Walmart’s Stock Surge: Can It Keep Up After the Q4 Report?

Walmart WMT shares have stood out in 2023, significantly outpacing not only broader market indexes and competitors like Target TGT but also giants like Amazon AMZN and others in the Magnificent 7 group.

Anticipating Walmart’s Quarterly Performance

As Walmart prepares to announce its quarterly results on Thursday, February 20th, investors will be eager to see if the stock can maintain its upward momentum. Following its last earnings announcement on November 19th, Walmart shares surged by over 20%.

Walmart vs. The Market

The chart below illustrates Walmart’s remarkable performance over the past year, showing an increase of 84.9% compared to a 22.6% rise in the S&P 500 index, 34.8% for Amazon, and a decline of 12.5% for Target.

Image Source: Zacks Investment Research

Setting the Stage for Retail Reporting

This week, Walmart will initiate the Q4 reporting cycle for traditional retailers, with many others releasing results the following week.

Insights into Consumer Spending Trends

The results from Walmart will provide valuable insights into overall consumer spending patterns and household financial health. Since the COVID-19 pandemic, many consumers have shifted their spending towards discretionary services, such as travel and dining, rather than on goods like appliances and furniture.

Target’s Struggling Sales

The notable decline in Target shares illustrated in the first chart stems from weak demand for discretionary merchandise, an area where Target has significant exposure.

Walmart’s Strength in Essential Goods

In contrast, Walmart’s business is strongly anchored in groceries and essential items, which tend to show stable demand during economic fluctuations. Their focus on value and well-executed digital strategies has allowed Walmart to gain market share in the grocery sector, appealing to higher-income households.

Bridging Markets with E-commerce

Despite its growing share of higher-income grocery spending, Walmart continues to serve lower-income consumers, who are grappling with the financial strains caused by inflation. By enhancing its digital offerings, Walmart has successfully attracted more affluent customers.

Projected Financial Performance

Analysts expect Walmart to report earnings per share (EPS) of $0.64 on revenues of $179.3 billion, reflecting year-over-year growth rates of 6.7% and 3.4%, respectively. However, Walmart’s non-grocery sales have faced challenges lately, though management hinted at potential recovery in some discretionary categories during recent calls. An uptick in discretionary spending would bode well not just for Walmart but also for Target.

Retail Sector Earnings Insights

So far, 17 out of 33 retailers in the S&P 500 index have reported their Q4 earnings. Zacks, which monitors this sector separately from Consumer Staples and Consumer Discretionary classifications, continues to track Walmart, Target, and other retailers along with e-commerce players like Amazon and various restaurants.

Retail Earnings Performance

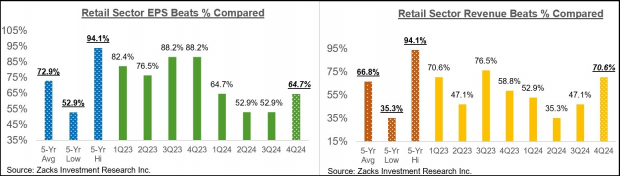

For those 17 companies that have reported, total Q4 earnings are up 47.1% from last year, with a revenue increase of 8.6%. Of these, 64.7% surpassed EPS estimates, while 70.6% exceeded revenue expectations.

Image Source: Zacks Investment Research

Comparison with Historical Data

The data shows that the EPS beats for online retailers and restaurant operators exceed those from previous quarters, although the current quarter’s EPS beat percentage of 64.7% is below the 20-quarter average of 72.9%. Conversely, performance on the revenue side appears strong, with Q4 revenue beat percentages exceeding recent averages.

Amazon’s Impact on the Sector

Significant growth comes from Amazon, which recently reported Q4 earnings up 86.9% on revenues that rose 10.5%. This highlights the ongoing convergence of digital and traditional retail, with Amazon expanding its brick-and-mortar presence and Walmart enhancing its online sales capabilities. This shift has been amplified by trends that surfaced during the COVID-19 pandemic, pushing both companies further into the digital ad space.

