Walmart’s Mixed Results Highlight Challenges Ahead for Retail Sector

On Thursday, Walmart (WMT) reported its latest earnings, which failed to excite the market. Despite this, the retail giant navigated a challenging operating environment effectively.

Positive Notes from Walmart’s Earnings

The report showcased several positives, including better-than-expected comparable store sales (comps), Walmart’s domestic e-commerce business becoming profitable for the first time, and the company’s ability to provide guidance amidst widespread operational uncertainty.

Weakness in General Merchandise

However, Walmart did face hurdles. Its general merchandise comps were slightly negative, driven by declines in electronics, home, and sporting goods. Yet, there was positive momentum evident in toys, automotive, and kids’ apparel. Management had forewarned investors about the sluggish start to this category during the April investor meeting, signaling improvement in trends as the quarter progressed.

The general merchandise sector remains weak post-COVID, although recent quarters have hinted at some recovery. Nonetheless, the current results indicate that any significant near-term improvement is unlikely. This poses additional challenges for Target (TGT), which has greater exposure to this category compared to Walmart.

Target’s Upcoming Earnings

Target is set to report its quarterly results before the market opens on Wednesday, May 21st. Other major retailers due to report this week include Home Depot (HD), Lowe’s (LOW), and Deckers Outdoors (DECK).

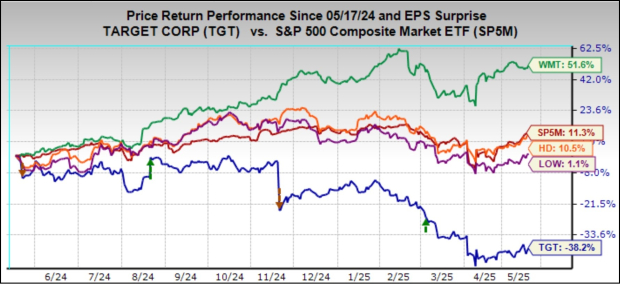

Target has struggled recently, with its stock losing over a quarter of its value this year, significantly lagging the broader market and Walmart’s appreciation of more than 8%. The accompanying chart illustrates a stark contrast in one-year performance: Target shares are down 38.2%, while Walmart is up 51.6%.

Image Source: Zacks Investment Research

Target’s Earnings Expectations

Analysts anticipate Target will report earnings of $1.68 per share on $24.42 billion in sales, reflecting year-over-year declines of 17.2% and 0.47%, respectively. Estimates have been trending downward, with the current prediction down from $1.74 just a week ago and $1.81 two months prior. Expectations for same-store sales also show a decline of 1.7%, contrasting with increases in previous quarters.

This weakness stems from ongoing low demand for Target’s discretionary merchandise, which is often more vulnerable to global trade issues than food and staples. Contrarily, Walmart asserts that two-thirds of its merchandise is sourced domestically, shielding it from tariff-related uncertainties. This leaves Target at a greater risk amid unfavorable global trade conditions.

Sentiment Impact and Market Reaction

Current negative sentiment surrounding Target shares, combined with weak expectations, suggests limited risk for the retailer from this earnings release. Still, the stock has reacted negatively to its last two quarterly reports.

Conditions for Home Improvement Retailers

Home Depot and Lowe’s are also facing a tough environment. Their challenges, however, are largely tied to the prevailing interest rate conditions rather than discretionary spending alone. High interest rates have dampened residential remodeling and major purchases, affecting these retailers’ sales.

The ongoing high yields, despite the Federal Reserve’s easing bias, have disappointed the broader housing sector, including home improvement retailers. Factors contributing to rising treasury yields include anticipated inflation stemming from new tariffs and fiscal pressures.

This scenario keeps mortgage rates elevated, restricting housing-related activities. Consequently, trends in existing home sales are unlikely to improve significantly in the near term, although the medium to long-term outlook remains favorable due to economic and demographic fundamentals.

Long-Term Fundamentals Remain Strong

Key fundamentals include record homeowners’ equity exceeding $30 trillion, a significant number of aging homes, and a housing shortage, all pointing to a robust long-term market for Home Depot and Lowe’s.

Both retailers have managed operations well in a challenging landscape, and no major surprises are expected in their upcoming earnings reports. While the China tariff pause offers some relief, it also signals challenges later in the year when a recovery was initially anticipated. Most current activity in these stores focuses on repair and replacement, with homeowners holding off on larger remodel projects.

Upcoming Home Depot Expectations

Home Depot, reporting before the market opens on May 20th, is projected to earn $3.59 per share on $39.33 billion in revenues, indicating year-over-year changes of -1.1% and +8%, respectively.

Notably, Home Depot’s comps turned positive for the first time after experiencing eight quarters of declines, rising by 0.8% against estimates of -1.2%. The expectation for same-store sales this quarter is around 0.28%. In contrast, Lowe’s had also seen positive comps in the previous quarter but is expected to decline by 1.99% in this upcoming report.

Retail Sector Earnings Overview

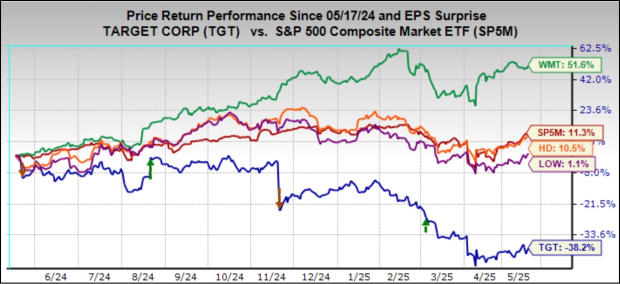

Regarding the Q1 earnings season for the retail sector, results from 21 of the 33 retailers in the S&P 500 have been reported so far. The Zacks Retail sector, which includes Walmart, Target, online vendors like Amazon (AMZN), and restaurants, has shown that these 21 retailers achieved a 16.7% increase in total earnings compared to last year, accompanied by a 5.4% rise in revenues. Among them, 57.1% exceeded EPS estimates, while only 47.6% met revenue expectations.

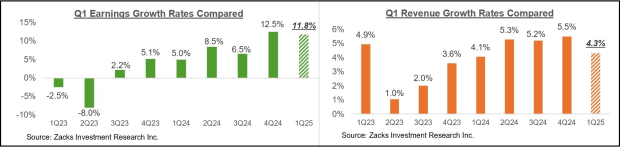

The comparison charts below provide historical context for the Q1 performance of these retailers.

Image Source: Zacks Investment Research

# Q1 Earnings Reports Show Mixed Results: Amazon’s Impact Highlighted

## Overview of Earnings Growth in Q1

Recent earnings reports reveal that the EPS and revenue performance for certain companies is significantly lower than historical averages. Focusing on the overall *earnings* growth rate, it’s important to analyze results both with and without Amazon’s influence. Amazon’s Q1 data shows impressive figures, with earnings rising by +42.6% and revenues increasing by +8.6%, surpassing expectations for both EPS and revenue.

## The Blending of Online and Brick-and-Mortar Retail

The convergence of digital and physical retail is notable. Amazon is now a key player in brick-and-mortar space following its acquisition of Whole Foods, while Walmart continues to expand its online presence. This evolving landscape has resulted from long-term industry trends, which were accelerated by the COVID-19 lockdowns. Additionally, Walmart is becoming a significant player in digital advertising, reflecting the shift in consumer behavior.

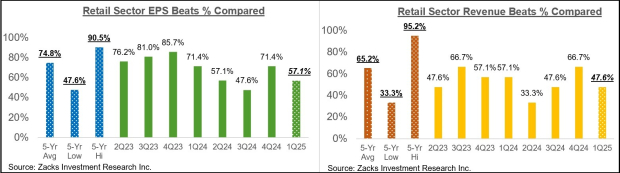

## Performance Metrics Without Amazon

As illustrated in the comparison charts, the earnings for the group excluding Amazon are down by -4%, with a modest +4% increase in revenue. This discrepancy highlights existing margin pressures within the sector. The annual earnings picture further demonstrates that the retail sector’s growth has primarily stemmed from Amazon, with profits essentially flat since 2021.

Image Source: Zacks Investment Research

## Key Earnings Releases This Week

This week, over 100 companies are set to report earnings, including 15 from the S&P 500. Notable contributors to this reporting cycle include Target, Home Depot, and Lowe’s, as well as Ralph Lauren, TJX Companies, Toll Brothers, and China’s Baidu.

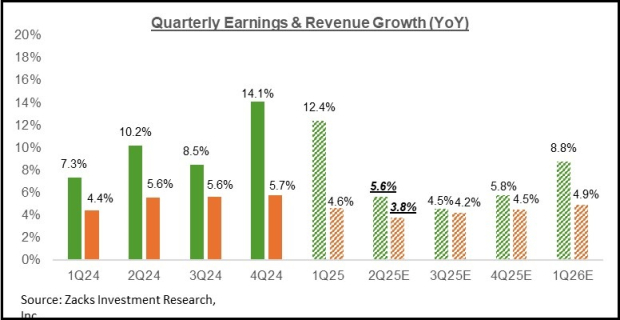

## Insights from the Q1 Earnings Scorecard

As of May 16th, 462 S&P 500 companies had reported Q1 earnings, representing 92.4% of the index. The reported earnings from these members increased by +11.8% year-over-year, supported by a +4.3% rise in revenue. Out of these, 74.2% exceeded EPS estimates and 62.1% surpassed revenue forecasts.

