UPS and FedEx Face Challenges Amid Market Volatility

United Parcel Service (UPS) and FedEx (FDX) are leaders in the Zacks Transportation—Air Freight and Cargo industry, with market capitalizations of $93.3 billion and $58 billion, respectively. These companies dominate the parcel delivery and logistics sector, handling the majority of packages delivered worldwide. Let’s delve into their financial fundamentals, growth potential, and the challenges they face.

Analyzing UPS: Revenue Struggles

UPS has recently faced revenue challenges due to geopolitical uncertainties and persistent inflation that negatively impact consumer confidence. Additionally, economic uncertainty stemming from tariffs has further complicated its business landscape.

Looking ahead, UPS predicts an 8.5% decline in average daily volumes for 2025 compared to 2024. Key factors include a slowdown in online sales within the U.S. and a downturn in global manufacturing activity. For 2025, UPS anticipates consolidated revenues of $89 billion, significantly below the Zacks Consensus Estimate of $94.6 billion reported during the fourth-quarter 2024 earnings announcement. Furthermore, UPS plans to reduce volumes with its largest customer, Amazon.com (AMZN), by over 50% by June 2026. This outlook does not factor in any potential repercussions from current tariff disputes, suggesting further guidance cuts may be possible.

In February, UPS raised its quarterly dividend by 0.6% to $1.64 per share, totaling an annualized payout of $6.56 per share. While this reflects a commitment to shareholders, concerns about the dividend’s sustainability persist. UPS has a notable dividend payout ratio of 84%, raising questions about its capacity to maintain such distributions long-term. Remember, during the peak pandemic period, UPS had strong business growth associated with e-commerce, leading to substantial dividend payments. However, free cash flow has declined since a peak of $9 billion in 2022.

Currently, UPS’s high dividend payout restricts its operational flexibility, with free cash flow almost matching dividend payments. As of the end of 2024, UPS reported free cash flow of $6.3 billion, just above its $5.4 billion dividend obligations. For 2025, UPS expects free cash flow around $5.7 billion and dividend payments approximating $5.5 billion.

UPS has also been proactive in expanding its network. In 2024, the company announced the acquisition of Estafeta, a Mexican express delivery firm. This strategic move aims to leverage rising cross-border demand fueled by Mexico’s manufacturing growth and shifts in the global supply chain. In August 2024, UPS further expanded its reach by partnering with Ninja Van Malaysia to enhance express delivery services in that region.

As UPS concluded 2024 with cash and cash equivalents of $6.3 billion against long-term debt of $19.4 billion, its debt-to-capital ratio stood at 0.54, slightly above the industry average of 0.49.

FedEx’s Cost Realignment Initiatives

FedEx is currently realigning its operations under a comprehensive initiative termed DRIVE. This program is aimed at optimizing costs in response to the changes in the post-COVID business environment. Expected savings from DRIVE initiatives are pegged at $2.2 billion for fiscal 2025, following savings of $1.8 billion for fiscal 2024. Cost-cutting measures include reducing flight frequencies, parking aircraft, and workforce reductions, all designed to enhance the company’s long-term profitability.

Additionally, FedEx recently increased its quarterly dividend by 10% to $1.38 per share ($5.52 annually) as part of its focus on rewarding shareholders. The company is also actively pursuing share buyback programs.

Despite economic headwinds like geopolitical uncertainty and rising tariffs, FedEx remains optimistic about generating consistent cash flows. In its third-quarter fiscal 2025 results, FedEx forecasted adjusted earnings per share to be in the range of $18 to $18.6, down from a previous estimate of $19 to $20. Revenue is expected to remain flat or slightly decline year over year, prompting a downward revision of capital spending from $5.2 billion to $4.9 billion.

FDX’s strategic investments aim to expand operations and enhance service offerings, positioning the company for long-term growth. As of the end of the third quarter for fiscal 2025, FedEx reported cash and cash equivalents of $5.1 billion versus long-term debt of $19.5 billion, giving it a favorable debt-to-capital ratio of 0.43 compared to the industry average and to UPS, demonstrating a stronger equity position.

