Major Miners Rio Tinto and Vale Prepare for Earnings Reports

On Wednesday, two of the world’s leading mining companies, Rio Tinto PLC RIO and Vale SA VALE, will reveal their fourth-quarter earnings.

While both companies show promising stock trends, investors will be keen to uncover which miner has the superior growth potential post-earnings.

Rio Tinto: Growth with Challenges Ahead

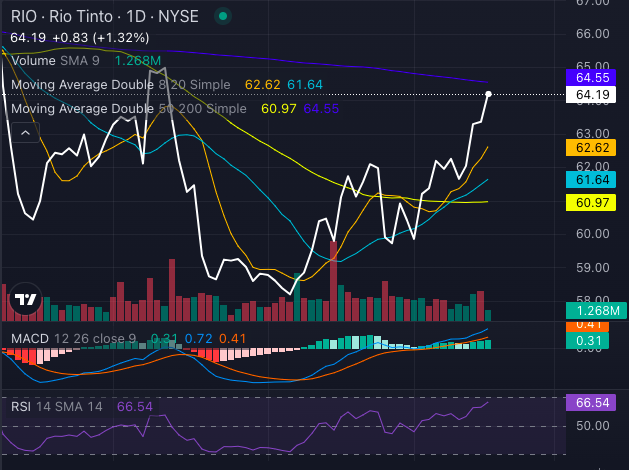

Chart created using Benzinga Pro

So far this year, RIO’s stock has increased by 9%, trading above its eight, 20, and 50-day simple moving averages (SMAs)—a sign of solid technical performance. Despite this, it’s still falling short of the 200-day SMA, currently at $64.55, which could limit future gains. With a relative strength index (RSI) of 66.54, RIO is nearing overbought territory, which may lead to selling pressures after the earnings announcement.

Vale: A Potential Rebound?

Chart created using Benzinga Pro

Vale, which suffered a significant 26.3% decline in stock price over the past year, has made a notable comeback with a YTD gain of 10.98%. Like Rio Tinto, Vale is trading above its short-term moving averages, indicating positive momentum. However, an RSI of 69.71 suggests it is even closer to overbought conditions compared to RIO. The resistance point at the 200-day SMA of $10.55 will be key as investors gauge whether the earnings report can push the stock higher.

Key Insights for Investors

From a technical perspective, VALE appears stronger due to its higher rebound and RSI, but this comes with an increased risk of market cooling. Conversely, Rio Tinto is facing selling pressures and the challenge of breaking through its 200-day SMA, which may indicate a period of consolidation.

The upcoming earnings reports will be crucial in determining which company can sustain its momentum. Should Vale produce impressive results, it may break past its 200-day resistance. For Rio, overcoming concerns about selling pressure will be vital to its performance in the aftermath.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs