Nuclear energy is experiencing a resurgence, driven by increased electricity demand and climate goals. As of December 5, 2025, around 65 reactors are under construction globally, with governments committed to tripling nuclear capacity by 2050. The World Nuclear Association estimates that global nuclear capacity may reach 1,428 GWe by that year.

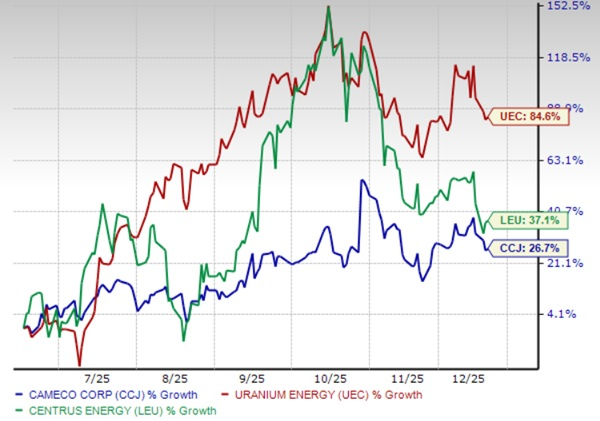

The U.S. Geological Survey has included uranium on its 2025 Critical Minerals List, underscoring its significance for national security. Key players in this nuclear revival include Cameco Corp., which produces over 30 million pounds of uranium annually, Uranium Energy Corp. with a total licensed production capacity of 12.1 million pounds, and Centrus Energy, a leader in producing High-Assay, Low-Enriched Uranium. These companies are expected to benefit from increased investments and government partnerships aimed at revitalizing the domestic nuclear fuel cycle.

With a projected investment of at least $80 billion from the U.S. government to support nuclear technologies, these stocks are poised for growth. For instance, Cameco anticipates 96% earnings growth in fiscal 2025, while Uranium Energy’s successful transitions suggest a more promising revenue trajectory. Centrus Energy has also secured over $1.2 billion for its expansion projects, positioning itself as the only licensed HALEU producer in the Western world.