Ur Energy Reports Q3 Loss, Misses Revenue Expectations

Ur Energy (URG) announced a quarterly loss of $0.02 per share, which was in line with the Zacks Consensus Estimate. In comparison, the company reported a loss of $0.07 per share in the same quarter last year, with figures adjusted for non-recurring items. A quarter ago, expectations were set for a $0.03 loss per share, and Ur Energy reported exactly that, resulting in no surprises this time.

For the past four quarters, Ur Energy has struggled to exceed consensus EPS estimates, indicating persistent challenges in meeting financial expectations. This quarter, revenues totalled $6.4 million, falling short of the Zacks Consensus Estimate by 33.79%. This revenue marked an improvement compared to the $5.75 million reported in the previous year, yet the company managed to exceed consensus revenue estimates only twice during the last four quarters.

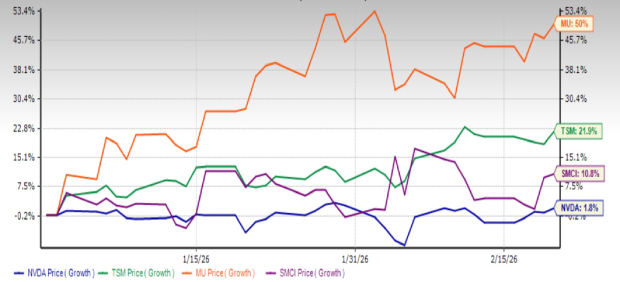

The future movement of Ur Energy’s stock price will greatly depend on insights provided by management during the upcoming earnings call, especially in light of these recent results. Since the start of 2024, Ur Energy’s shares have dropped approximately 22.7%, contrasting sharply with the S&P 500’s rise of 21.2% during the same period.

What’s Next for Ur Energy?

Given Ur Energy’s underperformance thus far this year, investors are keen to know what lies ahead for the stock. While predicting future outcomes can be challenging, the company’s earnings outlook serves as a helpful indicator. This outlook incorporates current consensus expectations for upcoming quarters and any recent changes in those expectations.

Research indicates a strong relationship between short-term stock fluctuations and revisions in earnings estimates. Investors may choose to track these revisions themselves or utilize reliable rating tools such as the Zacks Rank, which is known for effectively leveraging earnings estimate trends.

Leading up to this earnings release, the estimate revision trend for Ur Energy remains mixed. Although the results of the latest report may influence the magnitude and direction of future revisions, the current state of affairs assigns a Zacks Rank #3 (Hold) to the stock. This suggests that Ur Energy’s shares are expected to perform in line with the overall market in the near term. Investors can view Zacks’ list of top-ranked stocks here.

The projections for the upcoming quarters and the fiscal year will be interesting to monitor. Currently, the consensus EPS estimate is -$0.01 on revenues of $18.77 million for the next quarter, and -$0.09 on revenues of $32.11 million for the complete fiscal year.

It’s important for investors to consider the broader industry outlook when assessing stock performance. The Zacks Industry Rank places Mining – Miscellaneous in the bottom 32% of over 250 Zacks industries. Historical data reveals that the top half of Zacks-ranked industries outperform the bottom half by more than two-to-one.

Another company in the same sector, HudBay Minerals (HBM), has not yet reported its results for the quarter ending September 2024, with expectations to release information on November 13.

Forecasts suggest HudBay Minerals will report quarterly earnings of $0.05 per share, indicating a year-over-year decline of 28.6%. Over the past 30 days, the consensus EPS estimate has been revised downwards by 1.9%. Additionally, revenues are anticipated to total $470.43 million, a 2.1% decrease from the previous year.

Research Chief Names “Single Best Pick to Double”

Out of numerous stocks, five Zacks experts have selected their top choice expected to rise by 100% or more soon. Among these, Director of Research Sheraz Mian has identified one with the greatest potential for explosive growth.

This company aims at millennial and Gen Z consumers, achieving nearly $1 billion in revenue last quarter alone. Recent stock pullbacks present a prime opportunity for investment. While not every pick turns out to be a winner, this stock has the potential to follow the footsteps of previous Zacks selections that have doubled, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest investment recommendations from Zacks Investment Research, you can download the report titled “5 Stocks Set to Double” for free.

Ur Energy Inc (URG): Free Stock Analysis Report

HudBay Minerals Inc (HBM): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.