Image Source: Zacks Investment Research

## Historical Context of EPS and Revenue Beats

Current EPS and revenue beats are tracking below historical averages. The Q1 EPS beat percentage stands at 74.2%, slightly lower than the previous 20-quarter average of 78%. Similarly, the revenue beat percentage is at 62.1%, compared to a five-year average of 70.7%.

## Future Earnings Outlook

Looking ahead, earnings for Q1 are expected to increase by +12.4% year-over-year, backed by +4.6% higher revenues. This follows a prior growth rate of +14.1% in earnings with +5.7% revenue gains.

Image Source: Zacks Investment Research

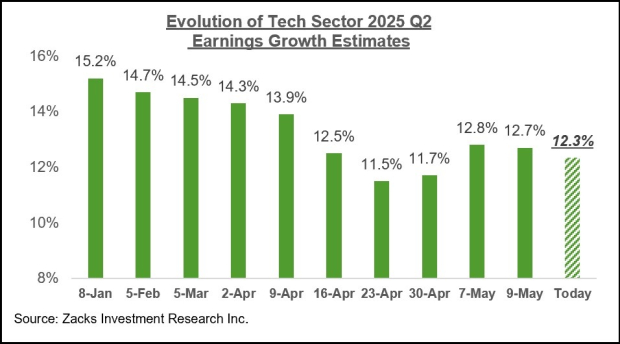

## Downward Estimate Revisions and Tech Sector Stability

Estimates for Q2 2025 have seen larger-than-usual downward revisions. However, there are signs of stabilization in Tech sector estimates. Recent data indicates that earnings expectations for the Tech sector have started to recover, suggesting a potential shift in outlook.

Image Source: Zacks Investment Research

## Conclusion

In light of these findings, while there is cautious optimism regarding earnings forecasts, analysts remain vigilant. The overall adjustments to estimates may not have stabilized completely, particularly following the substantial cuts observed in recent weeks.

Analysts Adjust Earnings Estimates Amid Market Stabilization

The recent management commentary during Q1 earnings calls appears to have influenced analysts’ perspectives, leading to a modest uptick in earnings estimates. This adjustment could signify growing optimism about a stabilizing and improving earnings landscape. If this upward trend persists in the upcoming weeks, it may strongly indicate that the earnings outlook is indeed firming up.

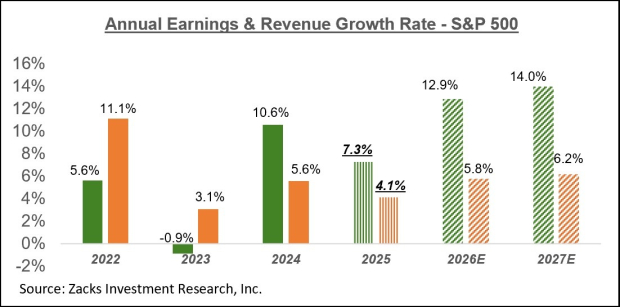

The chart below illustrates the overall earnings trajectory on a calendar-year basis.

Image Source: Zacks Investment Research

Key Insights on Earnings Trends

For those seeking a deeper understanding of the evolving earnings landscape, our weekly earnings Trends report provides valuable insights. This report helps make sense of the changing earnings picture.

Emerging Semiconductor Stock Gaining Attention

In the semiconductor sector, one stock has caught attention as a potential leader, although it is only 1/9,000th the size of NVIDIA—a company that has surged more than +800% since its recommendation. While NVIDIA continues to perform well, this new chip stock has considerable potential for growth.

With robust earnings growth and a widening customer base, this company is well-positioned to capitalize on the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to explode from $452 billion in 2021 to $803 billion by 2028.

This stock comes highly recommended for anyone looking to invest in this thriving industry.

For recent analysis and stock recommendations, consider these companies:

- Target Corporation (TGT)

- Walmart Inc. (WMT)

- Lowe’s Companies, Inc. (LOW)

- The Home Depot, Inc. (HD)

- Deckers Outdoor Corporation (DECK)

This article was originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.