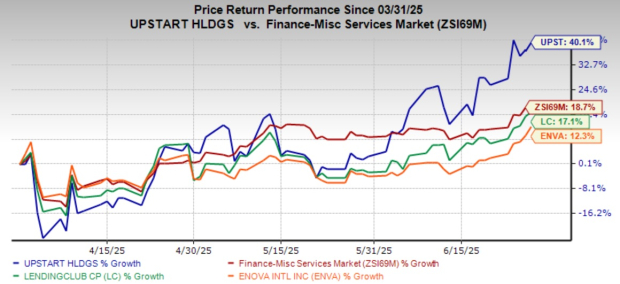

Upstart Holdings, Inc. (UPST) has achieved a 40.1% gain in Q3 2023, outperforming the Zacks Financial – Miscellaneous Services industry’s 18.7% increase. The company’s innovative use of artificial intelligence in consumer lending has set it apart from competitors such as LendingClub (LC) and Enova International (ENVA).

In Q1 2025, 92% of loans processed by Upstart were fully automated, contributing to rising conversion rates that jumped from 14% to 19% year-over-year. The company has diversified its offerings, with auto loan originations experiencing a 42% sequential increase, HELOCs rising by 52%, and small-dollar loans nearly tripling year-over-year.

However, Upstart faces challenges, including elevated interest rates impacting margins and competition affecting pricing for super-prime borrowers. Currently, its shares are considered overvalued, trading at a Price/Sales (P/S) ratio of 5.24X, compared to the industry average of 3.85X. Despite these hurdles, Upstart maintains a Zacks Rank of #3 (Hold), suggesting potential for long-term growth in the fintech space.