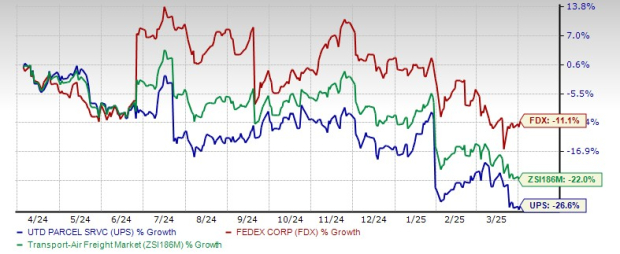

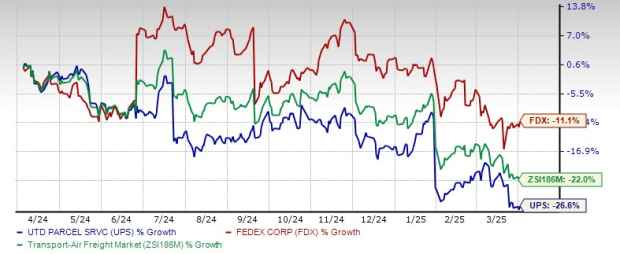

Stock Performance Analysis

Over the past year, UPS shares have fallen by 26.6%, underperforming the industry overall. In contrast, FDX shares have seen a decline of only 11.1%, outpacing its industry peers.

One-Year Price Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, UPS trades at a forward sales multiple of 1.06X, higher than its industry average of 1X. Conversely, FDX’s forward sales multiple stands at 0.65X. In terms of value assessments, FDX holds a Value Score of B, while UPS maintains a Value Score of C.

UPS’ P/S F12M Vs. FDX & Industry

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Earnings Estimates for UPS and FDX

The Zacks Consensus Estimate for UPS indicates a projected decline of 3% year-over-year in sales for 2025, while earnings expectations show only slight growth. The outlook for both companies illustrates the ongoing challenges facing the air freight and cargo industry amid fluctuating demand and economic pressures.

UPS and FedEx Face Challenges Amid Weak Demand and Cost Cutting

The Zacks Consensus Estimate for United Parcel Service (UPS) projects its 2026 sales will grow by 1.7% year-over-year. Meanwhile, the consensus for earnings shows a more promising 12.7% increase. However, estimates for earnings per share (EPS) for both 2025 and 2026 have been declining over the past 60 days.

Image Source: Zacks Investment Research

For FedEx Corporation (FDX), the Zacks Consensus Estimate for fiscal 2025 suggests flat sales year-over-year. The earnings consensus indicates a 3.3% growth for the same period. Looking ahead to fiscal 2026, sales and earnings estimates point to growth rates of 3.2% and 11.6%, respectively. Similar to UPS, FDX has experienced a downward trend in EPS estimates for both fiscal years over the last two months.

Image Source: Zacks Investment Research

Overview of Current Challenges

Both FedEx and UPS are currently facing revenue pressures driven by a challenging demand environment. Issues such as new union negotiations and declines in shipping volumes are significant concerns for both companies. In response to this weak demand, they are pursuing cost-cutting strategies, albeit through different methods. UPS is focusing on investments in automation and robotics to enhance operational efficiency and reduce its dependence on Amazon.com. Conversely, FedEx is in the midst of a major restructuring initiative and is working to complete a comprehensive long-term cost-saving program.

Comparative Valuation and Outlook

From a valuation perspective, FedEx presents a more attractive option compared to UPS. Additionally, FedEx has outperformed UPS in terms of stock price performance. Over the next five years, FedEx earnings are projected to grow by 11.5%, surpassing UPS’s growth forecast of 9.3%. Furthermore, FedEx has a more favorable financial leverage position. Considering these factors, FedEx may currently be the preferable choice over UPS.

At present, FedEx holds a Zacks Rank of #3 (Hold), while UPS is rated #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has identified five stocks with the highest potential for gains of 100% or more in the coming months. Among these, Director of Research Sheraz Mian highlights the one Stock expected to climb the highest.

This top pick belongs to an innovative financial firm boasting a rapidly expanding customer base of over 50 million and a diverse range of cutting-edge solutions. While not all of our elite picks are winners, this one could significantly outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which skyrocketed by 129.6% in just over nine months.

Free: see Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

United Parcel Service, Inc. (UPS): Free Stock Analysis report.

FedEx Corporation (FDX): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.