Upland Software Prepares for Q4 2024 Earnings Announcement

Upland Software (UPLD) is scheduled to report its fourth-quarter 2024 earnings results on March 12.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Revenue Expectations for Q4 2024

For the fourth quarter of 2024, Upland anticipates revenues between $65.9 million and $71.9 million, which indicates a year-over-year decline of about 5% at the midpoint.

The Zacks Consensus Estimate for fourth-quarter revenues stands at $68.06 million, reflecting a decrease of 5.71% compared to the same quarter last year.

Upland Software, Inc. Price and EPS Surprise

Upland Software, Inc. price-eps-surprise | Upland Software, Inc. Quote

Earnings Consensus and Historical Performance

The consensus estimate for earnings per share (EPS) is currently set at 24 cents, remaining unchanged over the past month. This marks a significant 71.43% increase from the reported figure in the same quarter last year.

Upland has outperformed the Zacks Consensus Estimate for earnings in three of the last four quarters, missing only once, with an average surprise of 29.23%.

Let’s examine the crucial factors affecting the upcoming announcement.

Key Factors for UPLD’s Q4 Performance

Upland’s fourth-quarter performance is likely to benefit from increased customer acquisitions and successful integrations of artificial intelligence (AI) technology.

The company’s Generative AI (Gen AI) solutions, which contributed to customer acquisition and expansion in Q3 2024, should continue to drive revenue growth this quarter.

AI-powered products such as Upland RightAnswers and Upland BA Insight are expected to enhance customer engagement and revenue further in the upcoming results.

In the third quarter, Upland gained 122 new customers, including 18 significant contracts, and strengthened ties with 312 existing clients, featuring 27 major expansions. This momentum is projected to support stability and growth in Q4 2024 revenues.

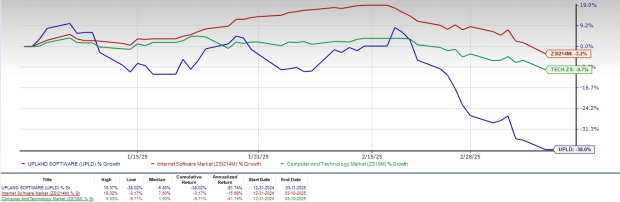

Stock Performance Compared to Market

In 2023, UPLD stocks have fallen 38%, lagging behind the broader Zacks Computer & Technology sector’s decline of 9.7% and the Zacks Internet – Software industry’s decrease of 3.2%.

Year-to-Date Performance

Image Source: Zacks Investment Research

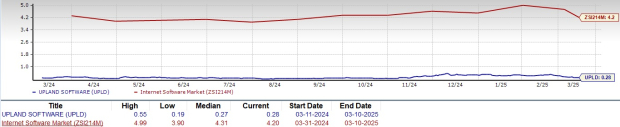

Value Proposition of UPLD Stock

UPLD stock is currently viewed as undervalued, receiving a Value Score of A.

With a forward 12-month Price/Sales ratio of 0.28X, this is significantly lower than the industry average of 4.20X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Growth Fueled by AI Innovations

Upland’s focus on integrating generative AI into its products has proven vital in attracting new customers and reinforcing relationships with current clients.

In February 2025, the company launched Panviva Sidekick, an AI assistant designed to deliver contextualized knowledge to agents in regulated industries, thus improving customer service.

This tool integrates advanced AI search and user-friendly features that support efficient decision-making.

Expansion Through Strategic Partnerships

Upland’s growing partnerships, particularly with Microsoft (MSFT) and Konica Minolta (KNCAY), likely contributed to growth in Q4.

In December 2024, Upland announced an expanded partnership with Konica Minolta, enhancing cloud-based fax solutions tailored for the bizhub One i-Series printers in North America.

In Q3 2024, Upland introduced BA Insight for Microsoft Azure AI Search, allowing seamless integration for intelligent content search with Azure, enhancing customer experience.

Additionally, Upland’s collaboration with IBM WatsonX for AI solutions has boosted product capabilities, reinforcing its appeal to enterprise customers by addressing data privacy requirements.

Investment Outlook for UPLD

The combination of a robust AI portfolio and expanding partnerships presents an attractive proposition for long-term investors considering UPLD stock.

Nonetheless, ongoing revenue issues related to the runoff of Sunset asset revenue are expected to continue impacting financial performance, particularly in Q4 2024.

Currently, UPLD holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a better opportunity before purchasing the stock.

Zacks’ Research Team Highlights Potential Growth Stocks

Our experts have identified five stocks with the highest chance of gaining over 100% in the upcoming months. Among these, the Director of Research, Sheraz Mian, underscores one stock with exceptional potential.

This top pick is from an innovative financial firm with a customer base exceeding 50 million, set to experience substantial gains. While not all of our selections guarantee success, this particular stock could outperform previous Zacks favorites like Nano-X Imaging, which surged 129.6% within nine months.

To view our top stock recommendation and four more promising options, download our free report on the 7 Best Stocks for the Next 30 Days. Click to access your copy.

Microsoft Corporation (MSFT) : Free Stock Analysis report

International Business Machines Corporation (IBM) : Free Stock Analysis report

Konica Minolta Inc. (KNCAY) : Free Stock Analysis report

Upland Software, Inc. (UPLD) : Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.