant declines. Staying composed during such downturns can be challenging; however, historical data often shows that investing in stocks during these times can yield excellent results. For instance, during the 2020 market downturn caused by pandemic-related disruptions, both the Nasdaq and S&P 500 indices more than doubled from their lowest points in April 2020, generating a compound annual growth rate exceeding 15%, significantly outpacing long-term market returns.

^IXIC data by YCharts

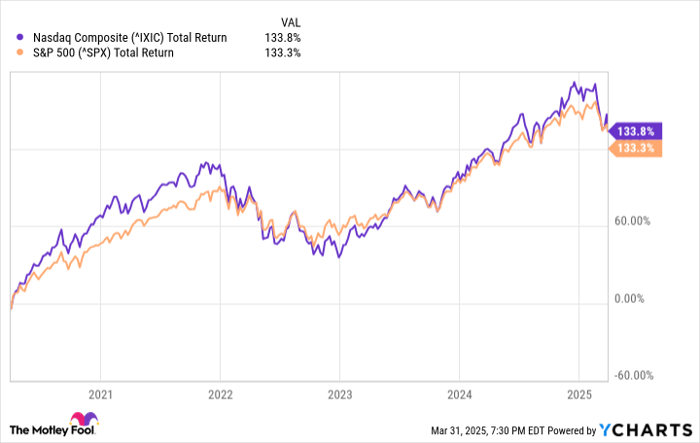

Looking at the bear market of 2022, both indices have rebounded strongly since then.

^IXIC data by YCharts

Generally, experiences from past bear markets highlight that timing the market perfectly remains impossible; no one can predict when it will hit bottom. However, investing in strong companies during negative economic phases aligns with Warren Buffett’s advice to “be greedy when others are fearful.” Instead of fearing downturns, savvy investors should view bear markets as a prime opportunity to acquire valuable stocks.

Top Stock Recommendation for Bear Markets

Shares of the e-commerce giant Amazon (NASDAQ: AMZN) have already declined 13% this year, in part due to overall market volatility. Nevertheless, it remains a solid choice for long-term investors. Amazon dominates several burgeoning industries, positioning itself as the leading player in the U.S. e-commerce market and global cloud computing sector. Currently, its cloud business, Amazon Web Services (AWS), along with its advertising unit, are the primary growth drivers for the company. Key metrics show that these segments are expanding rapidly.

AMZN Revenue (Quarterly) data by YCharts

In AWS, Amazon is increasingly offering various artificial intelligence (AI)-based services, which have become highly sought after over the last two years. With the early stages of AI adoption still unfolding, Amazon’s innovative capacity places it in a strong position to maintain its leadership in this niche. The company’s advertising segment also holds substantial potential for growth—its e-commerce platform is one of the most trafficked globally and benefits from a network effect: more merchants attract more consumers and vice versa.

Moreover, Amazon continues to explore new avenues for growth. Its pharmacy division is capturing market share from established players like Walgreens Boots Alliance, showcasing Amazon’s ability to offer convenience—such as drug delivery—over traditional methods. This success is bolstered by its extensive base of over 200 million Prime members.

Summarizing, Amazon consistently generates revenue, earnings, and cash flow, maintains leadership in growth sectors, and possesses a strong competitive advantage. Although its forward price-to-earnings (P/E) ratio is approximately 30, higher than the average forward P/E of 25 for the consumer discretionary sector, this premium is justified given the company’s industry standing. In the event of a significant bear market, Amazon’s stock would likely become even more appealing.

Should You Invest $1,000 in Amazon Now?

Before purchasing Amazon stock, it’s essential to consider this:

The Motley Fool Stock Advisor analyst team has identified their picks for the 10 best stocks for today… and Amazon is not among them. The stocks making their top 10 list could yield impressive returns in the upcoming years.

For instance, had you invested $1,000 in Nvidia when it appeared on the list on April 15, 2005, it would be worth $578,035 today!*

Stock Advisor offers investors a straightforward strategy for success with portfolio-building guidance, timely analyst updates, and two new Stock picks monthly. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since its inception in 2002.* Don’t miss the latest top 10 stock recommendations available when you join Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.