Final Thoughts on Q4 Earnings

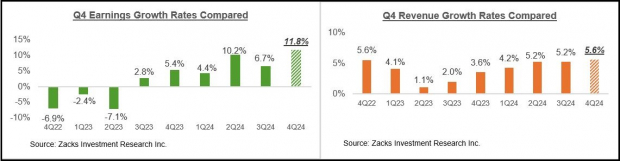

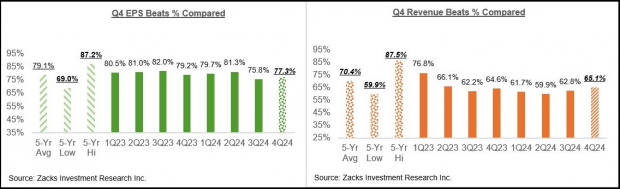

As of February 14th, Q4 results are available from 384 S&P 500 firms, accounting for 76.8% of the index’s total. These companies saw earnings increase by 11.8% year-over-year, alongside a revenue rise of 5.6%. Notably, 77.3% exceeded EPS estimates and 65.1% surpassed revenue forecasts.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

This Week’s Earnings Reports: Key Players to Watch

Nearly 400 companies are set to announce their financial results this week, which includes 43 members of the S&P 500. Alongside Walmart’s earnings release, several significant Chinese tech firms like Alibaba, Baidu, and Sohu.com are expected to report. Additionally, various restaurant chains such as Cheesecake Factory, Shake Shack, and Texas Roadhouse will also share their results.

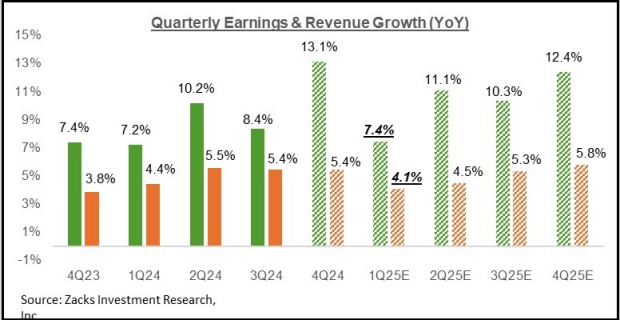

A Glance at Earnings Growth Trends

The upcoming chart provides insights into the earnings and revenue growth expectations for Q4, comparing them with trends from the previous four quarters and predictions for the next four quarters.

Image Source: Zacks Investment Research

Excluding performance from the top seven firms, Q4 earnings across the remaining S&P 500 index are projected to rise by +8.3%, alongside a revenue increase of +4.5%.

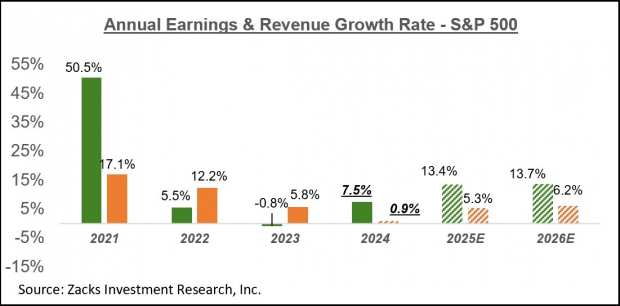

The next chart highlights the broader earnings landscape on a calendar-year basis, indicating strong earnings growth anticipated for 2025 and 2026.

Image Source: Zacks Investment Research

For a detailed breakdown of current earnings expectations, take a look at our weekly Earnings Trends report >>>> Assessing the Current Earnings Forecast

Top 7 Stocks to Consider for the Next 30 Days

Recently released: Analysts have identified 7 top stocks from a pool of 220 Zacks Rank #1 Strong Buys, predicting these to be “Most Likely for Early Price Gains.”

Since 1988, this focused list has outperformed the market more than twice, averaging a gain of +24.3% per year. Be sure to pay attention to these selected 7 stocks.

Access the full list now >>

Are you interested in the latest investment recommendations from Zacks Investment Research? You can download the report on “7 Best Stocks for the Next 30 Days” for free. Click to get your copy.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.