Riding the Uranium Wave

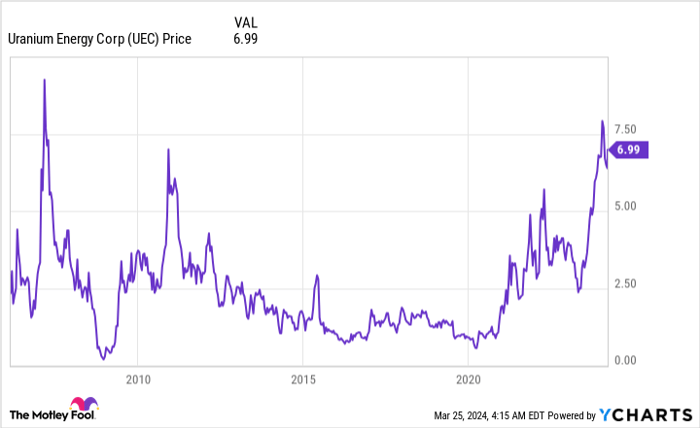

If you’re considering the prospects of investing in Uranium Energy Corp. (NYSEMKT: UEC), the recent surge in uranium prices might have caught your eye. From a rock-bottom around $18 in 2016 to a soaring $100 high in early 2024, the rally in uranium is undeniable. The allure of nuclear power as a clean energy source adds another layer of intrigue. But is this enough to take the plunge into Uranium Energy? Let’s unpack the possibilities.

The Bull Case for Uranium Energy Corp.

As uranium prices climb, companies in the uranium sector, like Uranium Energy, stand to benefit from increased revenue. Investors have certainly taken notice, driving up the stock prices of such companies. The primary argument for buying Uranium Energy lies in the expectation of further upticks in uranium prices.

However, markets are fickle, and what goes up must come down, as demonstrated by the recent price retreat impacting Uranium Energy’s stock. That said, the volatility in commodity pricing underscores the need for caution.

Another feather in Uranium Energy’s cap is its substantial stockpile of uranium purchased at lower rates in the past. This clever arbitrage move positions the company to generate cash by selling uranium from this reserve, enabling strategic investments in other areas.

The company’s expansion plans are ambitious, with hopes to reopen a mine by August 2024 and several more on the horizon. Investing in Uranium Energy now could mean getting in on the action before these additional mines come online. It’s a bet on the company’s growth trajectory, contingent on sustained uranium price strength.

Keeping Uranium Energy in Your Portfolio

If you’re already a Uranium Energy shareholder, the decision to hold onto your position factors in the potential upside of continued market strength. This would enable Uranium Energy to execute its mining plans and realize its long-term strategic vision.

However, a glance at the stock’s historical price performance reveals significant volatility. The rollercoaster ride through extreme highs and lows should give any investor pause. Brace yourself for the possibility of a sharp correction should uranium prices falter — this is not a stock for the faint of heart.

Navigating the Sell Signal for Uranium Energy Corp.

There are valid reasons for considering parting ways with Uranium Energy. The inherent volatility of uranium and the corresponding stock prices might prompt some investors to lock in gains and reduce risk exposure. A prudent decision, given the stock’s potential for fluctuations.

Unlike mining competitors such as industry stalwart Cameco (NYSE: CCJ), Uranium Energy’s fortunes are tightly tied to uranium prices due to its uranium stockpile serving as the primary asset. This dependency amplifies volatility risks, making Uranium Energy a riskier proposition compared to mine operators like Cameco.

Moreover, the company’s path to reopening a mine and building new ones presents substantial execution risks. Mining projects are intricate, capital-intensive endeavors with long gestation periods. With no operational mines currently, Uranium Energy has much to prove. Investing means wagering on both sustained uranium prices and the company’s ability to deliver on its construction plans — a gamble best suited for aggressive investors.

Reserved for the Boldest Investors

Uranium Energy’s narrative is intriguing yet fraught with peril. This isn’t a stock for conservative investors seeking stability. The company’s success hinges on robust uranium prices and flawless execution of its mining ventures. A speculative play that could yield riches or ruin, depending on how the uranium winds blow. Only the brave and daring need apply.

Should you invest $1,000 in Uranium Energy right now?

Before diving into Uranium Energy’s shares, consider this:

The Motley Fool Stock Advisor has pinpointed what they deem the 10 best stocks for investors today — and Uranium Energy didn’t make the cut. These chosen stocks promise potentially massive returns in the years ahead.

Stock Advisor offers an easy-to-follow recipe for success, featuring portfolio-building guidance, analyst updates, and two fresh stock picks monthly. Since 2002, the service has outstripped the S&P 500’s returns threefold*.

Discover the 10 stocks

*Stock Advisor returns as of March 25, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Cameco. The Motley Fool maintains a disclosure policy.

The thoughts and opinions expressed above reflect those of the writer and do not necessarily align with Nasdaq, Inc.